-

The Department of Justice told a court that the Consumer Financial Protection Bureau cannot legally request funding from the Federal Reserve System, arguing that the Fed has not turned a profit since 2022 and thus cannot fund the CFPB.

November 11 -

Recent merger activity also includes the purchase of an Alabama title company by technology firm Propy, as experts see ongoing consolidation through 2026.

November 11 -

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

Two government-sponsored enterprises are looking into expanding mortgage transfers between borrowers, according to the head of their oversight agency.

November 11 -

President Donald Trump downplayed criticism of the potential creation of a 50-year mortgage product, saying it would help more Americans afford monthly payments on homes.

November 11 -

More profitable companies are weighing deals because they're bullish on their leverage or are simply eying today's big price tags, the expert said.

November 11 -

The wholesale giant hasn't endured setbacks in litigation against five brokerages it's accused of selling loans to rivals Rocket Cos. and Fairway Independent Mortgage.

November 11 -

While the program is still going strong in spite of the shutdown, many misconceptions about its rules, even in normal times, are holding back use.

November 11 -

Federal Reserve Governor Stephen Miran said emerging stresses in housing and private credit markets warrant a reduction to short-term interest rates. While preferring a 50 basis point cut in December, Miran said he would settle for a 25 basis point reduction.

November 10 -

Mortgage credit availability increased 2.3% to 106.8 last month, marking the fourth consecutive month of growth.

November 10 -

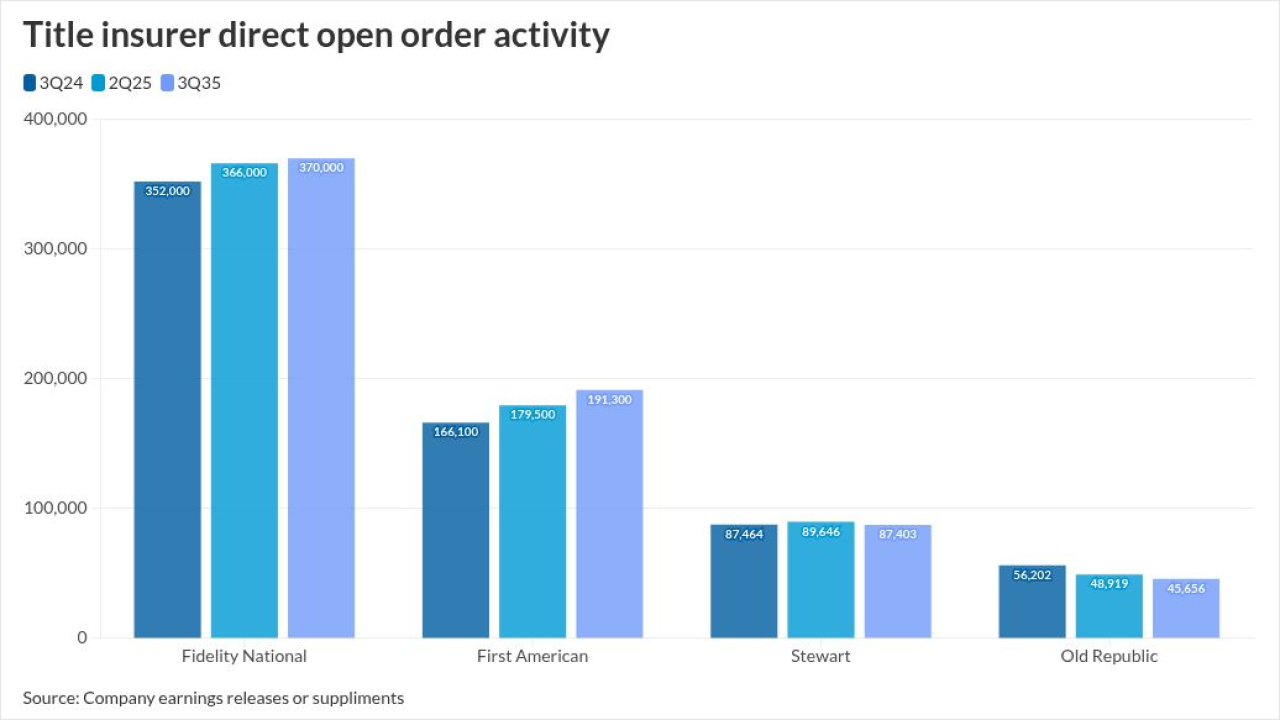

All five publicly traded title insurance companies reported a year-over-year increase in earnings during the third quarter, but only two had higher orders.

November 10 -

The number of highly qualified refinance candidates rose to 1.7 million, the most in three and a half years, as mortgage rates ease.

November 10 -

The bill would provide pay for furloughed government workers, resume withheld federal payments to states and localities and recall agency employees who were laid off during the shutdown.

November 9 -

The impacts of the federal government shutdown are hitting both originators and servicers, and as things drag out, the disruptions will increase.

November 9 -

President Trump and housing regulator Bill Pulte are considering introducing a 50-year fixed rate mortgage that Fannie Mae and Freddie Mac would purchase.

November 9 -

The FHFA director hinted at a partnership in the works and doubled down on criticism of homebuilders and the Fed chair in a housing conference interview.

November 7 -

The Consumer Financial Protection Bureau ended a consent order earlier than expected against the credit bureau TransUnion, saying the company already paid a $5 million fine and $3 million to consumers.

November 7 -

The volume of home equity lines of credit expanded for the 14th consecutive quarter, driven largely by fintechs and other nonbanks that are accounting for more and more of the business.

November 7 -

A trade group for participants in the clean energy loan program argues the upcoming regulations will be too burdensome and costly for participants.

November 7 -

Company leaders said current strategy sets it up to profit and compete against its rivals as the mortgage market improves in the coming months.

November 6