-

Supply chain attacks have doubled since 2021, with professional services firms increasingly acting as "stepping stones" to access bank data.

January 29 -

Treasury Secretary Bessent said FSOC is readjusting its approach to avoid stifling growth in moves with implications for capital, technology and mortgages.

December 11 -

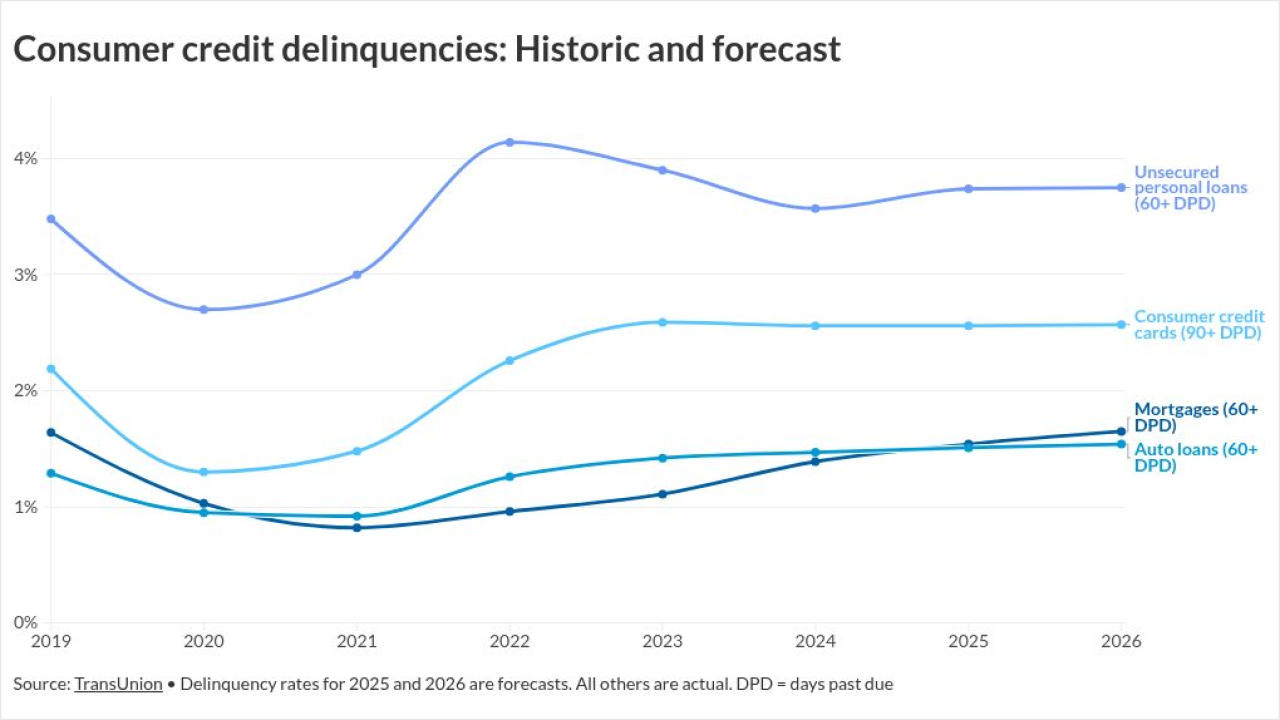

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10 -

Social media posts point to a 40% to 100% price hike this year, the latest in a series of hikes started in 2023, when for some lenders prices rose 400%.

November 24 -

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

The Consumer Financial Protection Bureau has seen a rapid drop in the effectiveness of its cybersecurity program, according to a new report from the Fed's Office of Inspector General.

November 3 -

Fannie Mae and Freddie Mac's credit risk-transfers and some older private-label mortgage-backed securities have exposures to the Washington DC area.

October 14 -

How decisions in construction and property oversight can reshape multifamily loan performance.

September 29 -

Here's what industry experts have to say about a risk that a housing regulator has spotlighted through referrals that have led to high-level allegations.

August 25 -

The tests modeled how Fannie Mae and Freddie Mac would fare after absorbing losses like a total $36.1 billion provision in credit losses in a severe downturn.

August 18 -

New technologies are helping carriers identify how vulnerable properties are to a wide variety of risks ranging from wildfires to wind, flooding and more.

July 6 -

The Federal Reserve is the latest bank regulator to purge reputational considerations from its supervisory materials.

June 23 -

In some ways, the uncertainty in mortgage and capital markets has been unprecedented this year, but other aspects are old hat for industry veterans.

June 23 -

Loans with alternative documentation and high combined loan-to-value ratios had more performance concerns, according to a new KBRA study.

June 6 -

The company wants some holders of bonds due next year to allow a higher debt-to-equity ratio so it can pursue strong returns while managing certain risks.

June 2 -

The increase reflects a broader trend that rating agency analysts are watching closely as depository ties to other types of financial institutions grow.

May 22 -

The Federal Housing Finance Agency chief also explained an alternate name he's used for the agency in his first speech at a Mortgage Bankers Association event.

May 19 -

As the risk of a recession rises, commercial real estate loans remain a major concern for banks and industry participants. One observer asked: "Is '25 the year where sellers start to capitulate, call a loser a loser, and move on?"

April 3 -

Compliance concerns prevent some lenders from moving toward development of an AI plan or policy, but hesitancy may turn out to be a poor business strategy.

April 3 -

A joint venture between the military-focused Palantir and investment conglomerate TWG will sell cybersecurity protection to financial institutions that are wary about the safety of artificial intelligence.

March 10