-

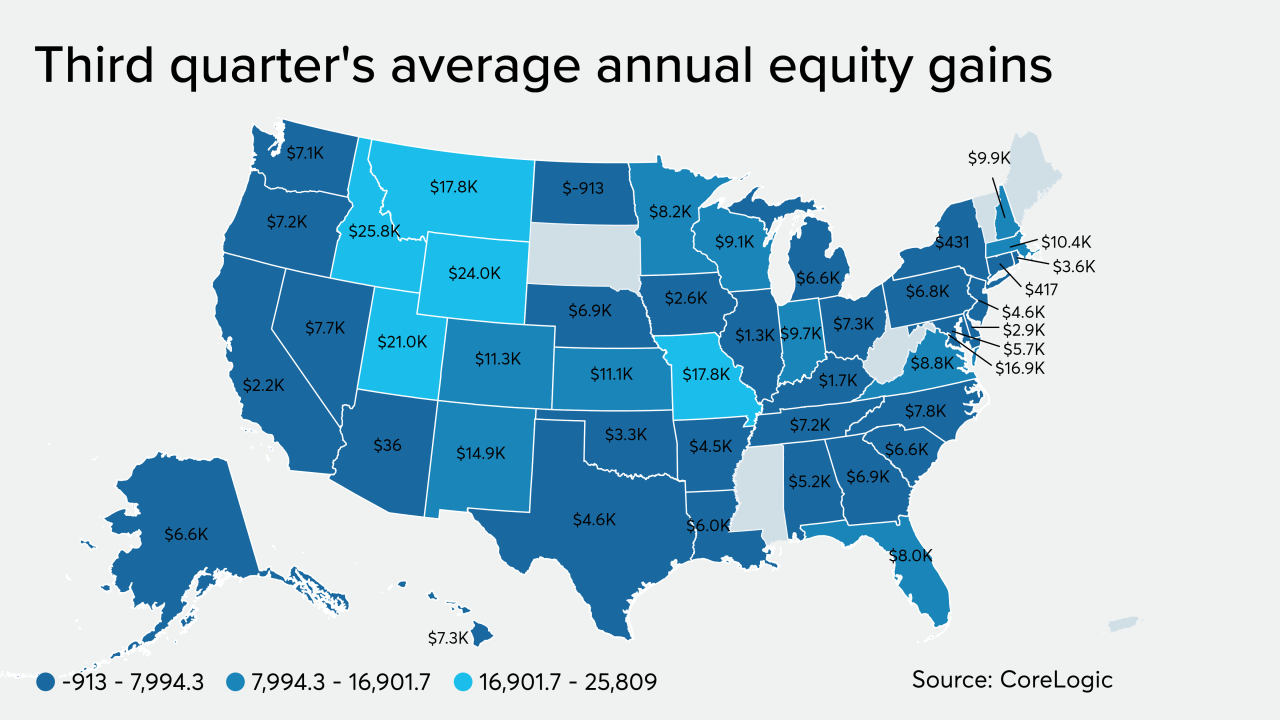

Home price gains continued during the fourth quarter and pushed the share of upside-down mortgages to the lowest level since the housing crisis, according to CoreLogic.

March 13 -

-

After maintaining a $250,000 exemption threshold for real estate appraisals for nearly 20 years, the National Credit Union Administration is set to raise that limit to $400,000.

January 31 -

As home value appreciation keeps churning, the share of those upside down on their mortgage grows smaller than ever, according to CoreLogic's Home Equity Report.

December 13 -

The housing market has changed dramatically since 2002 but the current appraisal limit has not. It's time for NCUA to catch up.

November 25

-

A new National Credit Union Administration proposal would raise the threshold for residential mortgages that require appraisals. However, the final rule is by no means a done deal.

November 21 -

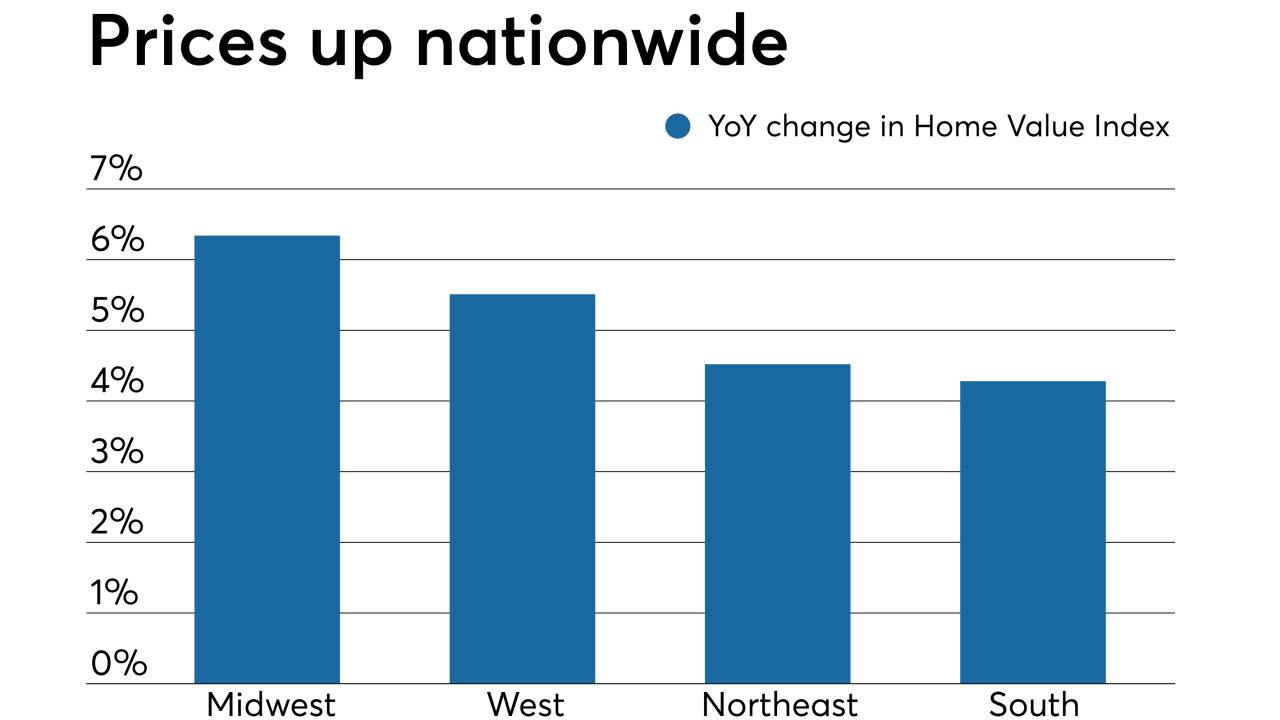

Home values posted the largest month-over-month spike in over five years due to continued buyer demand, according to Quicken Loans.

October 10 -

In the decade ending in June, close to $9 trillion in additional owner-occupied real estate wealth was gained by U.S. households. Pacific states, led by California, grabbed 37% of this gain.

October 1 -

The three federal banking agencies moved to raise the threshold for residential transactions that require an appraisal from $250,000 to $400,000.

September 27 -

Still overvalued — that's the latest assessment of the Dallas housing market by one of Wall Street's big ratings firms.

September 20 -

The legislation takes aim at third-party bank service vendors, the backlog of FHA appraisals, rural housing assistance and other issues where there is broad agreement.

September 11 -

A final rule on residential appraisals published this month could save depositories time and money in the short term, but potentially increase collateral risk.

August 30 -

Housing values across Cuyahoga County, Ohio, continued to increase while home abandonment and vacancy rates continued to decline over the last year, a new study found.

August 6 -

The regulators have yet to complete rules on regional bank supervision, community bank capital and other provisions meant to ease institutions' burden.

August 1 -

Loan officers' jobs are harder than they need to be because of back-end system inefficiencies, and it adds cost to the process.

July 31 cloudvirga

cloudvirga -

The National Credit Union Administration caught flak after it approved raising the threshold for appraisals on commercial real estate loans to $1 million.

July 18 -

Bolstered home equity gains from rising prices put owners in a stronger position should another housing bubble be on the horizon, according to CoreLogic.

July 18 -

The Federal Housing Administration is delaying a plan to put a hard stop on home loan files that lack digitally signed appraisals.

July 12 -

Appraiser and homeowner estimates of house prices are aligning closer after the second straight month of a tightened gap in perceptions of value, according to Quicken Loans.

July 10 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3