-

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

Overall, three-quarters of those in a National Mortgage News survey believe loan production will increase during 2026, but just 15% felt strongly about it.

January 29 -

Respondents to an exclusive NMN survey lay odds on lower rates boosting housing despite stagflation and recession risks. Here's how the Fed's view compares.

January 28 -

Submit your production volume from last year to be considered among the top in your field. The deadline for submissions is Feb. 27, and the clock is already running.

January 28 -

As the Federal Open Market Committee announces its near-term interest rate plans Wednesday, market watchers expect the central bank to hold interest rates steady as policymakers seek greater clarity on the health of the economy.

January 28 -

State regulators say proposed changes by the Federal Reserve that would make state bank examiners the primary boots on the ground will make bank examinations faster, but could cause some issues to go overlooked.

January 27 -

United Wholesale Mortgage, which was sued twice in December for alleged violations, put the blame for some text messages on an independent mortgage broker.

January 26 -

After the announcement last fall, Embrace added local staff and increased marketing nad outreach in New Jersey to assist potential Oceanfirst borrowers.

January 23 -

The 30-year fixed rate mortgage increased 3 basis points this past week, off of a three-year low point, but are nearly a percentage point lower than a year ago.

January 22 -

A retail channel veteran, Promisco has spoken frequently about the potential of AI to bring efficiency and lower costs in the loan origination process.

January 21 -

Executives surveyed by American Banker said companies vying to wrestle market share from banks are a major threat to operations in the coming year.

January 21 -

The company reported net income of $5.6 million in 2025, up 61.9% from the year prior, while mortgage banking revenue decreased by $120,000, or 39.5%.

January 21 -

The Consumer Financial Protection Bureau has backed off enforcement and supervision of consumer protection laws, leaving states to fill the void — and potentially creating a "patchwork" of state laws that banks will have to comply with.

January 21 -

Confidence among US homebuilders unexpectedly fell in January, as costly sales incentives outweighed a recent boost from lower mortgage rates and the president's housing proposals.

January 16 -

NAHB's remodeling index finished at its highest mark in a year, with the current industry outlook standing in stark contrast to homebuilder sentiment.

January 16 -

Mortgage applications for new-home purchases decreased 15.2% on a seasonally adjusted basis in December, according to the Mortgage Bankers Association.

January 15 -

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

United Wholesale Mortgage sees this branding partnership as an opportunity to recruit workers in its home market in the Detroit area, CMO Sarah DeCiantis said.

January 15 -

Over 46% of mortgage transactions examined had at least one significant wire fraud or title risk, with 3.2 findings per transaction, Fundingshield said.

January 14 -

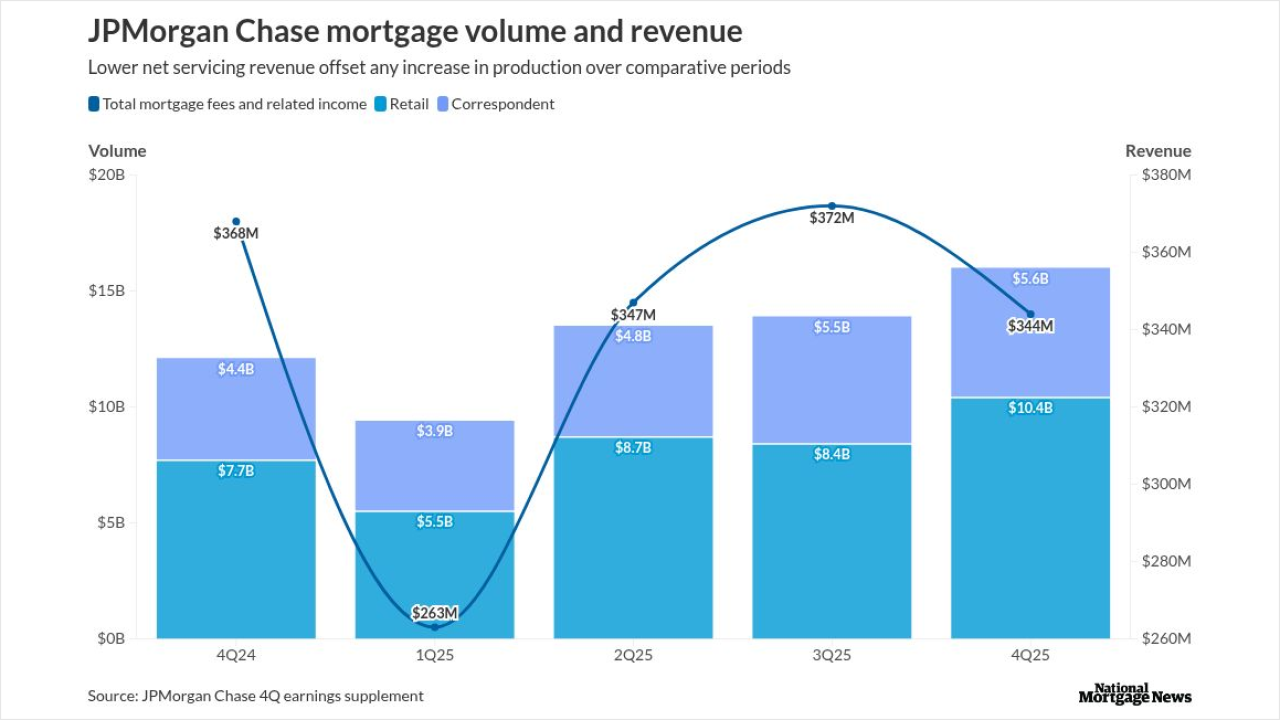

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13