-

Lenders should not get so desperate chasing volume by originating lower credit non-qualified mortgage products that they are inviting the next regulatory crackdown, said David Stevens, the Mortgage Bankers Association's CEO.

March 28 -

The non-bank lender's $299.8 million prime, high-balance deal is no surprise; it follows a warehouse securitization last year. Angel Oak is also in the market with a $238.8 million deal.

March 28 -

Banks would welcome a proposal to loosen Basel III capital restrictions because it would make holding mortgage servicing rights easier and stem the recent exodus of depositories from the servicing business, executives said.

March 26 -

A mortgage program created by a 2015 partnership between the Federal Home Loan Bank of Chicago and Ginnie Mae has securitized over $1 billion in government-backed mortgages, the partnership announced.

March 14 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

Over 40% of the collateral is from two 2016-vintage transactions that were recently "collapsed" because proceeds from liquidations had slowed. Then there's the exposure to Puerto Rico.

March 9 -

Tight margins, regulatory clarity and a renewed appetite to expand have made mortgage brokers and the wholesale channel attractive again, at least to the small and medium mortgage lenders.

March 8 -

Royal Bank of Scotland Group has agreed to pay $500 million to the state of New York after a $5.5B agreement last year with the FHA, and another probe is pending.

March 6 -

The $446 million Pearl Street Mortgage Company 2018-1 Trust is backed by 30-year, fixed-rate loans with credit characteristics in line with recent private-label prime jumbo transactions rated by Fitch Ratings.

March 5 -

Participants at the Structured Finance Industry Group conference in Las Vegas say that future deals could be linked to the performance of jumbo, as well as conforming loans.

February 28 -

Financial services groups are calling for more funding for the Internal Revenue Service that could fix flaws in the agency's system for verifying the income of mortgage applicants.

February 22 -

Lender and servicers are increasingly using nontraditional methods such as "hybrid" appraisals and broker price opinions in an attempt to cut costs, but some are more reliable than others.

February 21 -

Almost two years after settling mortgage securitization allegations with the Department of Justice and a group of states, Goldman Sachs has fulfilled more than half of its consumer relief commitment.

February 16 -

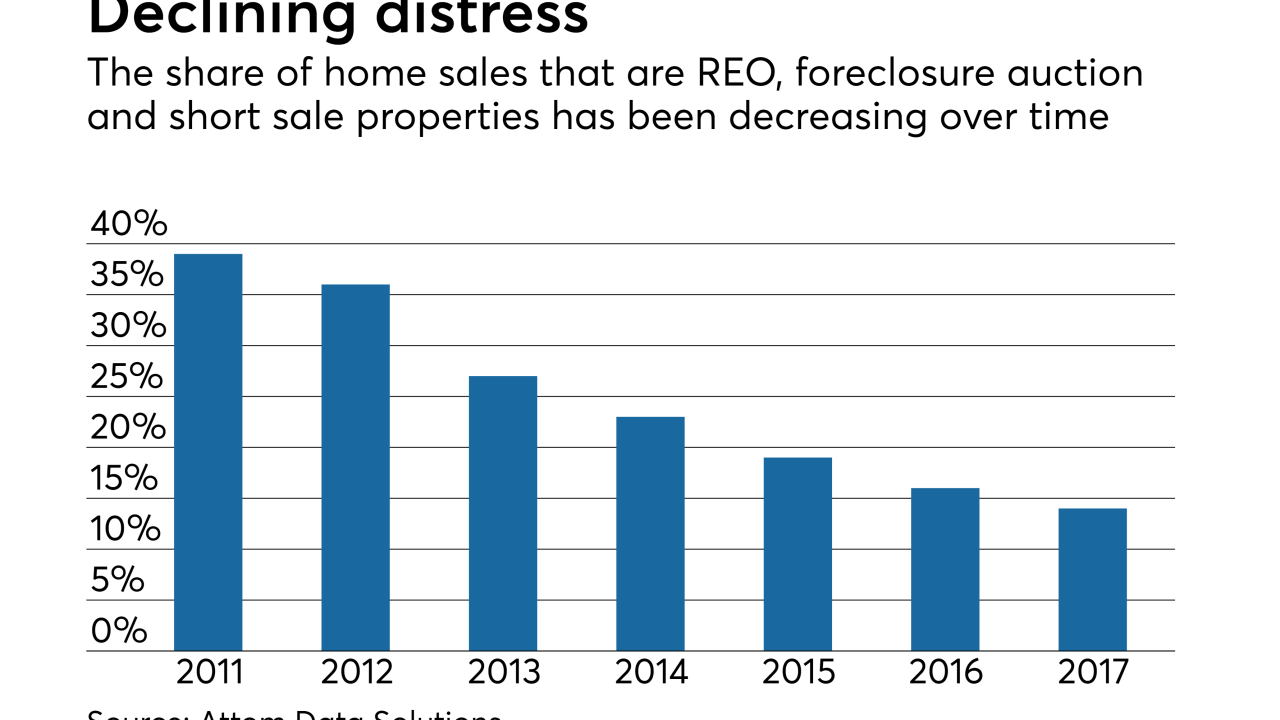

With few foreclosed homes left to pick up on the cheap, the biggest landlords are buying, or building, new single-family homes to pad their portfolios; mortgages on these properties could show up as collateral in rental bonds.

February 14 -

A new due diligence firm created by a trio of former Clayton Holdings executives wants to shake up a static business model.

February 12 -

Most of the collateral was acquired over the past year; that’s in contrast with the sponsor’s previous two transactions, in which a portion of the collateral was seasoned and refinanced from earlier transactions.

February 8 -

Mortgage servicers should approach efforts to overhaul their compensated structure with caution, as changes to the status quo "could have ripple effects across the entire real estate finance industry," warned Mortgage Bankers Association Chairman David Motley.

February 7 -

A group led by the National Fair Housing Alliance is suing Deutsche Bank, Ocwen Financial Corp. and Altisource Portfolio Solutions, alleging real estate owned properties in minority communities do not receive the same level of upkeep and maintenance as REO houses in white neighborhoods.

February 2 -

The Blackstone affiliate is cashing out over $200 million of home price appreciation in the process, resulting in a loan-to-value ratio that is unchanged from the original Colony American Homes transactions.

January 23 -

The weighted average FICO credit scores of securitized reperforming loans are deteriorating a little, according to a DBRS study of the bonds.

January 16