-

The startup, known for refinancing millennials' student loans, is now writing more than $100 million of home mortgages a month, and expects this to be its fastest-growing product. Here's why.

January 17 -

Mortgage application volume started off 2017 on a good note as activity increased 5.8% from one week earlier, according to the Mortgage Bankers Association.

January 11 -

Refinance volume rose among millennial borrowers in November, reflecting a nationwide trend, according to Ellie Mae.

January 10 -

The Federal Housing Administration said it would cut the annual premium by 25 basis points starting on Jan. 27, giving President-elect Donald Trump a limited window to delay or scrap the cut.

January 9 -

Quicken Loans parent company Rock Holdings has agreed to buy two online marketing service providers, marking the Dan Gilbert-owned conglomerate's entrance into the lead acquisition space.

January 6 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

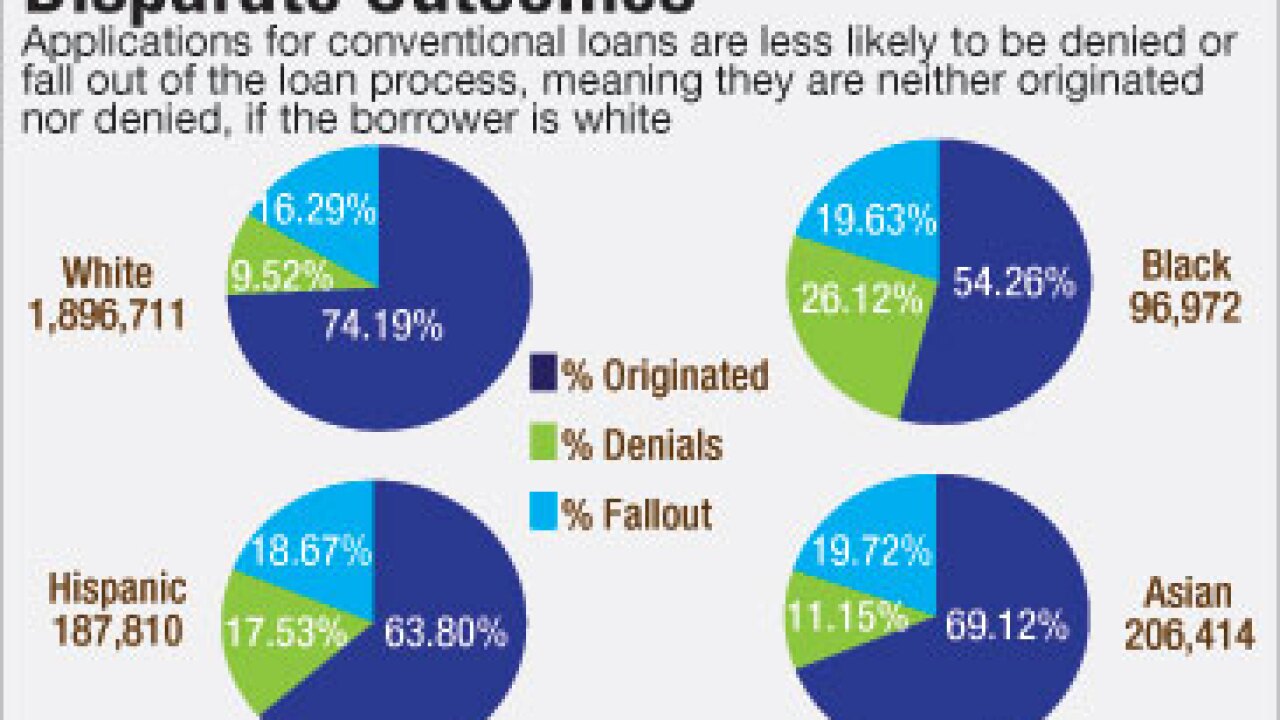

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Residential loan application activity continued its post-election slump, declining for the sixth time in the eight weeks, according to the Mortgage Bankers Association.

January 4 -

The commercial-and-industrial loan space is overheated and higher rates could stifle mortgage refinancings. Bankers could be fighting these fires and more in the new year.

December 29 -

Some of the most popular contributors to National Mortgage News' Voices community weigh in on what they see coming in the next year for origination, servicing, technology and regulation.

December 29 -

From selling servicing rights along with the loans to issuing private-label securities, a host of strategies from the past could return to the market as a result of the new political climate and interest rate environment.

December 29 -

Expectations of transaction volume in the year ahead are down for the fourth quarter in the wake of the presidential election, according to data from First American Financial Corp.

December 21 -

Refinance activity in November was even compared with the prior month, though the data suggested that the market is prepping for higher rates to cut into this segment, according to Ellie Mae.

December 21 -

Mortgage application volume rose 2.5% from the prior week, even as interest rates reached two-year highs, according to the Mortgage Bankers Association.

December 21 -

Rising interest rates have turned mortgage lenders' post-election outlook on profit margins bearish, according to Fannie Mae.

December 16 -

Mortgage rates moved higher for the seventh consecutive week, a sign that the markets are still in flux after the presidential election, Freddie Mac said.

December 15 -

The forecast for mortgage origination volume moved down for the first quarter of 2017 in the wake of the second interest rate hike by the Federal Reserve in a decade, according to the Mortgage Bankers Association.

December 14 -

Mortgage application volume decreased 4% from one week earlier as interest rates on 30-year loans continued to rise, according to the Mortgage Bankers Association.

December 14 -

SoFi Lending Corp.'s securitization of its student loan refis for high net worth individuals is now a model for its recent expansion into super prime jumbo mortgages.

December 13 -

Rising mortgage interest rates affect the volume of refinance and purchase originations, but don't necessarily spell bad news for home prices, explains Fannie Mae Chief Economist Doug Duncan.

December 12