-

Credit enhancement includes subordination, shored up by excess spread generated from excess spread between the cash flow on the collateral and the certificates.

December 10 -

Bigger loans make mortgage bonds riskier for investors. When homeowners have larger loans, they become more likely to refinance even with relatively small declines in interest rates.

December 9 -

Velocity Commercial Capital, 2021-4 uses subordination and excess spread that will cover both current and cumulative realized losses.

December 9 -

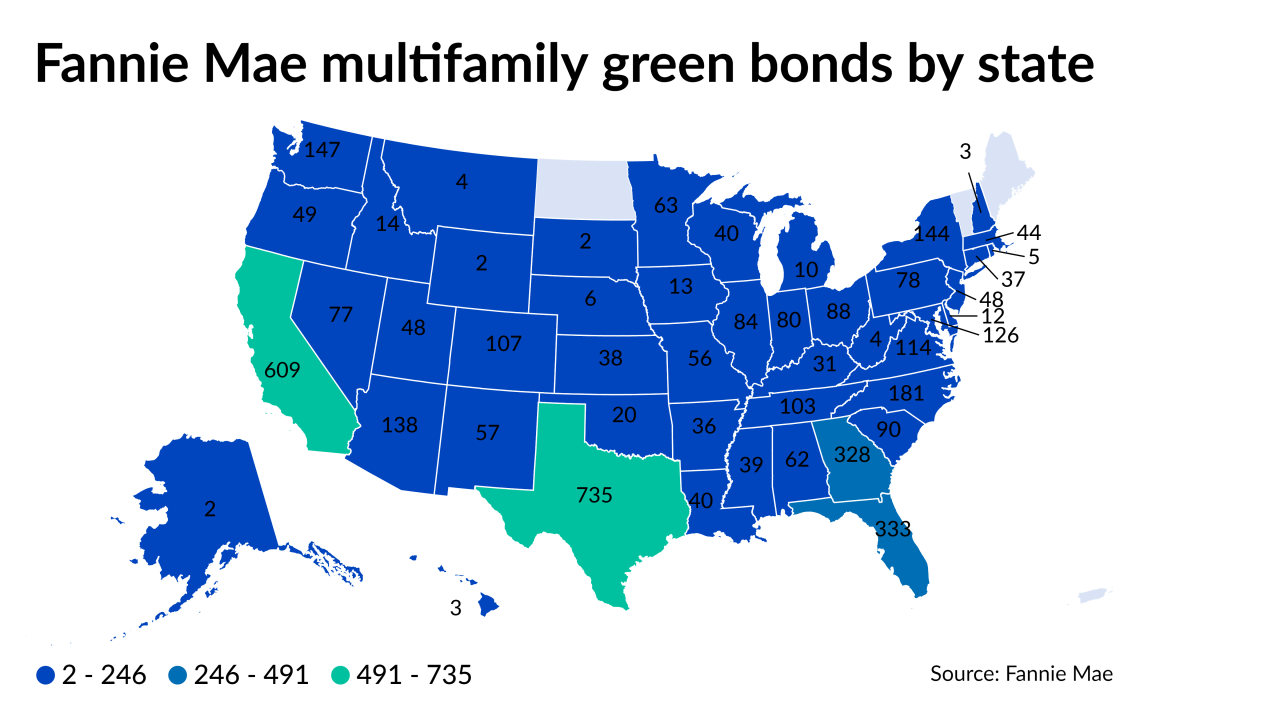

New securitizations of mortgages on energy-efficient rental housing totalled $12.7 billion during the first 11 months of this year, suggesting 2021’s total will come close to matching 2020’s $13 billion.

December 8 -

The pool includes a high concentration of loans originated through alternative underwriting, and on investment properties. Just 10.3% of the pool received COVID forbearance.

December 8 -

The findings in a new TransUnion study could lend momentum to recent efforts by Fannie Mae and Freddie Mac to encourage the reporting and use of rental-payment information in lending.

December 7 -

All of the loans are non-prime loans, and this is the first transaction that BREDS will sponsor using the BINOM shelf.

December 3 -

Former principal economist at the Federal Housing Finance Agency does the math on how the changes impact the missions of Fannie Mae and Freddie Mac.

December 3 Federal Housing Finance Agency

Federal Housing Finance Agency -

The entire collateral pool is made up of conforming, high-balance mortgage loans underwritten using an automated system designated by Fannie Mae or Freddie Mac.

December 3 -

LoanLogics, a Sun Capital affiliate, has purchased LoanBeam, a company with approvals from major government-related housing finance investors to provide digital processing and income calculations for tax documents.

December 2