-

A modest improvement in prices and mortgage rates encouraged buyers. Signings have now increased for four straight months, matching a pandemic streak.

December 29 -

Some action items could make a big difference for both mortgage lenders and consumers, but the Trump Administration is not yet focused on these concerns.

December 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

December 29 -

National Mortgage News takes a look back at some of the major or unique transactions which went on, or in some cases didn't happen, in the past 12 months.

December 29 -

Home prices rose 0.2% nationally month-over-month in November, but there were an estimated 37.2% more sellers than buyers in the market, Redfin said.

December 26 -

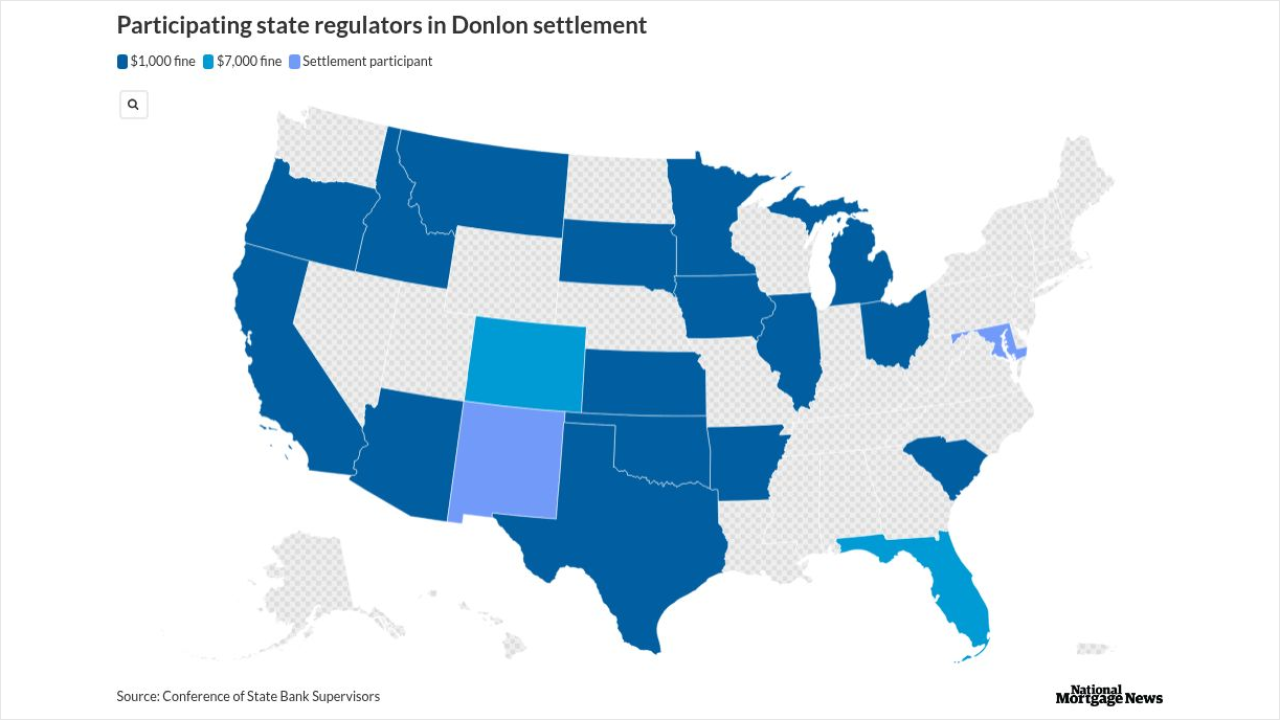

Patrick Terrance Donlon, CEO of Trusted American Mortgage, settled allegations from 21 states another person took industry education courses for him.

December 26 -

Rialto Capital allegedly engineered a way to keep it in default so that the company could win extra fees over time, according to a lawsuit filed Tuesday.

December 26 -

Three Democratic Senators say Demotech's assessments "raise profound governance and reliability concerns" in letters to Fannie Mae and Freddie Mac.

December 26 -

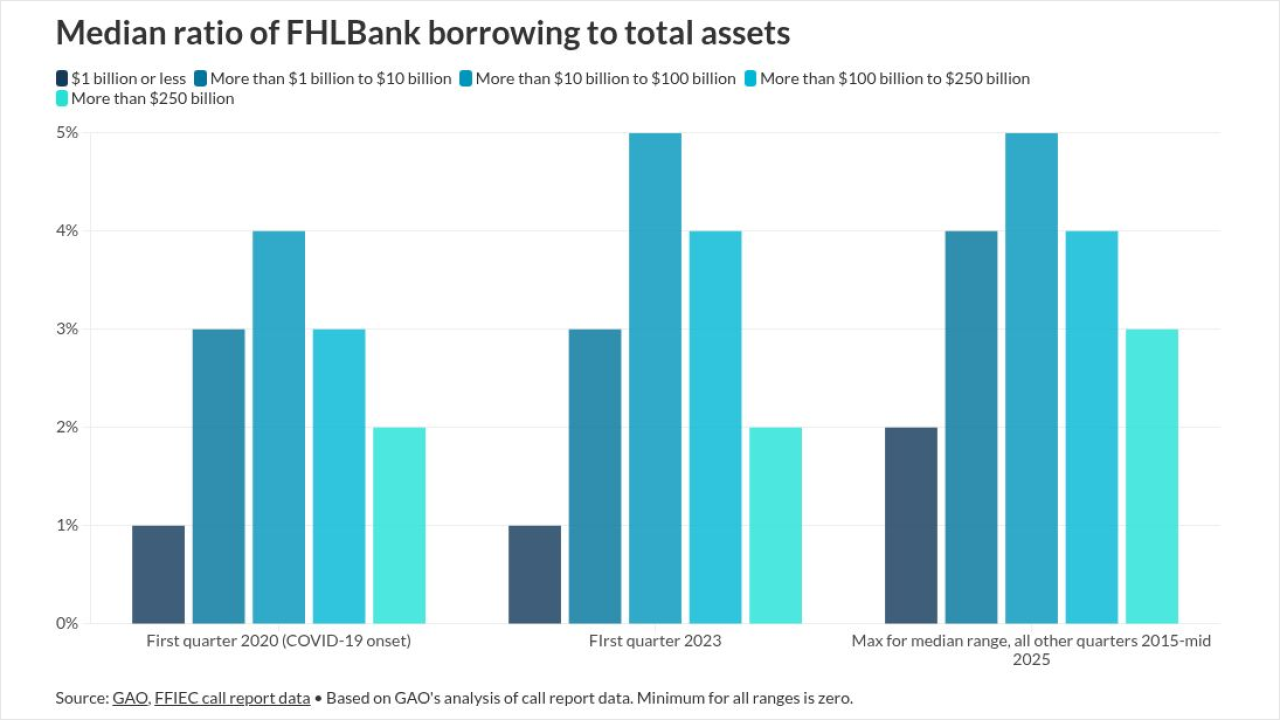

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Mortgage lenders test crypto-backed mortgages as Fannie Mae and Freddie Mac review digital assets in underwriting, weighing risk, non-QM loans and access for nontraditional homebuyers.

December 26 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

The MBA's Market Composite Index, a measure of mortgage loan application volume, dropped 5% on a seasonally-adjusted basis and 6% on an unadjusted basis.

December 24 -

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

The bank regulator is proposing to strengthen national preemption in the wake of conflicting decisions in related court cases.

December 24 -

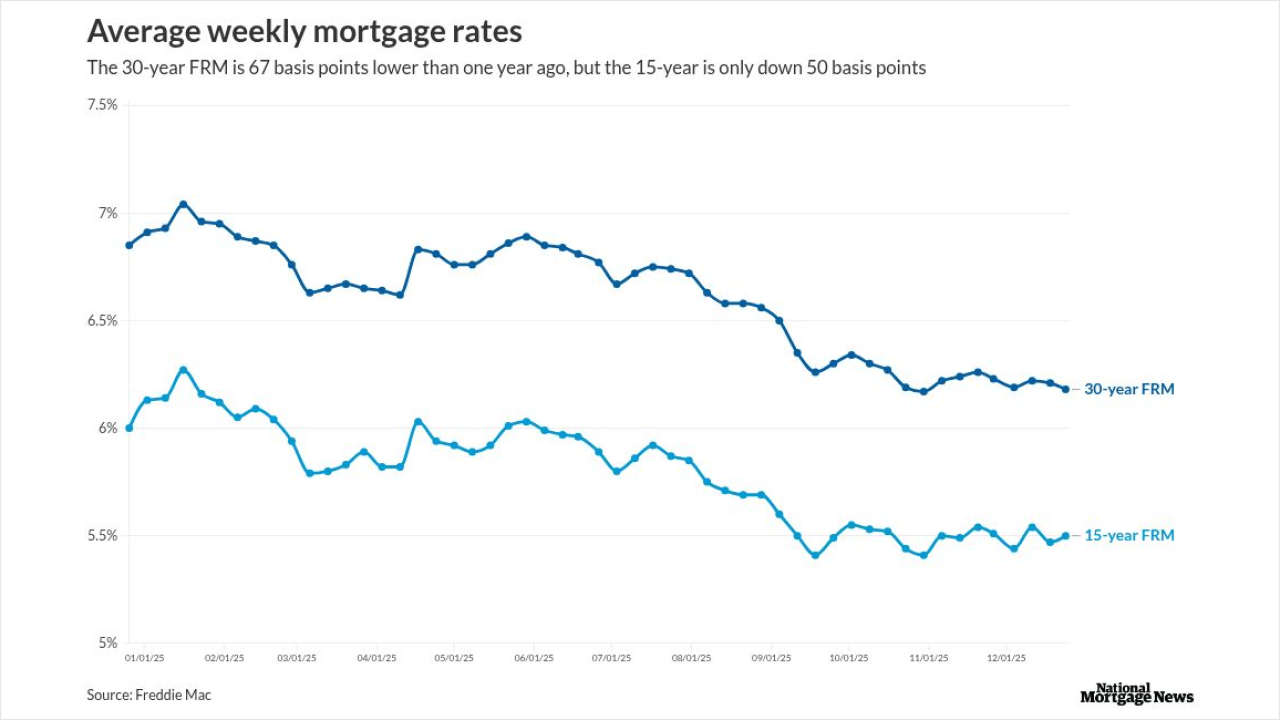

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24 -

Wellness rooms, thoughtful sensory inputs and layouts that boost functionality can reduce workplace stress.

December 24 -

Despite certain pronouncements otherwise, rumors of email's demise have been gravely exaggerated, as recent data shows it's not only still around, it's ubiquitous.

December 24 -

A rise in issuance of nonqualified mortgages and seconds is in the forecast but home prices, credit and the GSEs may impact private-label bonds' trajectory.

December 24 -

The regulator lowered benchmarks for acquisitions of certain single-family loans including low-income refinances, and left multifamily targets intact.

December 23