-

Bowing to industry pressure, the Consumer Financial Protection Bureau is warning consumers with notices on its complaint portal not to file disputes about inaccurate information on credit reports, among other changes.

February 5 -

Fraudsters and modestly dishonest employees can use generative AI to quickly create convincing fake utility bills, pay stubs, passports and other documents banks rely on.

February 5 -

The documents that the Housing Policy Council obtained from FHFA show past debate over one newer score and concerns about a single report with redacted context.

February 5 -

The National Consumer Law Center is claiming the Credit Data Industry Association wants to suppress Consumer Financial Protection Bureau complaint filings.

February 2 -

IMBs outperform banks, face outsized scrutiny, and confront rising affordability challenges, according to the President of the Community Home Lenders of America.

February 2 Developer’s Mortgage Co.

Developer’s Mortgage Co. -

Tri-merge mandates prop up a credit bureau/FICO oligopoly, raising mortgage costs with little benefit despite risk concerns, the chairman of Whalen Global Advisors argues.

January 22 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

A Community Home Lenders of America adds arguments against use of single bureau while another paper takes the position that the idea merits further study.

January 16 -

The San Francisco-based banking giant reported solid gains in credit card and auto lending as credit remained in check and quarterly operating costs declined from a year ago.

January 14 -

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

A housing official renewed his call for credit bureaus to address lenders' concerns. Low pull-through magnifies a cost that's small relative to others.

January 6 -

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

December 29 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

The Massachusetts Democrat requested to see records related to second liens that banks were required to expunge per terms of the 2012 mortgage settlement.

December 19 -

The trade group's letter to FHFA Director Bill Pulte pointed out that lenders were facing credit report price hikes for four straight years.

December 16 -

Rohit Chopra is named senior advisor to the Democratic Attorneys General Association's working group on consumer protection and affordability; Flagstar Bank adds additional wealth-planning capabilities to its private banking division; Chime promotes three members of its executive leadership team; and more in this week's banking news roundup.

December 12 -

The rent reporting platform says it's helped tenants raise their credit scores by double digits and unlocked $30 billion more in mortgage lending.

December 11 -

Charlie Scharf has a mostly optimistic take on Wells' consumer banking prospects entering 2026. But he's more downbeat about the company's once-dominant residential mortgage business.

December 10 -

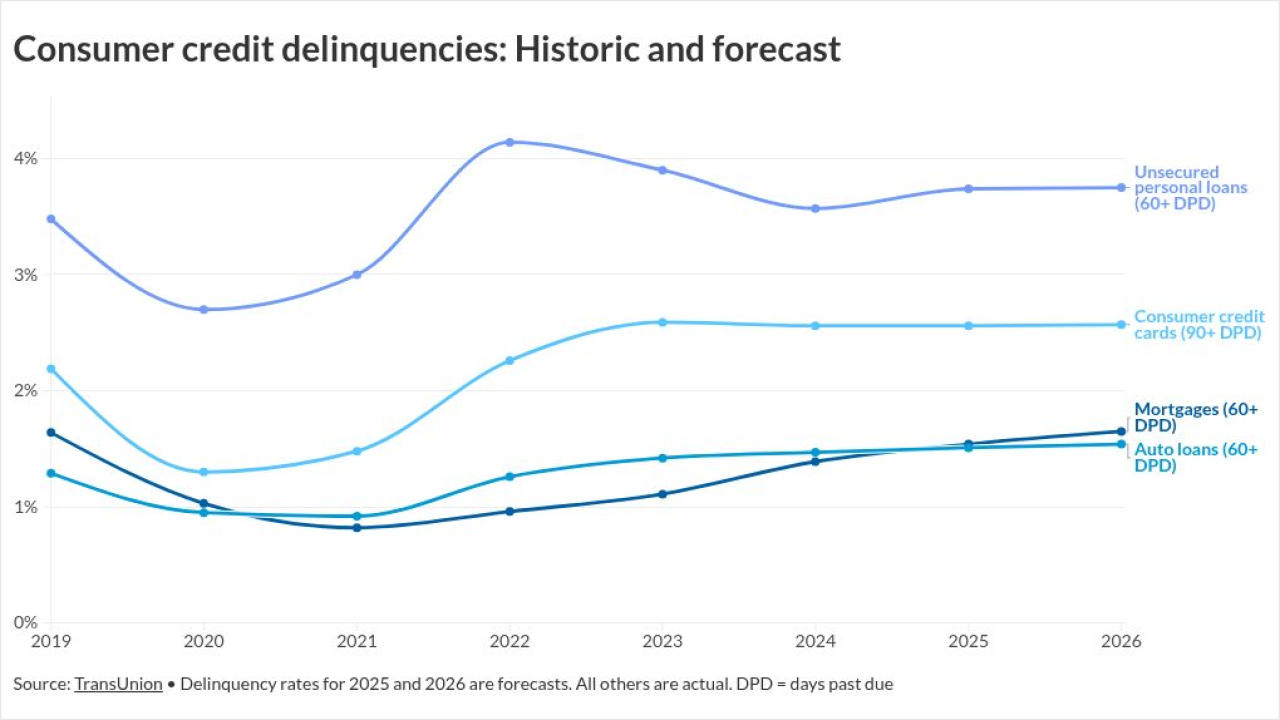

Overall performance is stable but inflation and unemployment have hurt newer borrowers in some cases, according to Transunion's 2026 consumer credit forecast.

December 10