-

JPMorgan Chase may be leading the next trend for banks seeking to shift risk away from their mortgage portfolios — if regulators give Wall Street the green light.

November 13 -

-

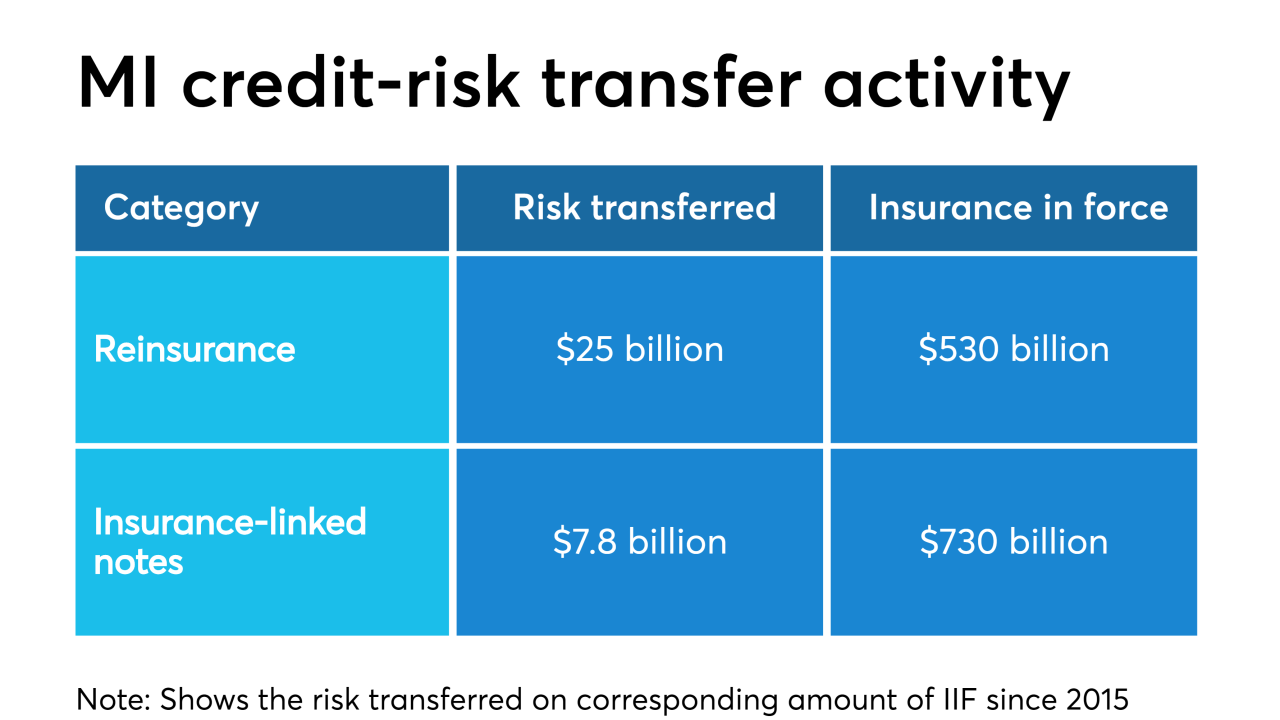

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

A risk management model revision that decreased single-family loan-loss allowances and a strong mortgage lending environment contributed to consistent earnings results at Fannie Mae in the third quarter.

October 31 -

Freddie Mac will make haste to leave conservatorship in line with new regulatory directives, but it's uncertain how quickly it can move, CEO David Brickman said in an earnings call.

October 30 -

The average number of attempts to defraud mortgage companies each month increased by 42% this year and hit the smallest businesses hardest, according to LexisNexis Risk Solutions.

October 29 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

The credit union regulator has spent 20 years asking lawmakers for greater oversight of third-party vendors. Here's why it might finally happen.

October 24 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22