-

But the industry-backed proposal differs by $13 million from the House version of the appropriation bill and it is not likely to get resolved until after the November election.

July 29 -

As Treasuries advance for a third-straight month, investors are fully pricing in at least two quarter-point rate reductions this year, slightly more than what policymakers have telegraphed.

July 29 -

In a new survey of bank executives from IntraFi, 90% of respondents said instances of check fraud have increased in recent years and half want law enforcement to make check fraud a bigger priority to stop criminals from stealing checks in the mail.

July 29 -

Four conceptual applications were chosen that address pain points in single and multifamily housing.

July 29 -

Catch up on the housing and mortgage industry issues pushing to the forefront of the 2024 election — and how each campaign is responding.

July 29 -

Increasing immediate volume and preparing for future volume are drivers for a ramp up in LO hiring, mortgage lenders say. Recruiters warn, however, that operations professionals should also be hired to avoid bottlenecks in production.

July 29 -

The lawsuit's conclusion ends fights by the rivals to depose each other's senior leaders.

July 29 -

InnSure executive director shares how communities can combat higher rates and mitigate climate risk by taking control of their insurability.

July 28 -

The second quarter for the subsidiary of Waterstone Financial posted its highest net income since the same period in 2022, while its volume was the most in seven quarters.

July 26 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

As the vice president gathers support from the Democratic party in hopes of securing the nomination, attention has turned to her policies, some of which aim to boost affordable supply.

July 26 -

Despite being a top concern for a wide swath of voters, housing affordability has largely been absent from presidential politics.

July 26 -

While the federal banking agencies are not changing any current rules, they issued a joint statement Thursday cautioning banks about risks in third-party deposit partnerships. They are also seeking public input on bank-fintech partnerships more generally.

July 25 -

A group of 14 state attorneys general, led by Tennessee, joined the chorus of opposition to the Fannie Mae pilot to not require title insurance on certain refinances

July 25 -

Moderating price growth and higher wages are leading to affordability relief, according to the Mortgage Bankers Association.

July 25 -

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

U.S. economic growth accelerated by more than forecast in the second quarter, illustrating demand is holding up under the weight of higher borrowing costs.

July 25 -

The annual J.D. Power mortgage servicer study found a six-point rise in the industry average score but also that consumer financial health slipped downward.

July 25 -

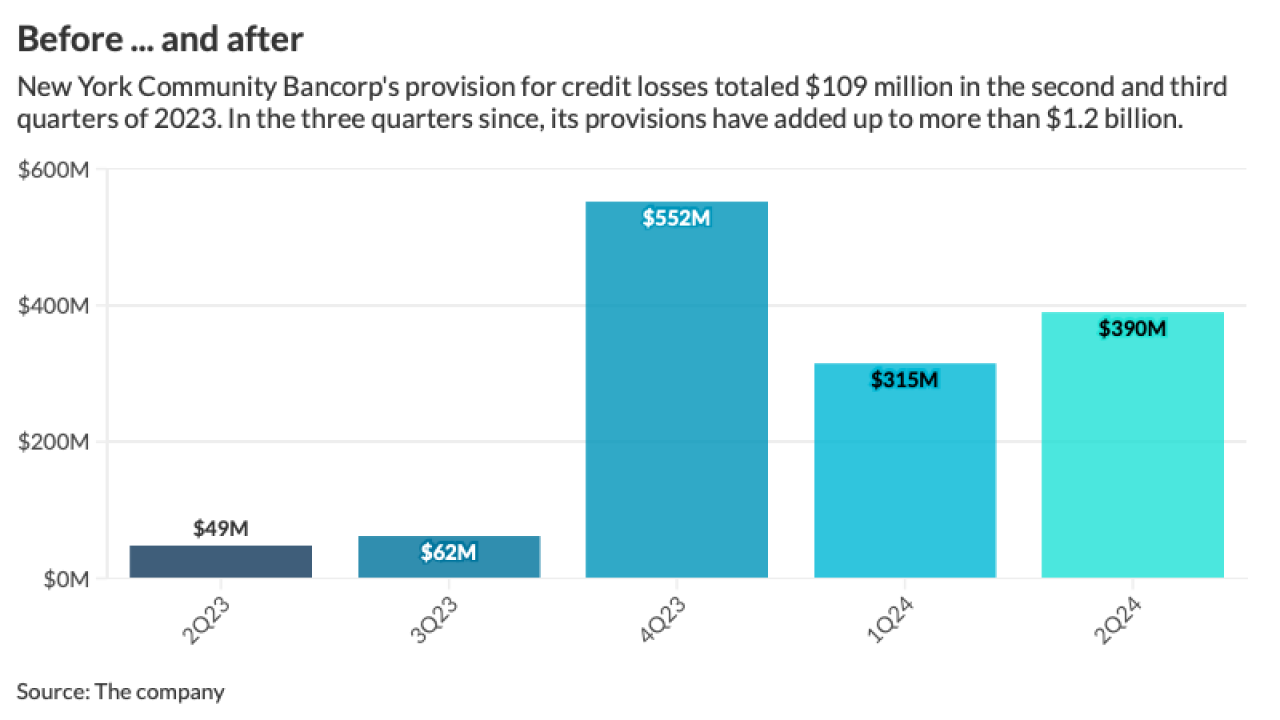

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25