-

American International Group is accessing the securitized market through a Credit Suisse deal backed by loans that were generally originated less than a year after TRID.

June 21 -

Housing finance reform discussions are heating up and there's a growing sense that legislation can be enacted sooner rather than later. Here's why.

June 21 -

Managing portfolios for an influx of servicing rights investors helps mortgage companies augment revenue and keep rising costs and compliance risks in check.

June 19 -

Five Oaks Investment Corp. priced its follow-up 4 million common stock offering at $4.60 per share.

June 16 -

A former Nomura Holdings trader was found guilty of conspiring to lie to clients about mortgage-bond prices, while another was cleared of all charges in a verdict that highlights the challenge of policing fraud in the market.

June 15 -

Federal Reserve officials forged ahead with an interest-rate increase and additional plans to tighten monetary policy despite growing concerns over weak inflation.

June 14 -

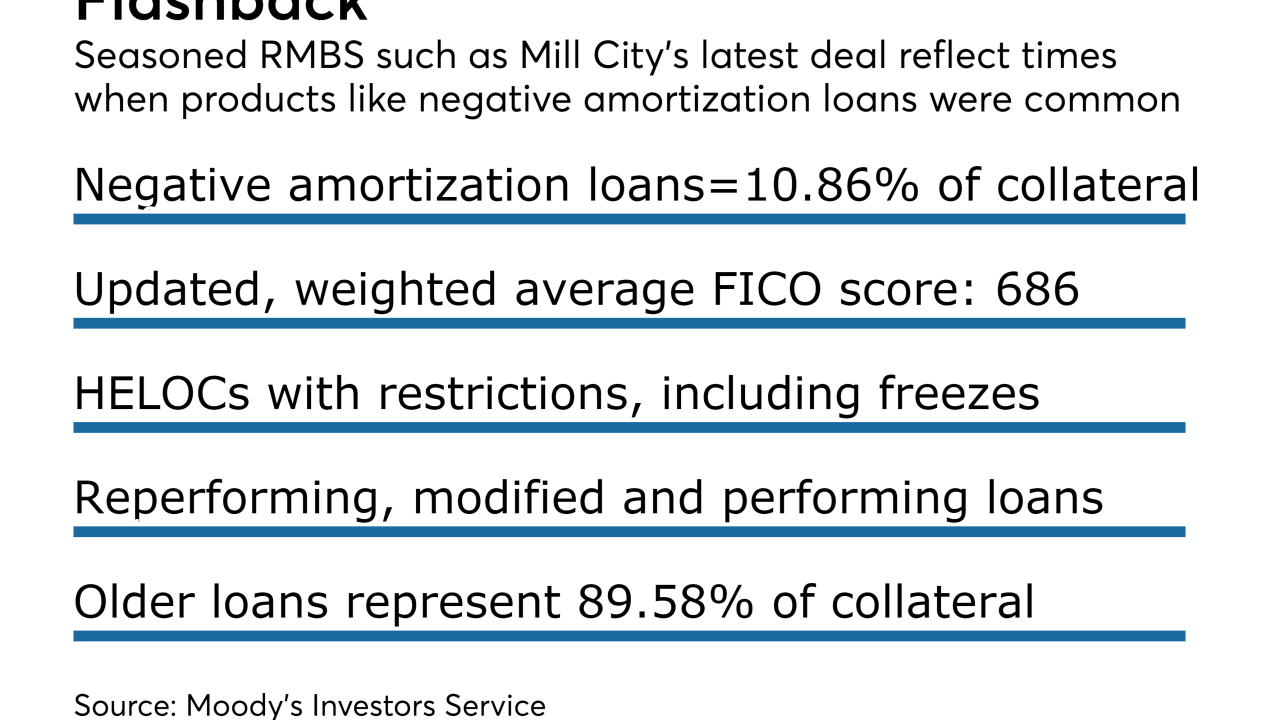

A loan securitization launched by Mill City has the largest concentration of seasoned negative-amortization loans seen in a residential mortgage-backed securities deal since the financial crisis.

June 12 -

Federal Reserve officials surprised some onlookers by unveiling a rough plan for balance sheet runoff in the minutes for their May meeting.

June 12 -

American International Group Inc. could securitize through a unit it has previously used to buy jumbo loans.

June 6 -

MFA Financial launched a debut offering of bonds backed by rehabbed loans Monday; several other firms have begun aggregating residential mortgages in preparation for possible securitization.

June 5 -

Deutsche Bank has reached a $95 million settlement with Maryland stemming from the housing crisis that will funnel $80 million to provide new mortgages or mortgage relief to eligible consumers as well as help finance affordable housing.

June 2 -

DLJ Mortgage Capital, a subsidiary of Credit Suisse, is securitizing $91 million of loans insured by the Federal Housing Administration that were once delinquent but are now making timely payments.

May 30 -

Two Harbors Investment Corp. is spinning out its commercial real estate lending business to a newly created real estate investment trust, Granite Point Mortgage Trust Inc.

May 24 -

JPMorgan Chase is marketing another offering of bonds backed by a mix of conforming and jumbo residential mortgages, according to Moody's Investors Service.

May 19 -

U.S. prosecutors working to convict three former Nomura Holdings Inc. mortgage-bond traders are trying to convince jurors that lying about prices amounts to fraud.

May 17 -

U.S. securities regulators are investigating whether bonds backed by single-family rental homes and sold by Wall Street's biggest residential landlords used overvalued property assessments.

May 9 -

One of the largest mortgage-bond investors says it would be a mistake for the federal government to relinquish control of Fannie Mae and Freddie Mac without first making major changes to the nation's housing-finance system.

May 5 -

Bayview Asset Management is marketing another $183 million of bonds backed by reperforming mortgages acquired last year from CitiFinancial Credit Co.

April 28 -

The onslaught of regulatory actions against Ocwen may open the door for Nationstar to pick up a massive subservicing portfolio from the beleaguered servicer.

April 27 -

Jesse Litvak was sentenced to two years in prison and fined $2 million after he was convicted a second time for lying about mortgage-backed securities prices.

April 26