-

The drop in home buying power heightened the risk of misrepresentations on purchase mortgage loan applications during November, as consumers are more willing to fudge information in an uncertain market, First American Financial said.

December 30 -

Mortgage applications decreased 5.3% on a seasonally adjusted basis from one week earlier led by a decline in conventional refinance loan demand, according to the Mortgage Bankers Association.

December 26 -

Freddie Mac reduced its origination forecast for 2020 to under $2 trillion, now projecting $184 billion less in refinance volume compared with its November outlook.

December 24 -

First mortgage volumes continue to rise at credit unions, but home equity lines of credit have fallen dramatically in recent years.

December 20 -

The critical defect rate for closed mortgage loans continued its decline in the second quarter, as lenders benefited from increased loan volume and profitability, an Aces Risk Management study found.

December 19 -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 18 -

Mortgage applications decreased 5% from one week earlier as, absent any rate incentive, activity slowed because of the holiday season, according to the Mortgage Bankers Association.

December 18 -

Mortgage lenders became slightly bearish on their profitability outlook in the fourth quarter, with the competitive landscape and shift to a purchase market cited as the main concerns, according to Fannie Mae.

December 12 -

Mortgage application activity increased 3.8% from one week earlier, with refinance volume for Federal Housing Administration-insured loans taking the spotlight, the Mortgage Bankers Association said.

December 11 -

Florida-based depository Capital City Bank has struck a deal to purchase a 51% share in regional lender BrandMortgage.

December 11 -

More than half of the third quarter refinance activity was the cash-out variety, with borrowers removing the most total equity from their homes in nearly 12 years, according to Black Knight.

December 9 -

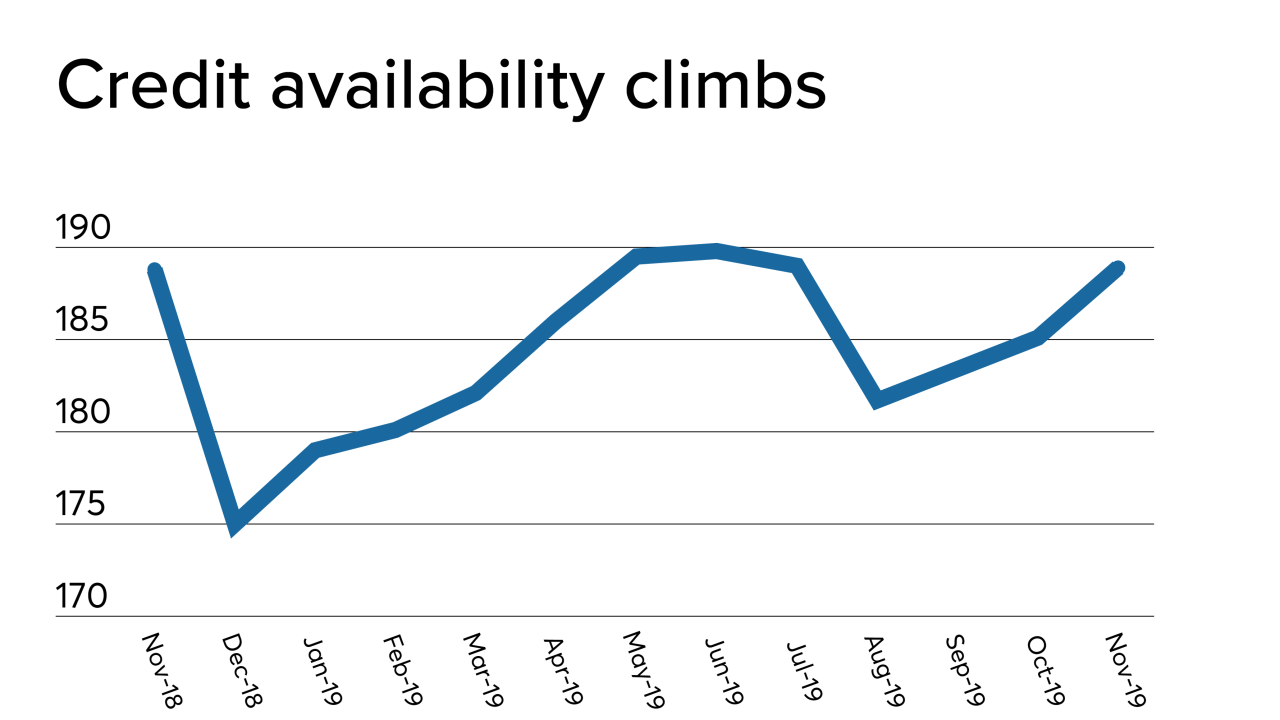

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

Purchase mortgage application activity is at its highest level since this summer on a seasonally adjusted basis, and should remain strong in December, according to the Mortgage Bankers Association.

December 4 -

In light of the Federal Housing Administration's strong financial performance, now is not the time to "reduce the FHA's footprint," but rather to broaden the critical access to credit role it plays.

December 3 Kellum Capital Group and Kellum Mortgage

Kellum Capital Group and Kellum Mortgage -

The outperformance of mortgage-backed securities versus U.S. Treasuries has extended for a third straight month into November, buoyed in part by a decline in volatility.

December 2 -

Mortgage application activity rose 1.5% compared with one week earlier as interest rates remained below 4%, according to the Mortgage Bankers Association.

November 27 -

Mortgage prepayment levels were at their highest in over six years during October, as existing homeowners took advantage of the lower rates to refinance, or to a lesser extent, purchase a new residence, Black Knight said.

November 25 -

River City Mortgage is staging an eight-state expansion of its footprint, and recently hired Carrington Mortgage Services President Raymond Brousseau to help oversee and direct its growth.

November 21 -

Mortgage lenders are operating in a refinance-dominated market again for the first time in years, but it may offer diminishing returns.

November 20