-

The average home value backing the loans is $117,000, well below the average $150,000 of other recent RPL securitizations, according to Fitch Ratings.

August 28 -

Fannie Mae and Freddie Mac will adjust their risk-sharing deals so that they can accommodate high loan-to-value loans refinanced under the programs replacing the Home Affordable Refinance Program.

August 28 -

MFA Financial Inc. co-CEO William Gorin died Aug. 10 after a long illness. He was 59.

August 14 -

Redwood Trust is raising $225 million in a debt offering with the proceeds to be used to repay borrowings that come due next year.

August 14 -

For all the talk that Janet Yellen’s plan to shrink the Federal Reserve’s balance sheet will hurt Treasuries, U.S. mortgage bonds face a bigger test.

August 11 -

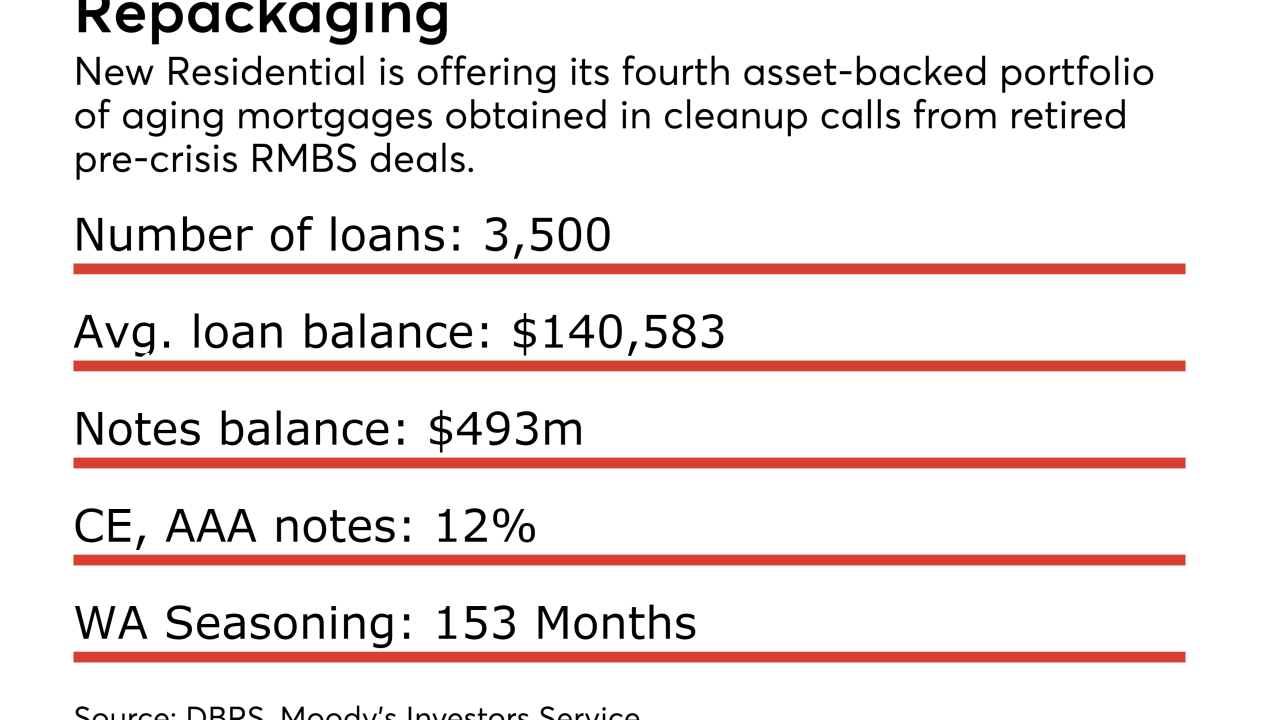

The senior tranche of triple-A rated notes to be issued benefits from 38.65% credit enhancement, up over 10 percentage points from 27.25% for the comparable tranche of the sponsor's previous deal.

July 26 -

Federal Reserve officials said they would begin running off their $4.5 trillion balance sheet “relatively soon” and left their benchmark policy rate unchanged as they assess progress toward their inflation goal.

July 26 -

Unlike the $15 billion-asset bank’s legacy mortgage bonds, the new offering is backed by loans to borrowers with strong credit and significant equity in their homes.

July 24 -

Former Ginnie Mae President Ted Tozer is joining the board of directors at PennyMac Financial Services starting Aug. 1.

July 19 -

U.S. District Judge André Birotte has dismissed all federal claims against Renovate America and its government bond-issuing partners in three lawsuits that had sought class-action status.

July 19 -

The credit characteristics of the collateral are broadly similar to the sponsor's inaugural deal, completed in February, but the capital structure has been tweaked.

July 19 -

The House Appropriations Committee approved a HUD funding bill Monday that would prohibit the FHA from insuring properties with a Property Assessed Clean Energy loan in a first-lien position.

July 18 -

Property Assessed Clean Energy loans can no longer be offered in unincorporated areas of Kern County, Calif. The controversial loans, meant to promote energy efficiency, began in California and are now offered in a number of states.

July 12 -

Royal Bank of Scotland Group agreed to pay $5.5 billion to settle the second of three major U.S. mortgage-backed securities probes the government-owned lender must overcome before it can fully return to the private sector.

July 12 -

Federal Reserve officials have mapped out plans to reduce their $4.5 trillion balance sheet, but they’ve left out one key detail: the starting point.

July 5 -

Morgan Stanley received credit for $30 million of consumer relief, completing 85% of the obligations required by its February 2016 settlement with New York State.

July 3 -

Test your knowledge of these key terms from the servicing sector of the mortgage industry.

June 30 -

Wells Fargo & Co. surprised investors this week by withholding more than $90 million due to buyers of pre-crisis residential mortgage-backed securities.

June 30 -

Angel Oak was able to secure triple-A credit ratings for its next offering of nonprime residential mortgage bonds, despite offering considerably less credit enhancement.

June 28 -

The real estate investment trust is issuing its fourth securitization of older performing and non-performing loans of the year, and 13th since 2014.

June 28