-

Financial services groups are calling for more funding for the Internal Revenue Service that could fix flaws in the agency's system for verifying the income of mortgage applicants.

February 22 -

Lender and servicers are increasingly using nontraditional methods such as "hybrid" appraisals and broker price opinions in an attempt to cut costs, but some are more reliable than others.

February 21 -

Almost two years after settling mortgage securitization allegations with the Department of Justice and a group of states, Goldman Sachs has fulfilled more than half of its consumer relief commitment.

February 16 -

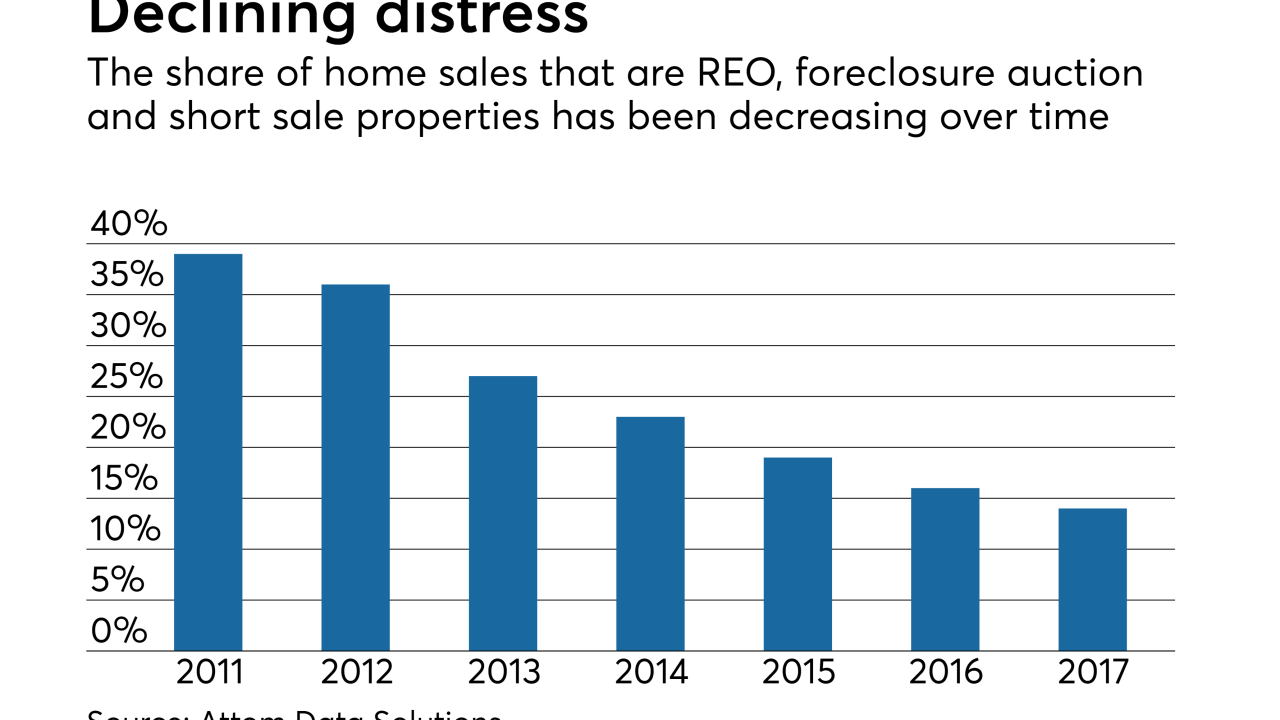

With few foreclosed homes left to pick up on the cheap, the biggest landlords are buying, or building, new single-family homes to pad their portfolios; mortgages on these properties could show up as collateral in rental bonds.

February 14 -

A new due diligence firm created by a trio of former Clayton Holdings executives wants to shake up a static business model.

February 12 -

Most of the collateral was acquired over the past year; that’s in contrast with the sponsor’s previous two transactions, in which a portion of the collateral was seasoned and refinanced from earlier transactions.

February 8 -

Mortgage servicers should approach efforts to overhaul their compensated structure with caution, as changes to the status quo "could have ripple effects across the entire real estate finance industry," warned Mortgage Bankers Association Chairman David Motley.

February 7 -

A group led by the National Fair Housing Alliance is suing Deutsche Bank, Ocwen Financial Corp. and Altisource Portfolio Solutions, alleging real estate owned properties in minority communities do not receive the same level of upkeep and maintenance as REO houses in white neighborhoods.

February 2 -

The Blackstone affiliate is cashing out over $200 million of home price appreciation in the process, resulting in a loan-to-value ratio that is unchanged from the original Colony American Homes transactions.

January 23 -

The weighted average FICO credit scores of securitized reperforming loans are deteriorating a little, according to a DBRS study of the bonds.

January 16 -

The $401.2 million COLT 2018-1 is the eighth overall securitization of non-qualified jumbo mortgages issued by the Lone Star Funds affiliate.

January 12 -

DoubleLine Capital is embarking on a plan to originate and securitize mortgages, seeking to fill a niche that has traditionally belonged to banks and brokerage firms.

December 21 -

Just over half of the collateral for the $883 million deal is eligible to be purchased by Fannie or Freddie; the bank itself contributed nearly half.

December 12 -

Securitization of nonperforming home equity conversion loans was pioneered by Nationstar; FAC's inaugural deal may be outstanding longer.

December 7 -

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

Roughly 52% of the properties backing Tricon American Homes 2017-SFR2 were obtained through the May acquisition; 19.4% were previously securitized by Silver Bay.

December 7 -

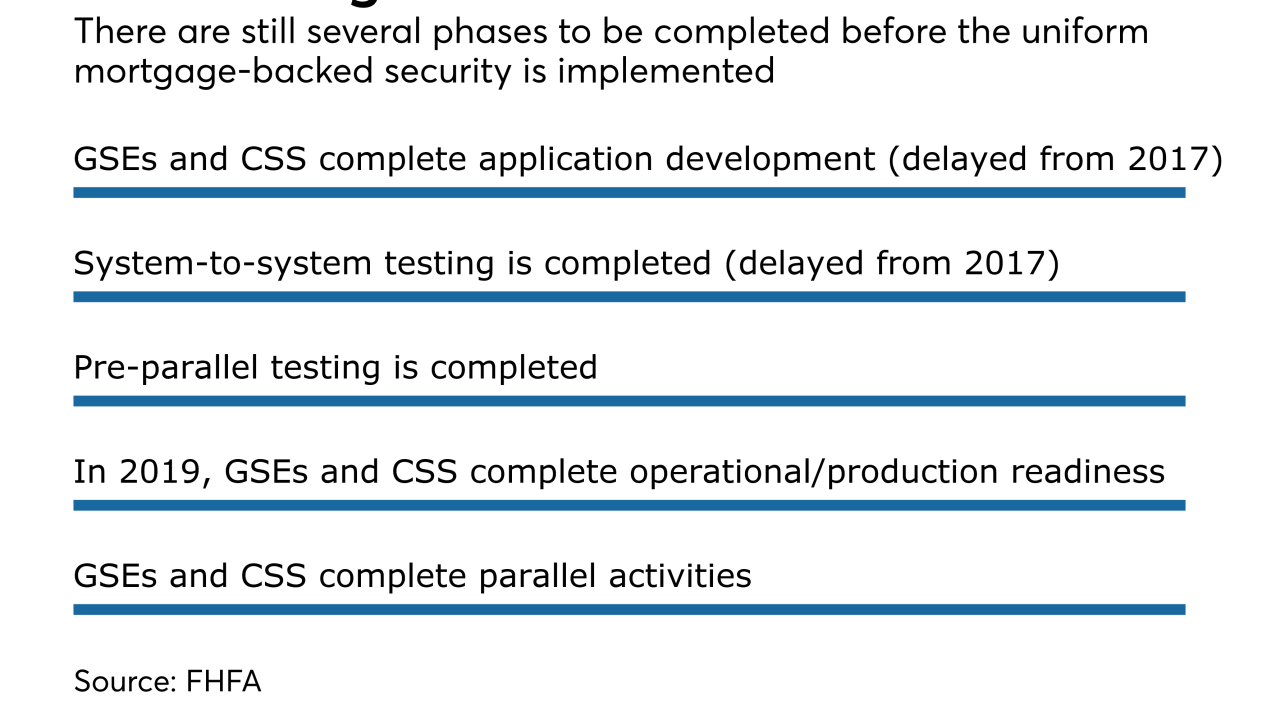

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

New Residential Investment Corp. is planning to purchase Shellpoint Partners in the first half of next year for $190 million with an additional earn-out over the next three years.

November 29 -

The senior tranche of Angel Oak 2017-3 benefits from 46.25% credit enhancement, up significantly from 37.75% for the sponsor’s July transaction, but in line with its April deal.

November 21 -

The impending bankruptcy of Walter Investment Management Corp. should not affect its subsidiary Ditech Financial's capability to service securitized mortgages, Fitch Ratings said.

November 20