-

Tom Marano, a former Bear Stearns banker, was apparently well compensated following the housing crisis for heading up ResCap and Ditech, both of which went into bankruptcy.

November 11 -

Sixty percent of the loans were underwritten with just 12- or 24-month bank statements, according to ratings agency reports.

November 5 -

The acquisition of the Ditech forward mortgage business will double New Residential's year-to-date origination volume in the fourth quarter alone, and further double that next year.

October 25 -

First-lien, prime residential mortgages are securing the Visio 2019-2 Trust, which will raise $202,682,000 from the market, and which has collateral that was funded by the Mortgage Pass-Through Notes, Series 2019.

October 24 -

The PSMC 2019-3 Trust is bringing $298.6 million in notes to the market, backed by residential mortgages rounded up by subsidiaries of American International Group.

October 23 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

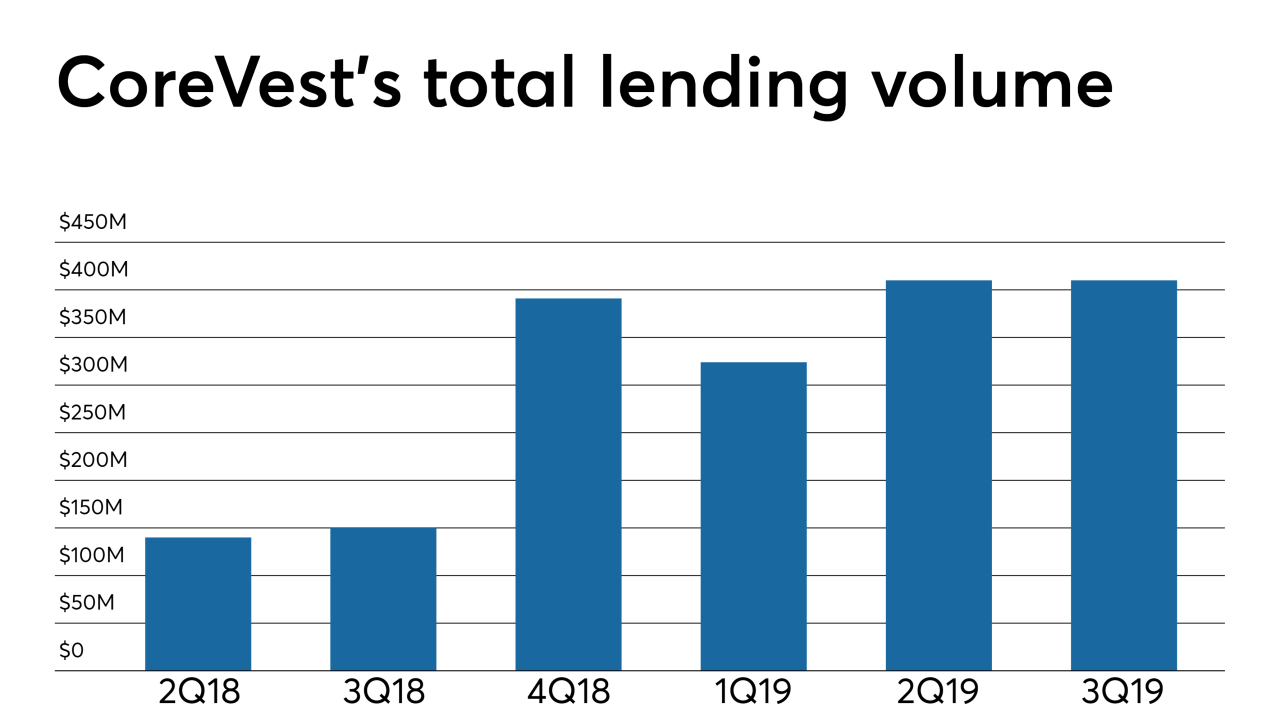

Redwood Trust is adding to its single-family rental lending business by purchasing CoreVest American Finance Lender from its management team and affiliates of Fortress Investment Group.

October 16 -

RESIMAC Bastille Trust RESIMAC Series 2019-1NC is an Australian-dollar (AUD) $1 billion transaction (approximately US$674.5 million) that will feature a US$250 million Class A-1 tranche of notes, according to Fitch.

October 15 -

Maren Kasper, who has led Ginnie Mae in the absence of a permanent president, is leaving the agency on Oct. 18 to pursue an opportunity in the private sector.

October 10 -

A year after Fannie Mae launched its first credit-risk transfer securitization using a real estate mortgage investment conduit, Freddie is now electing to also opt for a REMIC format in offloading the credit risk to private investors.

October 10 -

Fitch Ratings reports the deal is the first post-crisis RMBS securitization it has rated consisting entirely of manufactured-housing loans.

September 25 -

A final rule on residential appraisals published this month could save depositories time and money in the short term, but potentially increase collateral risk.

August 30 - LIBOR

Trustees are concerned about obtaining proper consents from legacy residential mortgage-backed securities investors in a timely fashion in order to make the switch from Libor to another index, Fitch Ratings said.

August 21 -

Citigroup's global markets realty arm is sponsoring a $362 million securitization of recently originated high-balance, nonagency mortgages, a change of pace from its recent focus on RPL deals.

August 16 -

Rates for 30-year mortgages are at their lowest since late 2016, sending many previously hesitant homeowners to their brokers.

August 8 -

A gradual approach would help the market absorb loans affected by the government-sponsored enterprises' expiring qualified mortgage exemption, a Redwood Trust executive told analysts during a recent earnings call.

August 5 -

PIMCO is resecuritizing a large swathe of mostly non-qualified home loans that were previously bundled in 2016-2017 mortgage-backed securities, according to presale reports.

August 5 -

Angel Oak Mortgage Trust 2019-4 involves 1,551 loans, according to ratings agency presale reports. Nearly 84% of the loans have borrowers who do not meet the CFPB’s qualified mortgage standard.

July 29 -

Jefferies is housing the initial round of $300 million in loans under a repurchase agreement with four lenders, as well as with the trust established for the transaction in Jefferies’ standing as the repo seller.

July 22 -

Verus Securitization Trust 2019-INV2 is backed by investor loans secured by 1,042 rental properties. The loans were originated by 76 different lenders.

July 16