-

Executives surveyed by American Banker said companies vying to wrestle market share from banks are a major threat to operations in the coming year.

January 21 -

The company reported net income of $5.6 million in 2025, up 61.9% from the year prior, while mortgage banking revenue decreased by $120,000, or 39.5%.

January 21 -

The Consumer Financial Protection Bureau has backed off enforcement and supervision of consumer protection laws, leaving states to fill the void — and potentially creating a "patchwork" of state laws that banks will have to comply with.

January 21 -

Confidence among US homebuilders unexpectedly fell in January, as costly sales incentives outweighed a recent boost from lower mortgage rates and the president's housing proposals.

January 16 -

NAHB's remodeling index finished at its highest mark in a year, with the current industry outlook standing in stark contrast to homebuilder sentiment.

January 16 -

Mortgage applications for new-home purchases decreased 15.2% on a seasonally adjusted basis in December, according to the Mortgage Bankers Association.

January 15 -

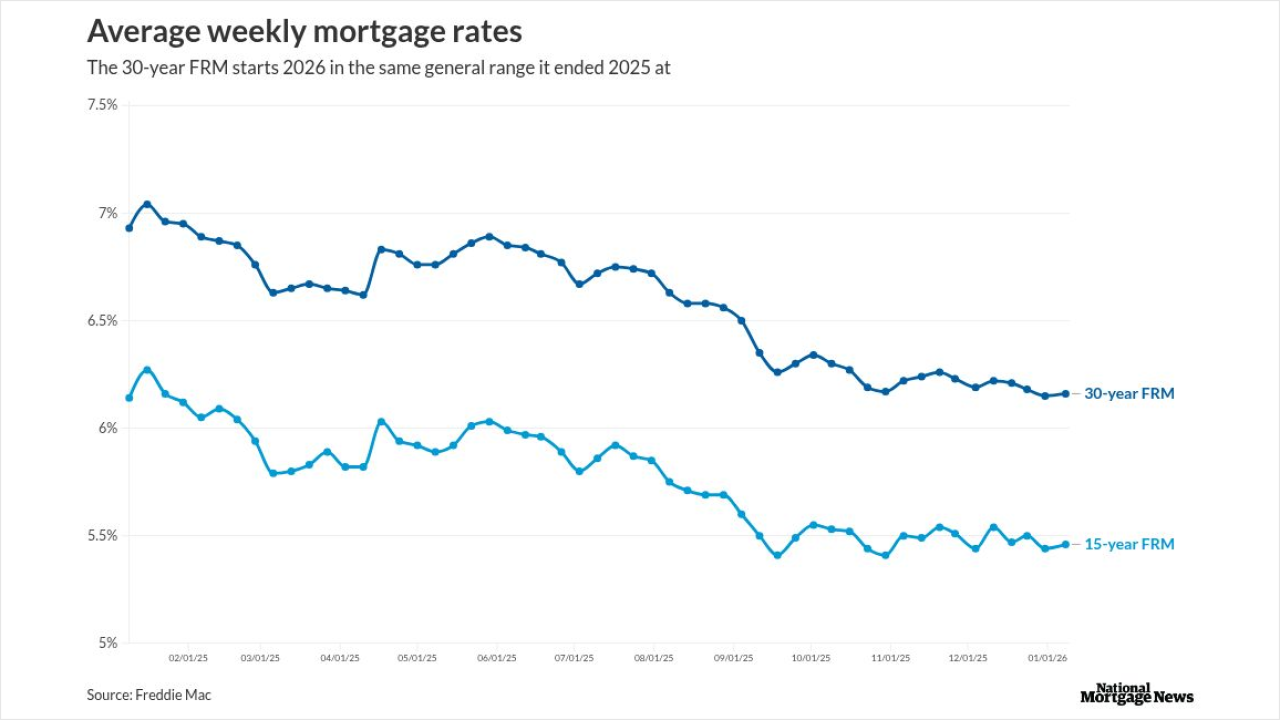

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

United Wholesale Mortgage sees this branding partnership as an opportunity to recruit workers in its home market in the Detroit area, CMO Sarah DeCiantis said.

January 15 -

Over 46% of mortgage transactions examined had at least one significant wire fraud or title risk, with 3.2 findings per transaction, Fundingshield said.

January 14 -

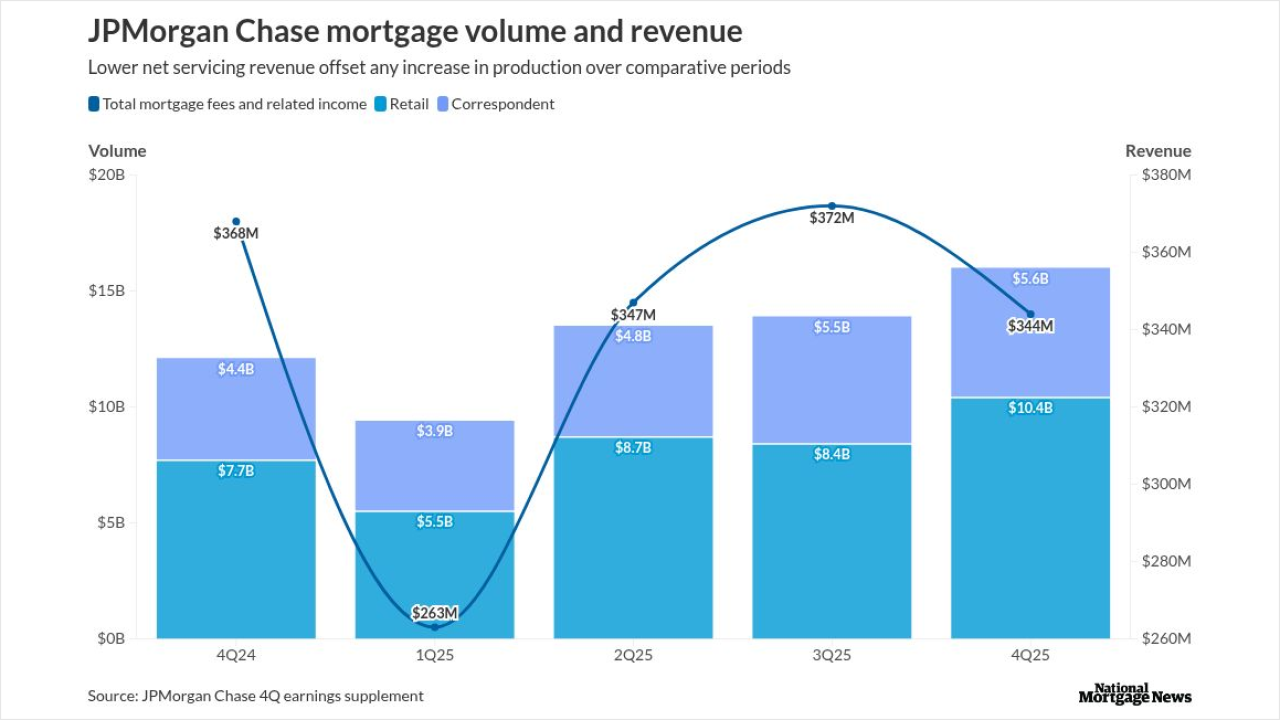

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

A Florida man's racketeering class action case accuses two mortgage employees of conspiring with a homebuilder to facilitate fraudulent construction draws.

January 13 -

Cryptocurrency development in the mortgage industry has accelerated in no small part from easing regulation and a push from FHFA Director Bill Pulte.

January 13 -

Sales of new homes in the US were little changed in October near the strongest pace since 2023 as builders lured anxious customers with price cuts and incentives.

January 13 -

The deal which brings hundreds of thousands of agents under one roof also combines retail lender Guaranteed Rate's separate joint ventures with each brokerage.

January 9 -

With ongoing affordability issues, the Federal Housing Administration program will keep taking low down payment market share from the private mortgage insurers.

January 9 -

Housing starts in the US fell in October to the lowest level since the onset of the pandemic as data delayed by last fall's government shutdown showed builders continued to cut back amid still-high prices and mortgage rates.

January 9 -

The rule, effective July 7, puts into place requirements similar to those for banks, except nonbanks do not have to make community investments or grants.

January 8 -

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

Loanlogics rolled out the LoanBeam NQM income analyzer in October and has four users for the non-qualified mortgage underwriting technology, including Pennymac.

January 7