-

In its so-called quarterly refunding statement Wednesday, the Treasury department said it anticipated keeping auction sizes unchanged for nominal notes, bonds and floating-rate notes, "for at least the next several quarters."

November 5 -

Southern states' government-sponsored enterprise share lags outside of a small number of metros, the Center for Mortgage Access' analysis of HMDA data shows.

November 5 -

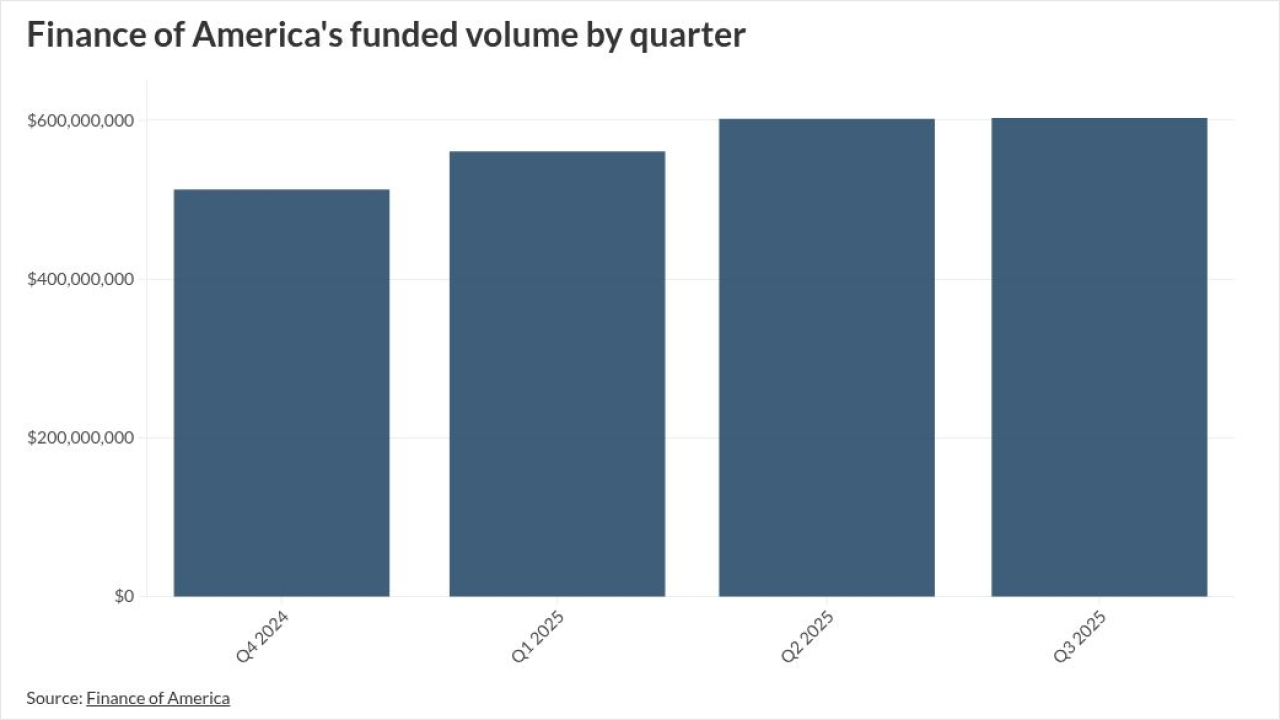

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

While FHFA reduced most of the single-family low-income goals, the MBA wants the refinance target for Fannie Mae and Freddie Mac cut as well, its letter said.

November 4 -

The latest case comes after at least three other zombie lawsuits in the past year, with the owner of the loan in question claiming $173,000 in past-due interest.

November 4 -

Newer automation that can serve as a wraparound to existing technology can cut servicing costs in a competitive industry, according to fintech executives.

November 4 -

The age at which people purchase their first home has climbed rapidly since 2021, when the median was 33, according to a National Association of Realtors survey of transactions from July 2024 through June.

November 4 -

Comptroller of the Currency Jonathan Gould said Tuesday that chartering compliant fintechs is "the only way" to level the playing field between banks and nonbanks. His comments come as the Office of the Comptroller of the Currency weighs new trust charters and stablecoin rules.

November 4 -

Federal Reserve Vice Chair for Supervision Michelle Bowman said she wants banks to be competitive in the digital assets space, provided those operations are siloed from the traditional finance side of the business.

November 4 -

The inspector general's office, responsible for overseeing the regulator, now sits vacant amid Director Bill Pulte's swift changes and numerous fraud probes.

November 3 -

Most of the pool of 1,011 residential mortgages, 69.7%, are considered non-prime mortgages, primarily due to the documentation and styles of underwriting.

November 3 -

The agreement, if approved by a federal judge, would end litigation over two distinct cybersecurity incidents in 2021 which affected over 2 million customers.

November 3 -

The Consumer Financial Protection Bureau has seen a rapid drop in the effectiveness of its cybersecurity program, according to a new report from the Fed's Office of Inspector General.

November 3 -

Now that quantitative tightening is ending, the debate on who should be the MBS buyer of last resort, Fannie Mae and Freddie Mac, or the Fed, is taking hold

November 3 -

In her first public appearance since President Trump moved to fire her from the Federal Reserve Board of Governors, Fed Gov. Lisa Cook reiterated her commitment to bringing inflation under 2% and said that the labor market remains "solid."

November 3 -

Refinancing pushed mortgage originations higher as rates eased, and home equity lending kept growing, but rising delinquencies signal mounting borrower stress.

November 3 -

Financial literacy advocate John Hope Bryant has joined with a Los Angeles-based developer in an effort to raise up to $300 million from banks to preserve and construct low-income housing around the country.

November 3 -

AI is transforming legacy modernization efforts as Wells Fargo builds systems for agents to take on humanlike tasks and interact with one another.

November 3 -

Wall Street dealers expect Bessent to signal as soon as Wednesday, when his department releases a quarterly statement on debt sales, that issuance in the $30 trillion Treasury market will keep shifting in that direction.

November 3 -

A successful summer pilot led to wider rollout of a program, whereby Robinhood Gold subscribers will be able to find discounted rates and closing costs.

November 3