-

President Donald Trump's support of legislation that would cap credit card interest rates at 10% has flagged in recent weeks, but experts say that the debate has highlighted significant gaps in regulators' understanding of the credit card market and how its risks are priced.

February 3 -

Executives surveyed by American Banker said companies vying to wrestle market share from banks are a major threat to operations in the coming year.

January 21 -

President Trump in Davos, Switzerland, talked about his call for lower credit card interest rates and more affordable housing in a lengthy speech that mostly focused on his plan to take over Greenland.

January 21 -

Bilt's new card caps interest rates at 10% for one year and Affirm is adding BNPL for rent as analysts predict the political environment will benefit fintechs.

January 16 -

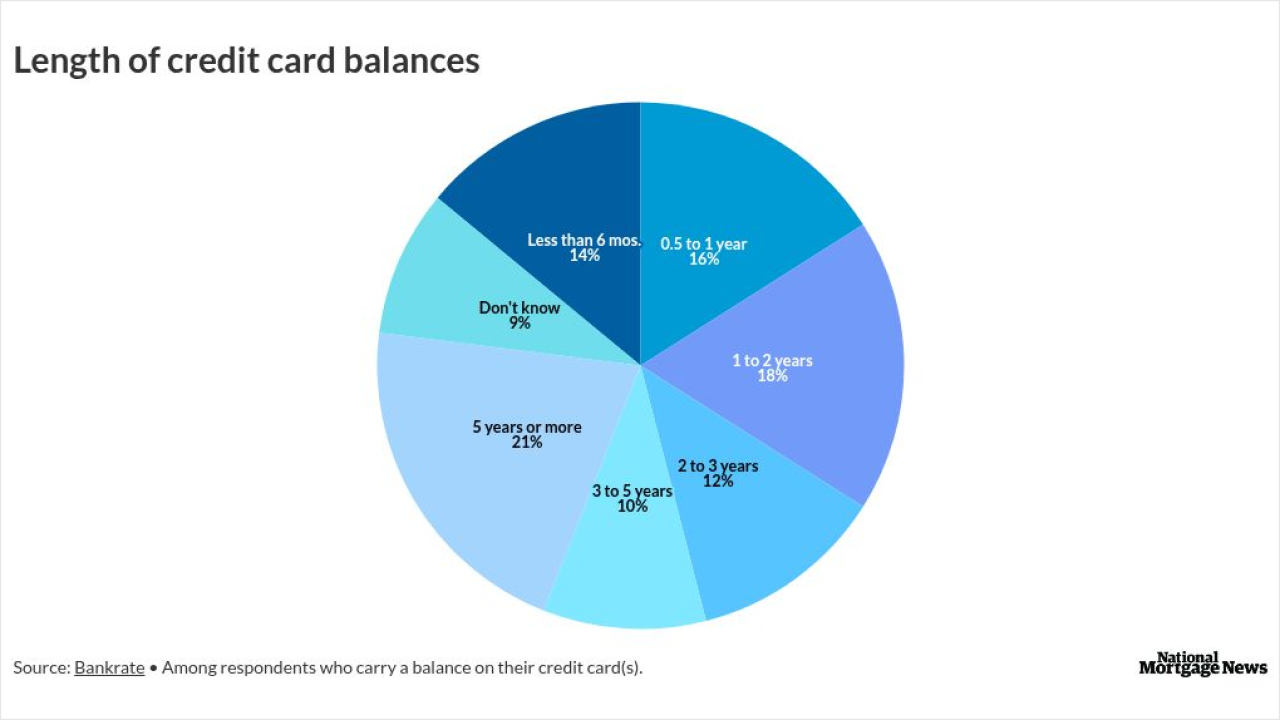

Nearly half of all credit card users carry a balance, according to Academy Bank. Higher non-mortgage debt levels can affect home loan underwriting.

January 12 -

Bank statement loans, a home equity credit card and a blockchain investment product are among the new offerings designed to reach an $11 trillion market.

December 5 -

The credit card will provide borrowers points for making their normal monthly mortgage loan payments and for the purchase of home products and services.

November 21 -

The credit score provider has developed "focused" language artificial intelligence models purpose-built for tasks like detecting payment fraud, assessing risk and recommending next best actions.

September 23 -

The new litUSD is being issued on Ethereum and backed one-to-one with the dollar using cash and cash equivalents being held by LitFinancial in reserve.

September 12 -

Late-payment rates among U.S. borrowers rose again in the second quarter, according to a report from the New York Fed. The trend reflects a sharp increase in student loan delinquencies, which have been climbing as pandemic-era policies have expired.

August 5 -

Mounting liabilities are raising the stakes for an economy that has come to rely more and more on high-end consumer spending to power expansion.

July 29 -

New self-regulatory guidelines for credit cards and checking accounts are arriving at a time of deregulation in Washington, D.C.

June 25 -

Rocket Companies and Mesa have both launched credit cards geared that offer homeowners perks and points for paying their mortgage and buying housing-related items.

May 30 -

Sen. Dick Durbin, the Senate's No. 2 Democrat, announced he will not seek reelection in 2026, concluding more than four decades in Congress. The Illinois lawmaker leaves behind a notable imprint on U.S. financial policy, particularly regarding swipe fees.

April 23 -

The Treasury will phase out the use of paper checks for most government payments in about six months. The Trump administration says the move will improve efficiency and reduce the cost of payment processing.

March 26 -

The law would have expanded the state's 12% interest rate cap in a manner that would have effectively banned fintech lending in the state.

March 25 -

Wall Street veteran Frank Bisignano pledged at a Senate Finance Committee hearing that he doesn't plan to privatize Social Security.

March 25 -

In comments to reporters, Sen. Elizabeth Warren, D-Mass., underscored what she said was a conflict of interest between Elon Musk's DOGE's actions at the Consumer Financial Protection Bureau and his business interests with X Money.

February 11 -

The post-pandemic increase in consumers falling behind on their credit card bills seems to be tapering off. "For 2025, we're seeing a lot of stability in delinquencies," an industry researcher said.

December 13 -

President-elect Donald Trump is nominating Frank Bisignano, the chief executive officer of fintech and payments company Fiserv Inc., to be the commissioner of the Social Security Administration.

December 4