-

As the vice president gathers support from the Democratic party in hopes of securing the nomination, attention has turned to her policies, some of which aim to boost affordable supply.

July 26 -

Despite being a top concern for a wide swath of voters, housing affordability has largely been absent from presidential politics.

July 26 -

While the federal banking agencies are not changing any current rules, they issued a joint statement Thursday cautioning banks about risks in third-party deposit partnerships. They are also seeking public input on bank-fintech partnerships more generally.

July 25 -

A group of 14 state attorneys general, led by Tennessee, joined the chorus of opposition to the Fannie Mae pilot to not require title insurance on certain refinances

July 25 -

Moderating price growth and higher wages are leading to affordability relief, according to the Mortgage Bankers Association.

July 25 -

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

U.S. economic growth accelerated by more than forecast in the second quarter, illustrating demand is holding up under the weight of higher borrowing costs.

July 25 -

The annual J.D. Power mortgage servicer study found a six-point rise in the industry average score but also that consumer financial health slipped downward.

July 25 -

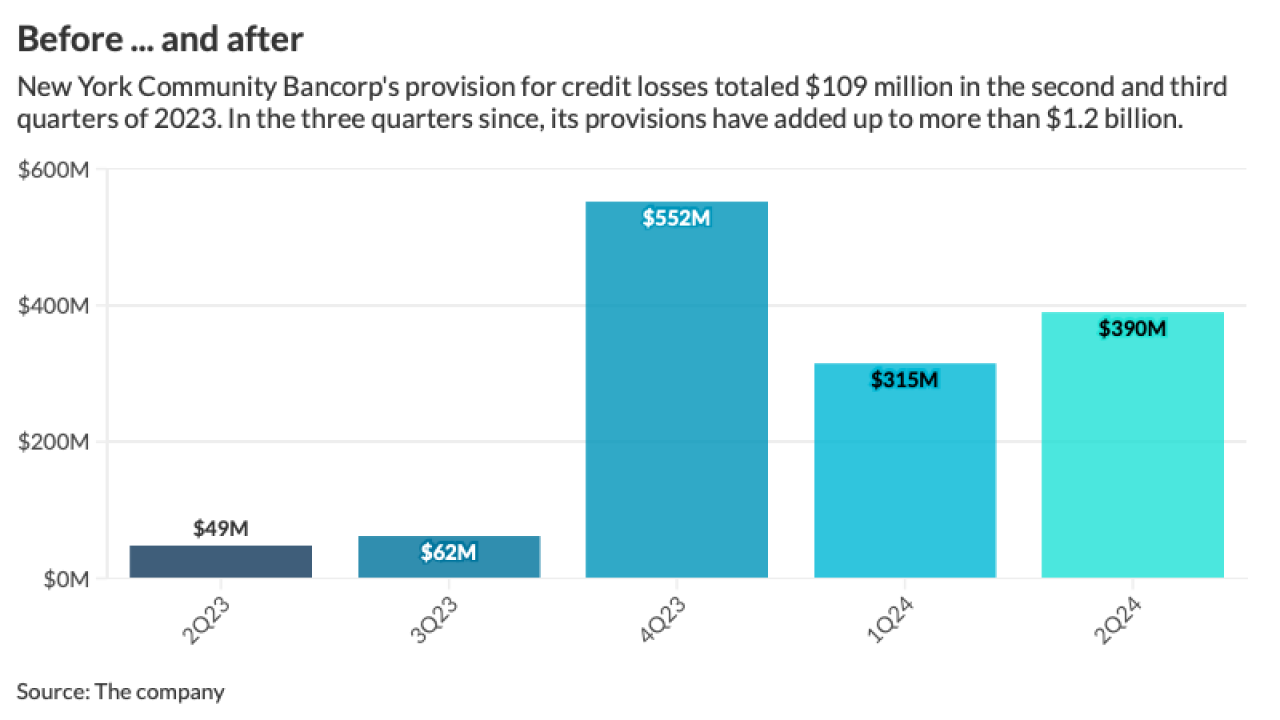

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

Federal Deposit Insurance Corp. Vice Chair Travis Hill has called for a full reproposal of the Basel III endgame capital standards, emphasizing the need for joint advancement by all three major federal banking agencies and an additional comment period for industry feedback.

July 24 -

Government data reports from June, though, point to an inauspicious start for new construction in the current quarter.

July 24 -

Rent growth will see a decrease of 2.7% and the vacancy rate will grow to 6%, Freddie Mac predicts.

July 24 -

ACNB is acquiring Traditions Bancorp in an in-market deal where the latter's mortgage ops will add to its insurance and wealth management units.

July 24 -

In considering the purchase of new digital mortgage tools, look at technology through the eyes of borrowers and how it can help ease their anxiety, originators say.

July 24 -

Forbearance rose for the first time since October 2022 in one report. Delinquencies jumped from a near-record low in another. Experts debate the ramifications.

July 24 -

Sales of new U.S. homes unexpectedly declined for a second month in June as the mix of stubbornly high mortgage rates and prices deterred prospective buyers.

July 24 -

While the number of refinances saw a small uptick last week, purchase lending languished as housing costs keep buyers sidelined, the Mortgage Bankers Association said.

July 24 -

Climate change is leading to an increase in frequency of catastrophic weather events, causing property damage and issues with homeowners insurance.

July 24