-

The Bay Area's affordable housing stock got a major shot in the arm, with the launch of a $500 million fund to build and preserve homes for low- and middle-income residents.

January 28 -

Recent comments attributed to the acting head of the Federal Housing Finance Agency (who is also comptroller of the currency) have stoked speculation about the Trump administration’s housing finance policy.

January 25 -

Several new members of the House Financial Services Committee with backgrounds in housing could use their experience to address Chairman Maxine Waters' top agenda items.

January 23 -

A lapse in rental-assistance funding, an understaffed FHA and other effects of the government shutdown are causing real harm to families, said the chair of the House Financial Services Committee.

January 11 -

Rising construction costs and a big drop in public funding is forcing an organization that builds inexpensive homes for low-income buyers in the Bay Area to sell them for higher prices than many of those people can afford.

January 3 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

Cash-strapped lenders need to find a way to consistently fund marketing that resonates with more cultures if they really want to be able to replace lost volume by reaching underserved borrowers.

December 21 Cultural Outreach

Cultural Outreach -

The House Financial Services Committee held a hearing to examine the outgoing committee chairman's bipartisan GSE reform bill, but lawmakers were already looking ahead.

December 21 -

The current deputy secretary of the Department of Housing and Urban Development, Pam Patenaude, will step down in January.

December 17 -

Fannie Mae and Freddie Mac charged lenders slightly lower guarantee fees in 2017 for mortgages with riskier characteristics, according to a Federal Housing Finance Agency report.

December 10 -

The nation is suffering from a housing affordability crisis and lower construction costs and increased government subsidies can ease the pain, consumers state in a National Association of Home Builders survey.

December 7 -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

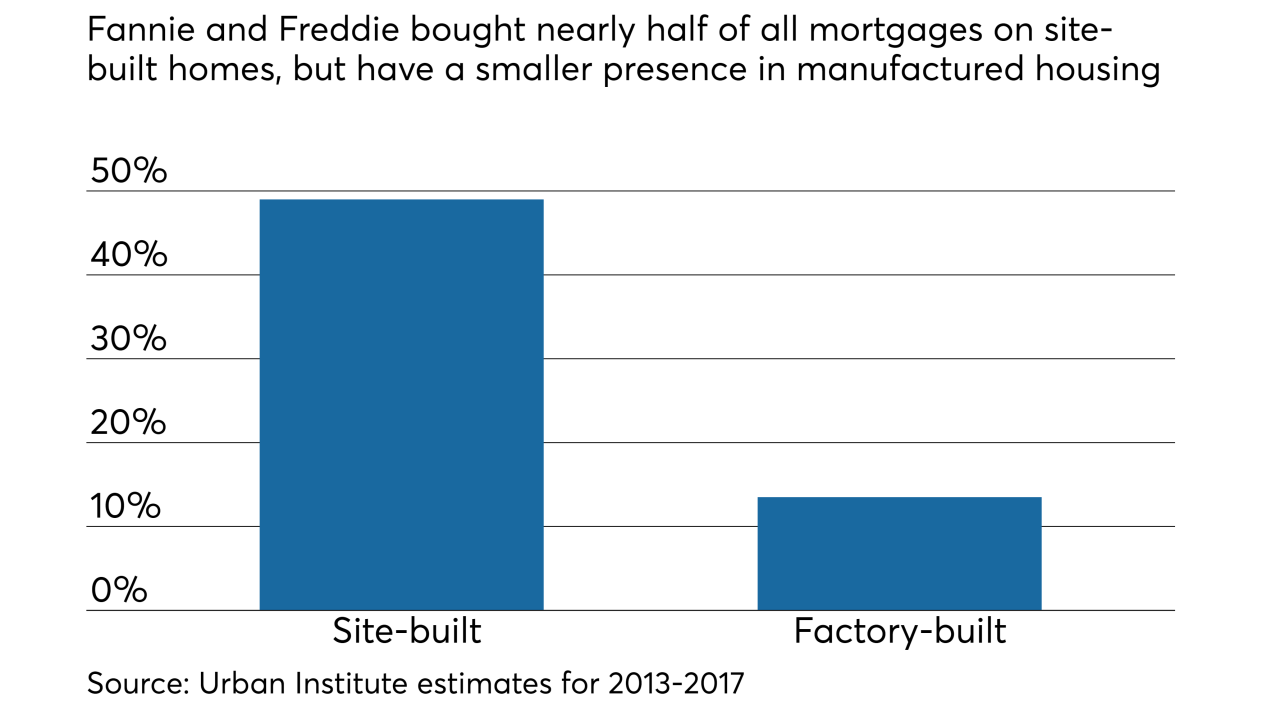

A new Freddie Mac pilot program will offer mortgages on manufactured housing with terms that more closely resemble conventional financing for site-built homes.

November 30 -

The Federal Housing Administration's risk-sharing program with the Federal Financing Bank began as a temporary fix, but the agency is exploring how to make it more permanent.

November 27 -

The end of one-party rule in Washington could move the needle on efforts to devise a new housing finance framework.

November 18 -

Providing city-owned land to build more homes, easing regulations for property owners to put up casitas, expanding down payment programs for prospective new homeowners — these are just a few of the recommendations in a new report on Santa Fe's housing problems.

November 14 -

Minnesota Housing will invest $87.5 million in 1,700 new and existing housing units for low-income Minnesotans this year.

November 8 -

Real estate and mortgage industry groups outspent proponents 3-to-1 to defeat Proposition 10, a measure to allow California municipalities to set local rent control laws.

November 7 -

Austin's record-breaking $250 million affordable housing bond appeared to be on its way to approval late Tuesday.

November 7 -

The presumptive chair of the House Financial Services Committee will likely take the panel in a sharply new direction and have a new bully pulpit to criticize the Trump administration.

November 6