-

The $401.2 million COLT 2018-1 is the eighth overall securitization of non-qualified jumbo mortgages issued by the Lone Star Funds affiliate.

January 12 -

DoubleLine Capital is embarking on a plan to originate and securitize mortgages, seeking to fill a niche that has traditionally belonged to banks and brokerage firms.

December 21 -

Just over half of the collateral for the $883 million deal is eligible to be purchased by Fannie or Freddie; the bank itself contributed nearly half.

December 12 -

Securitization of nonperforming home equity conversion loans was pioneered by Nationstar; FAC's inaugural deal may be outstanding longer.

December 7 -

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

Roughly 52% of the properties backing Tricon American Homes 2017-SFR2 were obtained through the May acquisition; 19.4% were previously securitized by Silver Bay.

December 7 -

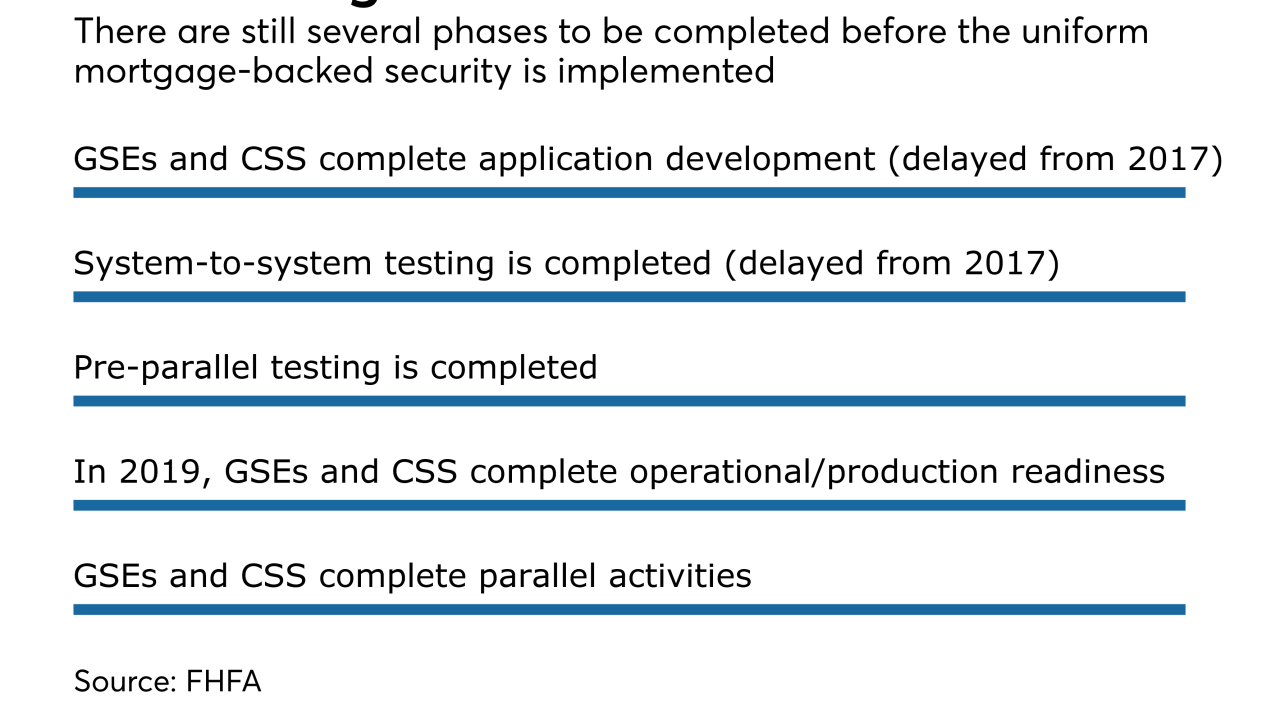

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

New Residential Investment Corp. is planning to purchase Shellpoint Partners in the first half of next year for $190 million with an additional earn-out over the next three years.

November 29 -

The senior tranche of Angel Oak 2017-3 benefits from 46.25% credit enhancement, up significantly from 37.75% for the sponsor’s July transaction, but in line with its April deal.

November 21 -

The impending bankruptcy of Walter Investment Management Corp. should not affect its subsidiary Ditech Financial's capability to service securitized mortgages, Fitch Ratings said.

November 20 -

That’s an about-face from the bank’s previous transaction, completed in October, which was backed by fixed-rate mortgages, nearly half of which were underwritten to standards for purchase by Fannie Mae or Freddie Mac.

November 16 -

Impac Mortgage Holdings' nonqualified mortgage origination volume increased 248% year-over-year in the third quarter as the company accumulates loans for a planned securitization next year.

November 9 -

James Bennison, head of alternative capital markets at Arch Capital Group, says that a new insurance-linked security helps with regulatory capital requirements and provides information that can help the company to better manage risk.

November 3 -

A large portion of the collateral for both IH 2014-SFR2 and IH 2014-SFR3 is being rolled into a new securitization, IH 2017-SFR2.

November 1 -

New Residential Investment Corp. may seek to accelerate the process of transferring more than $100 billion in mortgage servicing rights it agreed to buy from Ocwen for $400 million.

October 31 -

Credit Suisse's plan for consumer relief in a multibillion-dollar Department of Justice settlement related to residential mortgage-backed securities could reduce the costs involved, according to the settlement monitor's first report.

October 30 -

The deal, known as Bayview Opportunity Master Fund IVb Trust 2017-RT6, pools 2,745 current loans, of which nearly 58% have been clean for at least two years, and 55.2% have been modified.

October 26 -

Jeff Tennyson is out as president of Radian Group's Clayton Holdings real estate services business as the holding company provided further details about its restructuring plan.

October 18 -

Many of the prime jumbo loans backing the transaction, JP Morgan 2017-4, were contributed by originators with limited history in that product, according to DBRS.

October 18 -

Bank of America set aside $100 million in its reserves for representation and warranty claims ahead of a pending settlement to resolve legacy mortgage issues.

October 13