-

Millennials closed mortgage loans at their fastest pace in four years as lower interest rates pushed up purchasing power and incentivized them to pull the trigger, according to Ellie Mae.

May 1 -

Home prices in 20 U.S. cities rose in February at the slowest pace since 2012, decelerating for an 11th straight month, as sellers continue to make properties more affordable to lure buyers.

April 30 -

Growing wages combined with flat mortgage rates handed homebuyers' increased affordability with a 2.4% boost in purchasing power for February, according to First American Financial Corp.

April 29 -

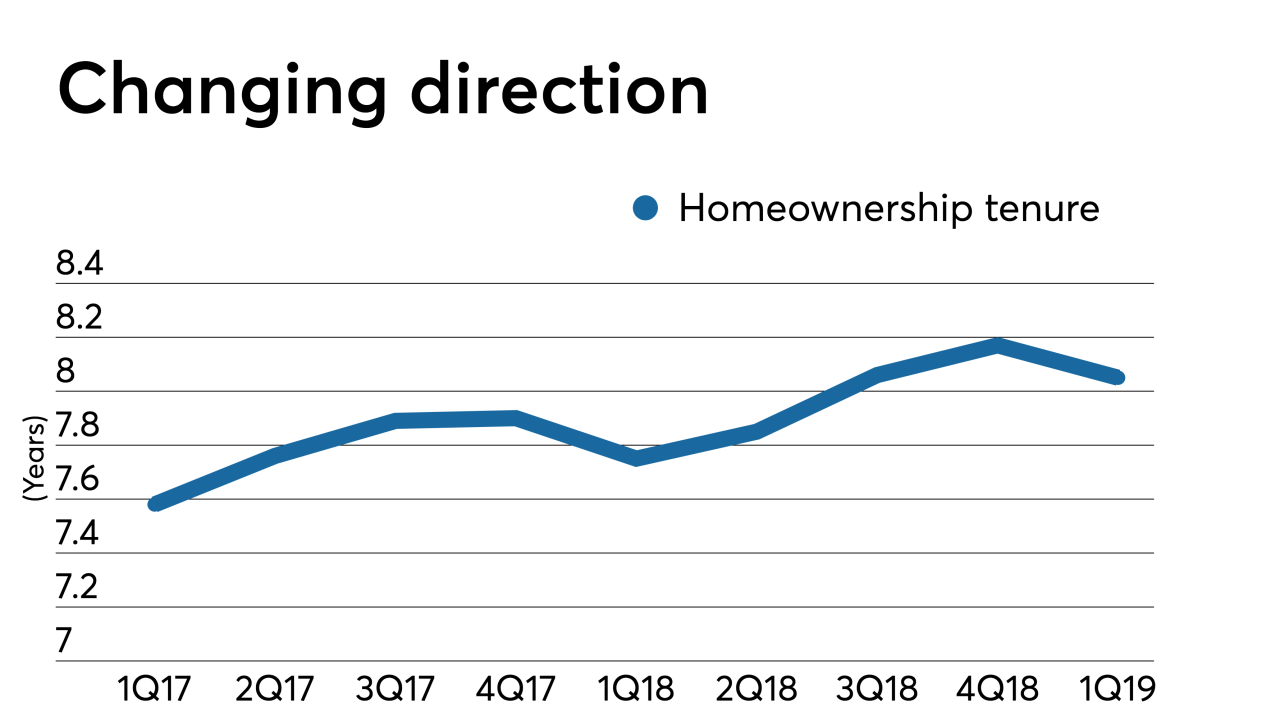

Homeownership tenure took a dip at the start of the year as the housing market cooled off. And while improved affordability helps, consumers are still staying put for nearly twice as long as they were before the crisis.

April 26 -

With as many as 2,155 apartment units either proposed or under construction in Santa Fe, observers have different views on what role these large projects will play in Santa Fe's housing crisis.

April 24 -

Buyers in the tightest housing markets finally got what they've been looking for: inventory. But instead of sales surging as a result, they're sinking.

April 22 -

Home prices dipped from February — while annual growth remained suppressed — due to affordability and inventory issues, according to Quicken Loans.

April 9 -

A discussion on how to modernize policies to combat housing discrimination quickly turned into a sharp critique of the social media giant's advertising practices.

April 2 -

Despite slowing home price growth, nearly 75% of millennials make financial concessions to afford housing compared to 40% of older generations, according to CoreLogic.

April 2 -

While housing prices in North Texas have stopped soaring higher, homeownership is still unaffordable for the majority of Dallas-Fort Worth residents.

April 1 -

From the high of the Rocky Mountains to down all across the South, here's a look at the 12 housing markets with the largest average annual migration.

March 29 -

As affordability lacks around the country, improving wages and shifting balance toward buyers could turn the tide, according to Attom Data Solutions.

March 28 -

Home prices in 20 U.S. cities registered their smallest gains since late 2012, decelerating for a 10th month in January as buyers held out for more affordable properties.

March 26 -

David Brickman will take the helm of the mortgage giant at a time of transformation in the mortgage market and housing finance policy.

March 21 -

Mark Calabria has notably criticized the government’s role in housing, but some groups have taken him at his word when he told senators that he supported affordable housing initiatives.

March 20 -

Fannie Mae estimates the average 30-year fixed-rate mortgage to hold at 4.4% through 2019 and 2020 due to the overall slowdown in the economy, according to the March housing forecast.

March 20 -

From the desert of the Southwest to all across Florida, here's a look at the 12 housing markets deemed best for first-time home purchasers.

March 20 -

Houses selling well at lower price points are likely to encourage the creation of more entry-level homes, according to a new report by the National Association of Home Builders and Wells Fargo.

March 18 -

Home sale prices posted their smallest annual gain since March 2012 and mortgage rates have declined, leaving bidders less inclined to race for a deal, but at the same time, a cooler housing market suggests more consumers may be willing to explore homeownership.

March 14 -

While home prices continued the gradual annual growth in February, its plateaued monthly progression could open a big spring for mortgage lending, according to Quicken Loans.

March 13