-

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

After their first increase in six weeks, mortgage applications declined despite lower interest rates, according to the Mortgage Bankers Association.

August 29 -

Wells Fargo & Co. is cutting 638 mortgage employees as the nation’s largest home lender contends with a slowdown in the business.

August 24 -

Mortgage applications increased 4.2% from one week earlier, rising for the first time in over a month, according to the Mortgage Bankers Association.

August 22 -

Fannie Mae decreased its 2018 origination forecast for the fourth time this year in anticipation of more upward pressure on rates, and housing weakness that persists despite increased overall economic strength.

August 16 -

Mortgage applications waned for the fifth week in row, hitting their lowest levels in six months, as the summer's growing interest rates plateaued.

August 15 -

Amid a tight housing market and rising rates, mortgage brokers and wholesalers have been engaged in an intense competition for control over borrower relationships.

August 13 -

Mortgage applications declined for the fourth consecutive week as interest rates remained at high levels.

August 8 -

An increase in millennials making home purchases is a call to the mortgage industry for a quicker, more efficient digital process.

August 1 -

Mortgage applications dropped for the third consecutive week around rising interest rates and languid housing starts.

August 1 -

As regulators move forward with policy changes designed to curb so-called refinance churning of Department of Veterans Affairs-insured mortgages, concerns have surfaced about the fate of loans originated during the transition period.

July 25 -

A lack of new and existing homes for sale led to a drop in purchase and overall mortgage application volume although refinances grew.

July 25 -

There is an opportunity for home sales to break out of the doldrums if price appreciation slows, mortgage rates remain flat and supply increases, Freddie Mac said.

July 23 -

Rising median home prices and tight housing inventory led purchase and overall mortgage application volume to fall although refinances rose.

July 18 -

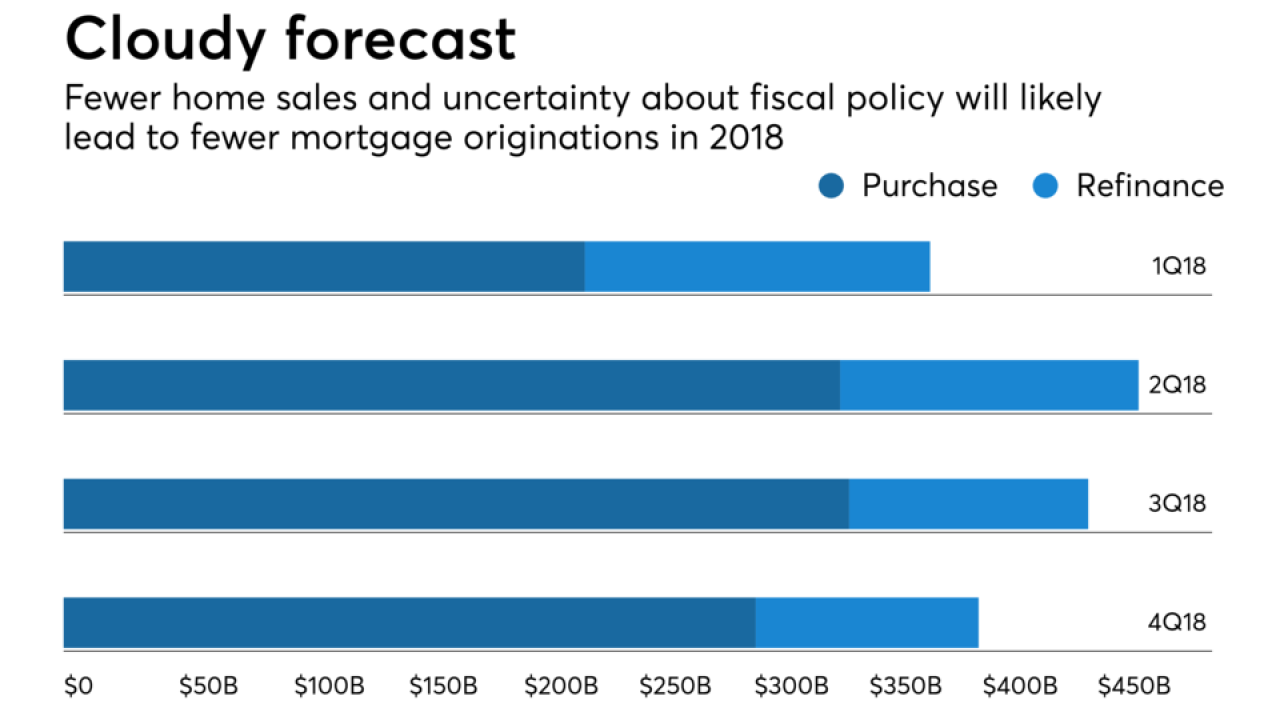

Fewer sales of existing homes and uncertainty around future fiscal policies will result in fewer mortgage originations than previously expected, according to Fannie Mae.

July 17 -

As property values continue appreciating, Caliber Home Loans added a jumbo loan product to its portfolio lending suite to support borrower needs in a climate of higher home prices.

July 17 -

To keep winning business in an increasingly competitive loan channel, United Wholesale Mortgage is giving brokers more control of the borrower relationships that persist even after loans close.

July 13 -

The job market gaining steam year-over-year pushed the purchase and overall mortgage application volume upward despite refinance activity dropping to an 18-year low.

July 11 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

Volatility in the financial markets, uncertainty with foreign trade and the housing supply deficit caused mortgage applications to drop for the second straight week.

July 5