-

A federal judge recommended that an enhanced real estate reporting requirement, which could send paperwork and costs soaring next year, remain intact.

December 11 -

This year Point has funded more than $2 billion in home equity investments to more than 20,000 homeowners nationwide.

December 10 -

With the Federal Reserve decision largely factored in, Jerome Powell's comments on future outlook is more likely to influence the housing market.

December 10 -

Charlie Scharf has a mostly optimistic take on Wells' consumer banking prospects entering 2026. But he's more downbeat about the company's once-dominant residential mortgage business.

December 10 -

Hartford, Connecticut, Rochester, New York, and Worcester, Massachusetts, headed the list of the 100 largest metro areas in the country, according to Realtor.com.

December 10 -

The terms of NRMLT 2025-NQM7 will not allow it to advance principal and interest on loans that are delinquent by 180 days or more.

December 10 -

The House Financial Services Committee discussed allowing banks to experiment with artificial intelligence with a waiver from regulatory penalties, including consumer protection laws, in a hearing.

December 10 -

The Federal Reserve's interest rate-setting committee is widely expected to cut rates by 25 basis points today, but where the central bank goes from here is an open question.

December 10 -

Home equity is becoming a data-driven asset that demands sharper valuation and analytics as lending options expand, according to Clear Capital's EVP of Strategy and Growth.

December 10Clear Capital -

A senior advisor at NAIC, the association of state insurance regulators, told attendees of its fall meeting that the imminent FEMA Review Council report should answer questions about funding for disaster relief and flood insurance, as well as other related issues.

December 10 -

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

Sen. Hassan sent letters to corporate owners of manufactured housing communities, looking for answers on affordability and living conditions for their residents.

December 10 -

A former employee cited a ransomware gang's claim in October that it stole 20 terabytes of sensitive customer information from the industry vendor.

December 10 -

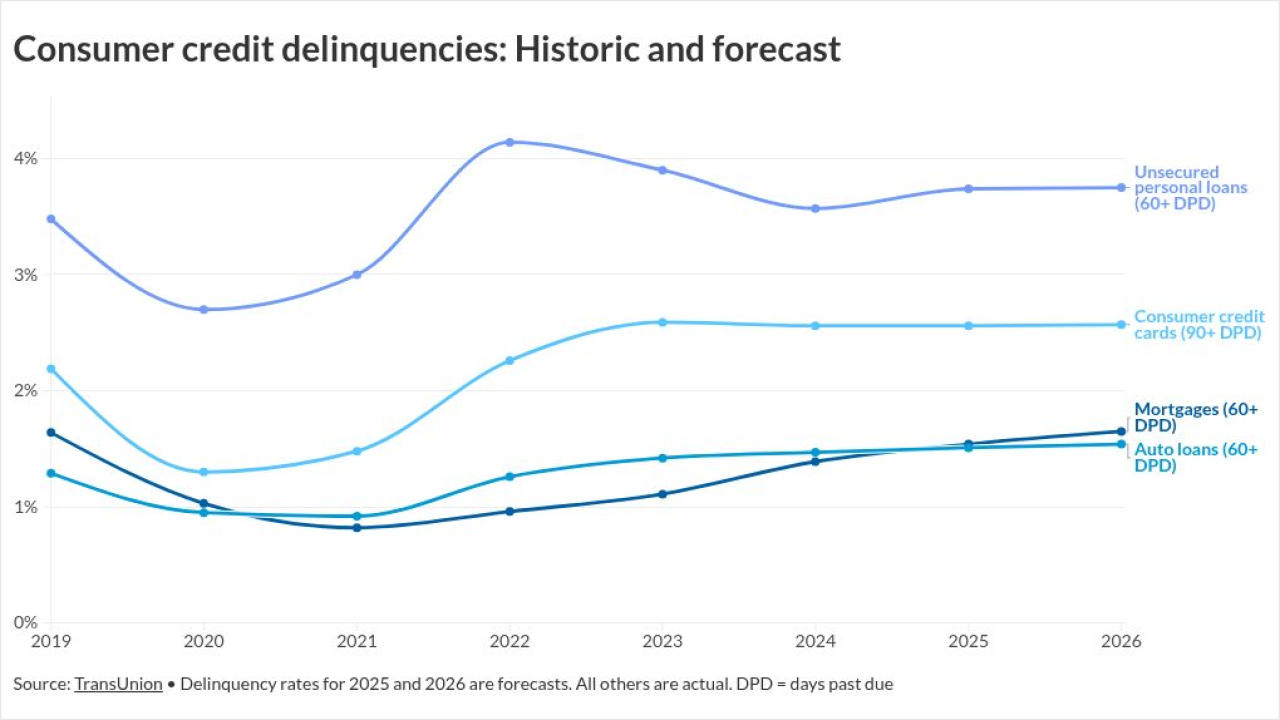

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10 -

A federal court cannot modify a preliminary injunction to compel the acting director of the Consumer Financial Protection Bureau to request funding for the agency, the Department of Justice said.

December 9 -

The company's latest funding announcement caps off a year of tailwinds that propelled growth for home equity investment platforms and related lending products.

December 9 -

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

December 9 -

The decision in a New York case that is also undergoing federal review puts pressure on related parties to get things right within a statute of limitations.

December 9 -

Democratic senators are calling for Senate Banking Committee Chairman Tim Scott to compel the acting director of the Consumer Financial Protection Bureau to testify.

December 9 -

An influx of adjustable-rate and cash-out refinance mortgage programs during the month pushed the Mortgage Credit Availability Index 0.7% higher in November.

December 9