-

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

December 18 -

After the end of the draw periods that range from two to five years, the amortization begins, during which borrowers have a repayment period ranging from three to 25 years.

December 11 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10 -

If cumulative loss or a delinquency trigger event is in effect, then the deal will distribute principal among the class A notes before any principal allocation the class M1 or class B certificates.

November 26 -

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

November 24 -

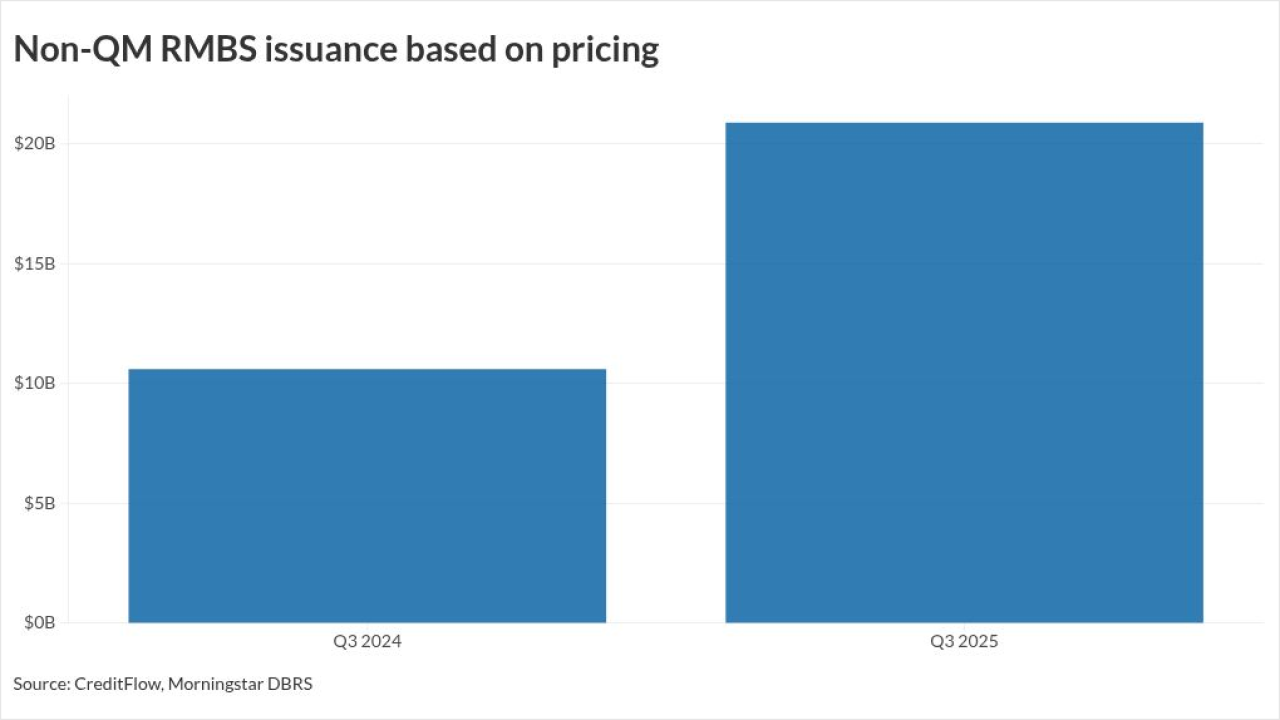

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

The Structured Finance Association is adding its weight to recent support for a Securities and Exchange Commission action that could modernize Reg AB II.

November 18 -

SEMT 2025-12's collateral profile is slightly weaker compared with the prior transaction, with a slightly lower weighted average FICO score.

November 12 -

Second-lien mortgages make up the collateral pool. Those assets normally have a high expected loss severity, but the borrowers appear to be of prime credit quality.

November 11 -

Most of the pool of 1,011 residential mortgages, 69.7%, are considered non-prime mortgages, primarily due to the documentation and styles of underwriting.

November 3 -

Karsten Giesecke and Michael Karol join Morriello to represent clients such as lenders and private equity funds in transactions including RMBS, CMBS, franchise loans and esoteric assets.

October 17 -

Rithm Capital, a real estate investment trust, is sponsoring the deal, in which property focused investor loans represent 32.60% of the collateral pool.

October 6 -

Notes are expected to pay a coupon of 4.5% on the A1 through M2 tranches, compared with a 5.25% coupon on the previous deal.

August 8 -

The case pitted high-profile senior-tranche investors like PIMCO against junior bondholders the interpretation of contracts that predated later policy changes.

July 24 -

Most indicators cited by Morningstar DBRS are favorable to a good securitization market the rest of the year, but inflation is one of several challenges.

July 14 -

The notes are backed by home improvement installment loans originated by approved dealers in Foundation Finance Company's network.

July 11 -

The deal is the seventh prime jumbo issuance from Chase Home Lending Mortgage Trust in 2025.

July 8 -

The RMBS notes benefit from geographic diversity and credit enhancement.

July 2 -

The prime jumbo RMBS transaction is collateralized by 402 residential mortgage loans.

July 1