-

A report from Democratic staff on the Senate Permanent Subcommittee on Investigations said accounting firm KPMG gave Silicon Valley Bank, Signature Bank and First Republic clean audits despite internal warnings, fraud allegations and apparent risks of failure.

September 17 -

A Washington, DC tax accountant pleaded guilty for submitting falsified documents in his application for a $1.4 million purchase loan, which he later received.

December 23 -

The SEC chair's ambitious agenda drew fierce resistance from Wall Street and the crypto industry.

November 21 -

Measures designed to give banks and credit unions more flexibility to help customers weather the coronavirus pandemic are set to expire Dec. 31 unless Congress renews them.

September 18 -

Fannie Mae's profitability suffered but it managed to stabilize the mortgage market in the first quarter even with the coronavirus disrupting, among other things, certain credit-risk transfer vehicles it has used.

May 1 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

Declines in mortgage servicing rights valuations at JPMorgan Chase and Wells Fargo point to the resurgence of a dilemma that came up during the last downturn.

April 15 -

The $2 trillion deal passed by the Senate late Wednesday would aim to put banks and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

March 25 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

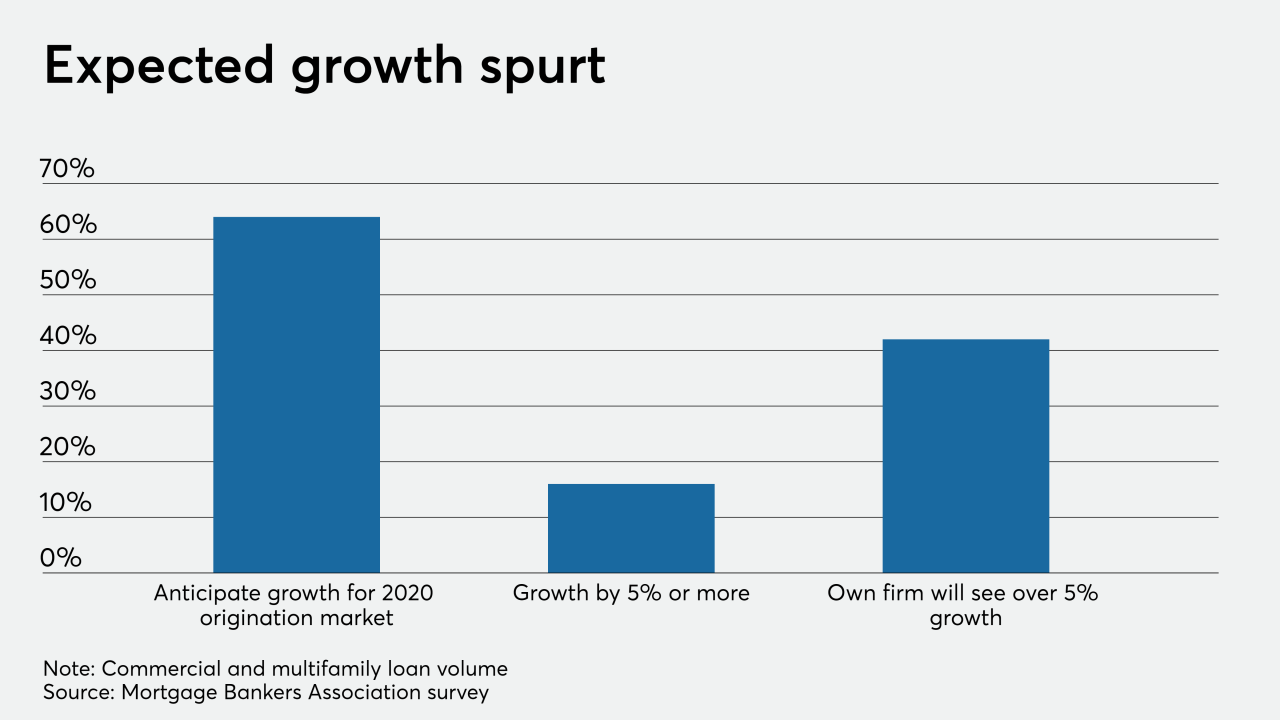

Bolstered by a high demand by both lenders and borrowers, 2020's commercial and multifamily loan volume is anticipated to shoot well past last year's record total but adapting to the LIBOR and CECL shifts will provide challenges, according to the Mortgage Bankers Association.

January 10 -

The four prudential agencies, which will enforce the new credit loss methodology developed by the Financial Accounting Standards Board, said they want to promote consistency.

October 17 -

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

The bipartisan House effort to delay the Current Expected Credit Loss standard comes less than a month after Republican senators introduced a similar bill.

June 11 -

Private mortgage insurers can help to ease banks' compliance burden when it comes to the Current Expected Credit Loss accounting standard, an industry executive said.

May 22 -

Democrats and Republicans on the House Financial Services Committee called for steps to minimize the harm to community banks and credit unions bracing for the new accounting standard.

May 16 -

Freddie Mac will keep building on the financial reforms that produced profitability during conservatorship as broader government-sponsored enterprise proposals take shape, according to departing CEO Don Layton.

May 1 -

Fannie Mae is considering sharing more risk with the private sector to reduce future strain on its earnings from the implementation of the Current Expected Credit Loss accounting standard next year.

May 1 -

Credit card issuers would have to set aside more in reserves because of higher loss histories, according to research by Keefe, Bruyette & Woods on the impact of the new loan-loss standard.

February 20 -

Rep. Blaine Luetkemeyer, R-Mo., told the mortgage giants' chief federal regulator that the Financial Accounting Standards Board’s new model for estimating loan losses could pose risk across the mortgage market.

February 14