-

November rate locks fell seasonally but hit their strongest level since 2021, led by refis, while lenders shifted more loans to the GSE cash window.

December 10 -

Sen. Hassan sent letters to corporate owners of manufactured housing communities, looking for answers on affordability and living conditions for their residents.

December 10 -

A former employee cited a ransomware gang's claim in October that it stole 20 terabytes of sensitive customer information from the industry vendor.

December 10 -

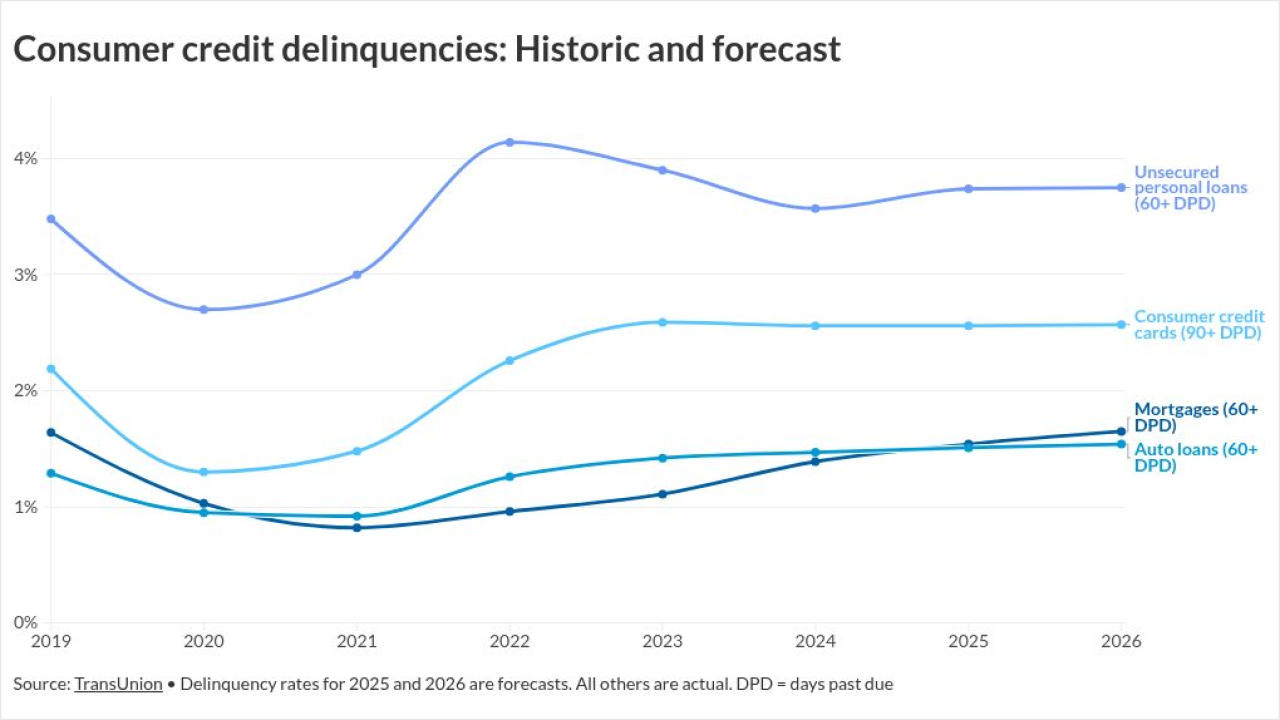

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10 -

A federal court cannot modify a preliminary injunction to compel the acting director of the Consumer Financial Protection Bureau to request funding for the agency, the Department of Justice said.

December 9 -

The company's latest funding announcement caps off a year of tailwinds that propelled growth for home equity investment platforms and related lending products.

December 9 -

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

December 9 -

The decision in a New York case that is also undergoing federal review puts pressure on related parties to get things right within a statute of limitations.

December 9 -

Democratic senators are calling for Senate Banking Committee Chairman Tim Scott to compel the acting director of the Consumer Financial Protection Bureau to testify.

December 9 -

An influx of adjustable-rate and cash-out refinance mortgage programs during the month pushed the Mortgage Credit Availability Index 0.7% higher in November.

December 9 -

Home Depot Inc. is offering cautious preliminary guidance for next year, a sign that the home-improvement retailer doesn't anticipate the housing market to rebound in the short term.

December 9 -

In a new interpretive letter, the Office of the Comptroller of the Currency will allow banks to serve as middlemen for "riskless" crypto trades, extending existing brokerage authority for securities to digital assets.

December 9 -

New rules means sellers and servicers will need to have plans demonstrating proper oversight of their artificial intelligence and machine learning practices.

December 9 -

In a world assailed by extreme weather, homeowners and purchasers need to know their property's vulnerability to wildfire or flooding. Ratings like those Zillow took down are a big improvement on often outdated federal flood maps and state wildfire maps.

December 9 -

Michael Burry, the money manager made famous in The Big Short, believes a re-listing of the US housing-finance giants is "nearly upon us."

December 9 -

An attorney for Christopher J. Gallo, who is battling 18 federal charges, said the lender's 18-month delay in pursuing the sign-on bonus makes little sense.

December 9 -

Treasury yields climbed to the highest in more than two months, following losses in most global government-bond markets, ahead of a Federal Reserve interest-rate decision that may alter expectations for monetary policy in 2026.

December 8 -

The provider of actuarial-related services is bringing a company that provides mortgage servicing rights analytics and risk management into the fold.

December 8 -

Hildene, which partners with Crosscountry Mortgage for non-QM securitizations, is doing this deal as part of its buy of an annuity provider, SILAC.

December 8 -

In oral arguments held Monday morning, a majority of Supreme Court justices seemed poised to overrule a 90-year-old precedent validating multimember independent commissions, but it remains uncertain what limits — if any — the court may impose on the president's removal powers.

December 8