-

Improved capitalization and smaller balance sheets should help several weather the likely consolidation that is coming, Moody's said.

September 3 -

Low pool concentrations of loans on properties located in Ida's path, plus robust property insurance are expected to rein in impacts and insulate noteholders.

September 3 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

A majority of the deal was underwritten to a less-than-full documentation standard, but meets ATR standards. Almost half of the loans are on California homes.

September 1 -

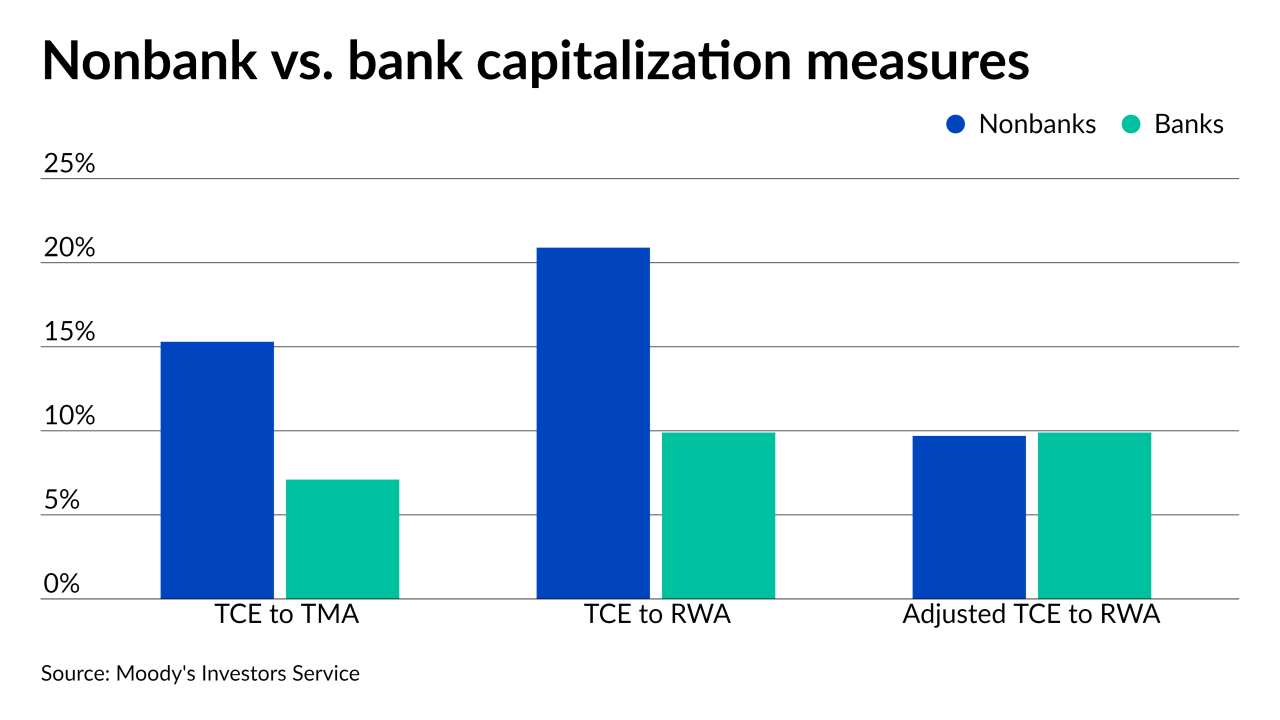

By some current measures, nonbank capitalization looks strong compared to banks, but the way a Ginnie Mae proposal aims to assess the value of mortgage servicing rights would change that, Moody’s Investors Service reported Tuesday.

August 31 -

The Federal Housing Finance Agency in the Trump administration had been preoccupied with Fannie Mae and Freddie Mac’s capital position. Acting Director Sandra Thompson has shifted the agency’s focus to affordable housing and fair lending.

August 27 -

The deal appears to take advantage of a shift in federal rules reducing the level of non-owner-occupied loans Fannie Mae and Freddie Mac can purchase.

August 26 -

Even as lenders increased purchase share, higher expenses and margin compression related to pricing competition led to smaller quarterly net gains.

August 24 -

The proceeds from the trust’s certificates will refinance some CMBS debt, among other balance sheet uses.

August 24 -

Revenue at the fintech company grew from prior periods without even taking into account any contributions from the Title365 acquisition at the end of the quarter.

August 20