-

The credit characteristics of the collateral are broadly similar to the sponsor's inaugural deal, completed in February, but the capital structure has been tweaked.

July 19 -

The House Appropriations Committee approved a HUD funding bill Monday that would prohibit the FHA from insuring properties with a Property Assessed Clean Energy loan in a first-lien position.

July 18 -

Property Assessed Clean Energy loans can no longer be offered in unincorporated areas of Kern County, Calif. The controversial loans, meant to promote energy efficiency, began in California and are now offered in a number of states.

July 12 -

Royal Bank of Scotland Group agreed to pay $5.5 billion to settle the second of three major U.S. mortgage-backed securities probes the government-owned lender must overcome before it can fully return to the private sector.

July 12 -

Federal Reserve officials have mapped out plans to reduce their $4.5 trillion balance sheet, but they’ve left out one key detail: the starting point.

July 5 -

Morgan Stanley received credit for $30 million of consumer relief, completing 85% of the obligations required by its February 2016 settlement with New York State.

July 3 -

Test your knowledge of these key terms from the servicing sector of the mortgage industry.

June 30 -

Wells Fargo & Co. surprised investors this week by withholding more than $90 million due to buyers of pre-crisis residential mortgage-backed securities.

June 30 -

Angel Oak was able to secure triple-A credit ratings for its next offering of nonprime residential mortgage bonds, despite offering considerably less credit enhancement.

June 28 -

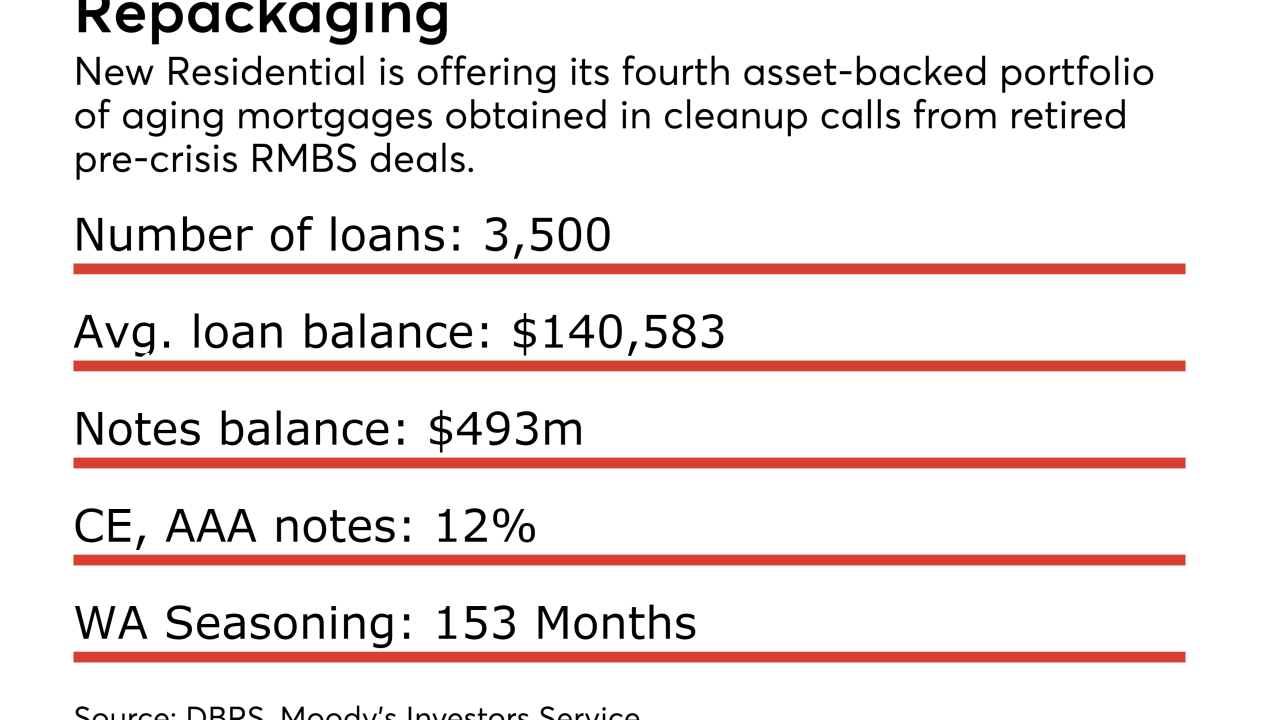

The real estate investment trust is issuing its fourth securitization of older performing and non-performing loans of the year, and 13th since 2014.

June 28 -

American International Group is accessing the securitized market through a Credit Suisse deal backed by loans that were generally originated less than a year after TRID.

June 21 -

Housing finance reform discussions are heating up and there's a growing sense that legislation can be enacted sooner rather than later. Here's why.

June 21 -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

Five Oaks Investment Corp. priced its follow-up 4 million common stock offering at $4.60 per share.

June 16 -

A former Nomura Holdings trader was found guilty of conspiring to lie to clients about mortgage-bond prices, while another was cleared of all charges in a verdict that highlights the challenge of policing fraud in the market.

June 15 -

Federal Reserve officials forged ahead with an interest-rate increase and additional plans to tighten monetary policy despite growing concerns over weak inflation.

June 14 -

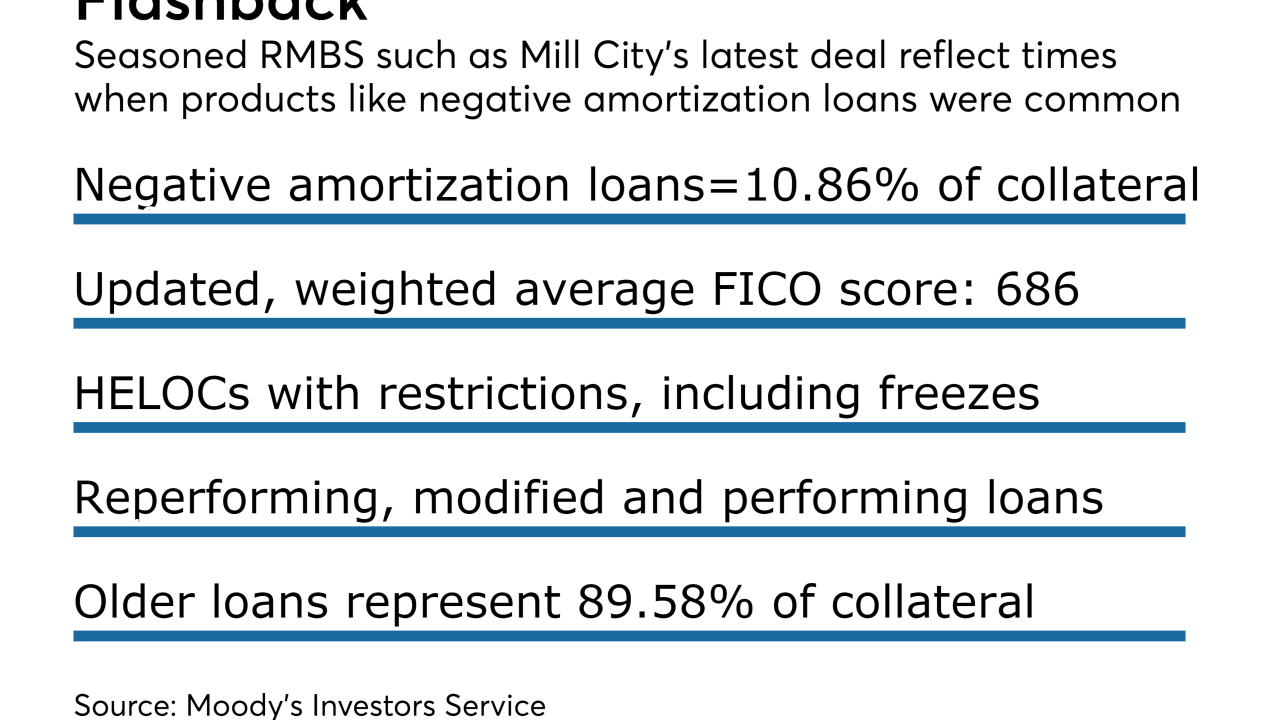

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

Federal Reserve officials surprised some onlookers by unveiling a rough plan for balance sheet runoff in the minutes for their May meeting.

June 12 -

American International Group Inc. could securitize through a unit it has previously used to buy jumbo loans.

June 6 -

MFA Financial launched a debut offering of bonds backed by rehabbed loans Monday; several other firms have begun aggregating residential mortgages in preparation for possible securitization.

June 5