-

As consumers search for homebuying advantages, local lenders discuss the 12 metro areas where it’s more affordable to purchase a property rather than rent a comparable house, according to Realtor.com data.

April 30 -

Even as properties spent the least time ever on the market and the average sale-to-list home price ratio broke 100%, some indicators point to a slight reversal, which could head off “runaway home price speculation or a housing bubble,” Redfin chief economist Daryl Fairweather said.

April 9 -

That means depreciation is a risk that could creep back into some regions, potentially requiring lenders and government-related agencies to consider it when setting down payment requirements or managing loan workouts once forbearance ends.

April 6 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

That growth could be attractive to a housing finance industry that needs to find new loan sources as easy rate-and-term refinances dwindle.

March 25 -

Stuck between local zoning hurdles and a lack of ideal federal financing, ADUs could be an important aspect to unlocking much-needed inventory.

March 24 -

The $10 million program appears to be the first of its kind in the nation.

March 23 -

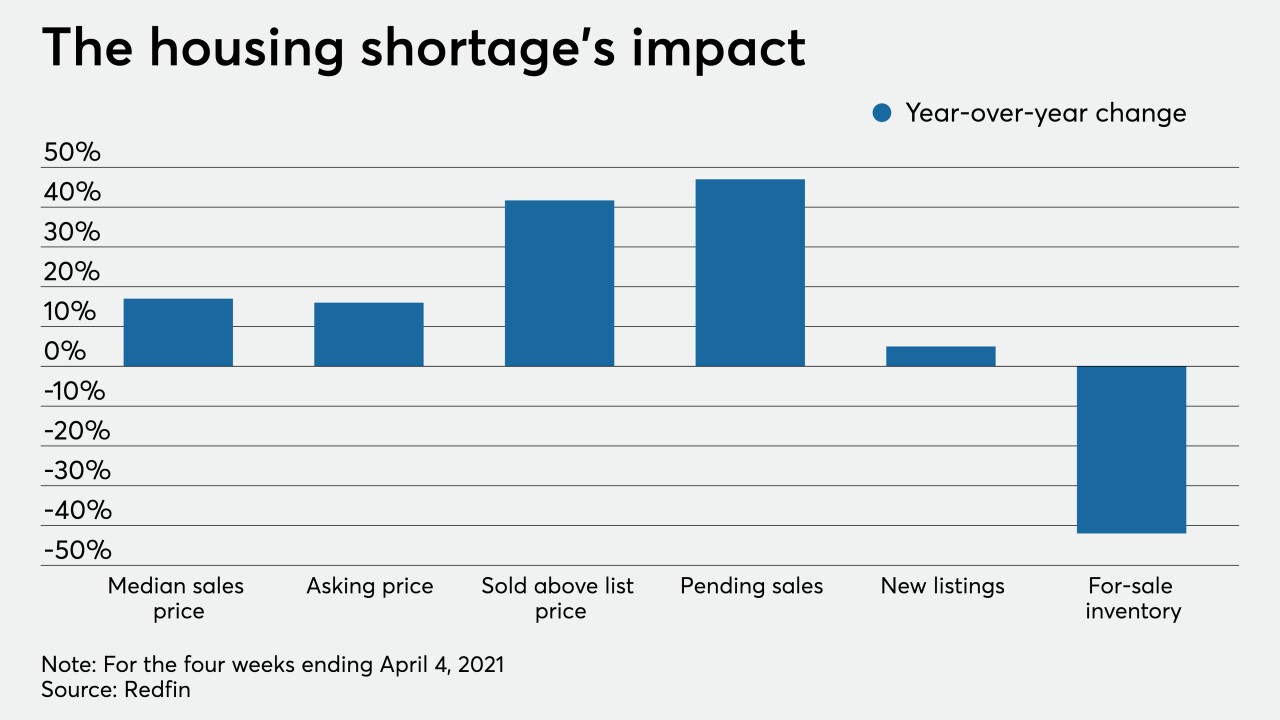

The number of home listings collapsed to the lowest level on record, leaving “nearly all of the shelves empty,” Glenn Kelman said in the company’s latest home sales report.

February 26 -

Despite intensified demand and plummeting inventory, consumer home purchasing power made gains behind falling interest rates in October, according to First American.

December 28 -

October's annual appreciation rate was at its fastest since April 2014, CoreLogic said.

December 1