-

A provision in the tax bill passed by the House of Representatives would only intensify the housing crunch by crippling affordable housing construction, developers and local government officials say.

December 1 -

The Federal Housing Finance Agency's final guidelines for evaluating "duty to serve" activities create new ways for Fannie Mae and Freddie Mac to get extra credit for going above mandatory levels of lending to underserved markets.

November 30 -

New Penn Financial has entered into a pilot program to provide mortgage financing to participants in Home Partners of America's Lease Purchase program.

November 29 -

Nonprofit agencies looking to purchase unsubsidized affordable housing properties can use a new impact gap financing program from Freddie Mac to fund the acquisition.

November 28 -

Over half of mortgage industry executives anticipate first-time home buyer growth in 2018, estimating that market will grow at a faster pace than the overall housing market, according to Genworth Financial.

November 17 -

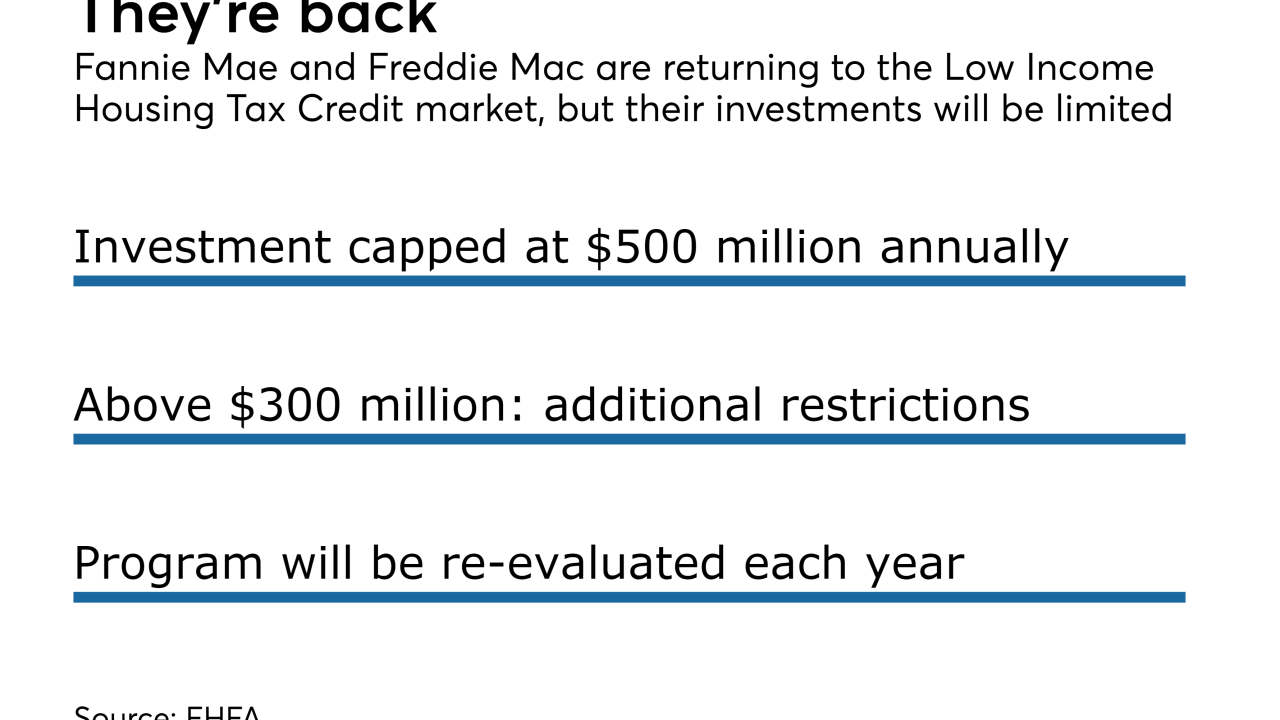

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

The plan is up from the previously announced 200,000 homes.

November 15 -

Housing advocates are pressing Senate Republicans to expand the low-income housing tax credit program while pushing back against a House GOP plan that would eliminate financing for half of all affordable housing units.

November 14 -

A new city program approved by the Chicago City Council will offer vacant lots to affordable housing developers for $1 each.

November 10 -

The elimination of private activity bonds “would throw gasoline on a housing shortage," said John Chiang, California's treasurer.

November 9 -

As the economy improves and millennials move around the country in search of jobs, some are finding themselves far from the youth culture they learned to expect from city life in other parts of the country.

November 9 -

An emerging group of local entrepreneurs is taking up arms against the sky-high cost of living in the Bay Area, hoping to end once and for all the housing crisis crippling the region.

November 7 -

Fannie Mae is testing a conforming loan product that makes use of a New Hampshire law that lets manufactured housing in resident-owned communities get treated like units in a co-operative building.

October 27 -

The Worcester City Council has asked the city administration to identify affordable housing that might exist for people resettling here from hurricane-battered Puerto Rico and the U.S. Virgin Islands.

October 25 -

Nearly half of all Memphis renters are "cost burdened,'' meaning they spend more than 35% of their household income on housing.

October 19 -

A six-lane highway lined with strip malls cuts through a patchwork of tamed lawns and suburban houses in Delran, N.J., where population has sprouted rapidly in recent decades.

October 17 -

The destruction of scores of houses and apartments in the North Bay fires virtually guarantees that the affordable housing crisis in Marin County, Calif., is about to get even worse.

October 16 -

The District of Columbia transaction may have potential on a national level.

October 13 -

For families with household incomes below $50,000, the improving housing market in 2016 meant rising prices, and fewer homes and apartments they can afford to rent or buy, according to a report from HousingWorks RI.

October 11 -

The program to purchase and support affordable mortgages for New Yorkers will include an RBC unit and provisions for military veterans.

October 5