-

Former CFPB Director Richard Cordray and consumer advocates have designed a proposed state consumer agency that would subject more financial firms and fintechs to state oversight.

January 10 -

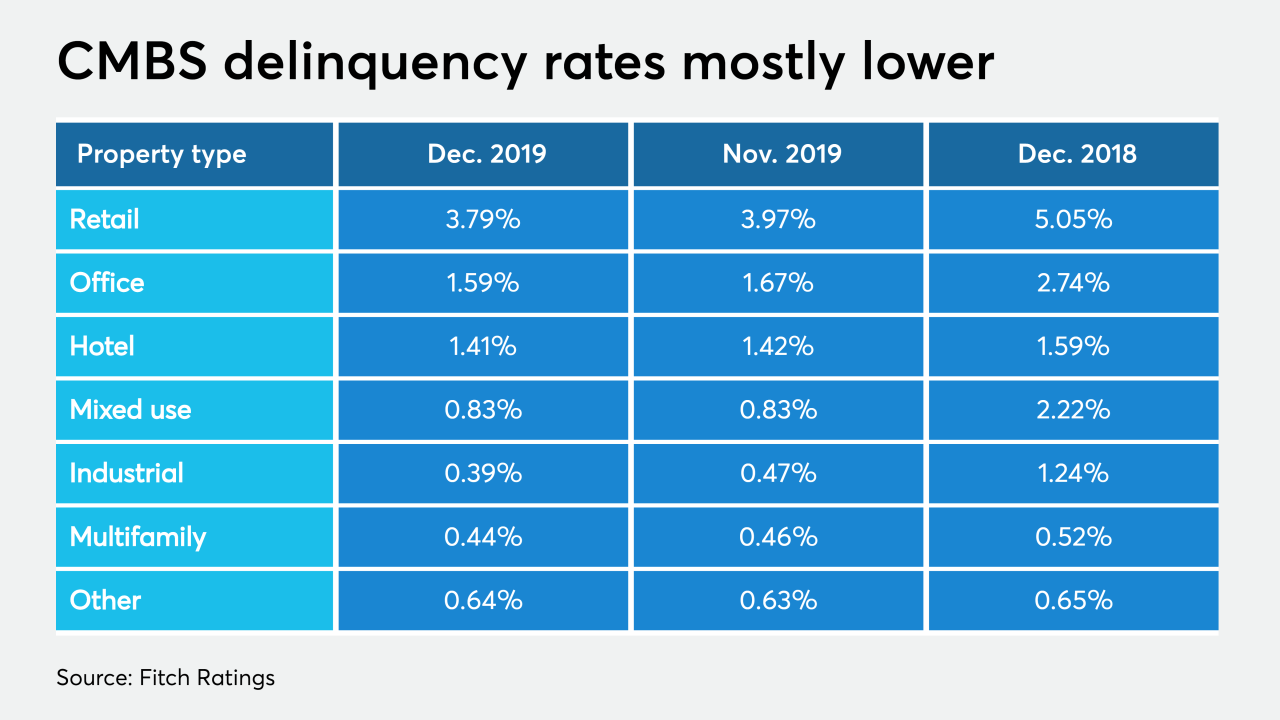

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

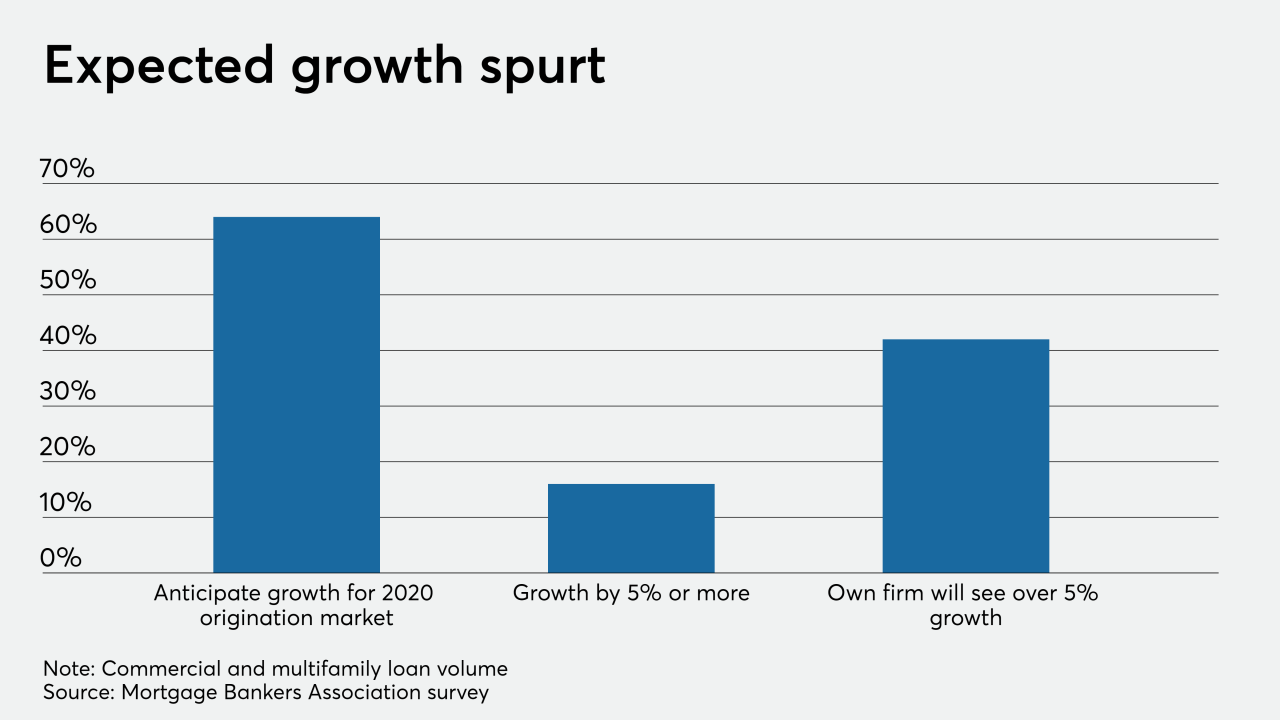

Bolstered by a high demand by both lenders and borrowers, 2020's commercial and multifamily loan volume is anticipated to shoot well past last year's record total but adapting to the LIBOR and CECL shifts will provide challenges, according to the Mortgage Bankers Association.

January 10 -

The developer of three adjacent lots said one of the reasons for the sale was her time was up with her mortgage holders.

January 10 -

In a case highlighting a fraud risk for mortgage companies and other financial institutions, two Garden State residents were sentenced for using fake money orders attempting to fraudulently discharge debts.

January 9 -

Goldman Sachs is sponsoring a $1.33 billion bond offering backed by commercial mortgages, in the first rated conduit deal of the year.

January 7 -

A Charlotte, N.C., developer detailed plans to build apartments and commercial space through a federal tax program that has faced scrutiny in recent months.

January 7 -

The foreclosed former home of Fireman's Fund Insurance in Novato, Calif., could become the site of a mixed-use development.

January 6 -

Freedom Credit Union has listed for sale the three downtown Springfield, Mass., office buildings it took back in November in a mortgage foreclosure.

January 2 -

Susan Riel succeeded Ronald Paul as CEO of the Maryland bank shortly before questions surfaced about credit quality and lending practices.

December 31 -

Tom Lopp abruptly suspended a program that accounted for 83% of Sterling Bancorp's mortgage production this year. An ongoing audit of the program and pressure to diversify beyond mortgages are reasons to watch Lopp and Sterling in 2020.

December 27 -

The Consumer Financial Protection Bureau faces a busy policy agenda heading into the new year, as well as strong external forces that are beyond its control.

December 24 -

The board- and management-level handing of CRE concentration was the chief concern of FDIC examiners, making up more than 56% of all the supervisory recommendations regulators made in the two-year period.

December 24 -

The owner of the MacArthur Center Mall in Norfolk, Va., has defaulted on a $750 million loan which includes the property as collateral.

December 20 -

First mortgage volumes continue to rise at credit unions, but home equity lines of credit have fallen dramatically in recent years.

December 20 -

Downtown San Jose, which has been overshadowed by its Bay Area neighbors, is having a real estate development boom because it qualifies as an opportunity zone

December 20 -

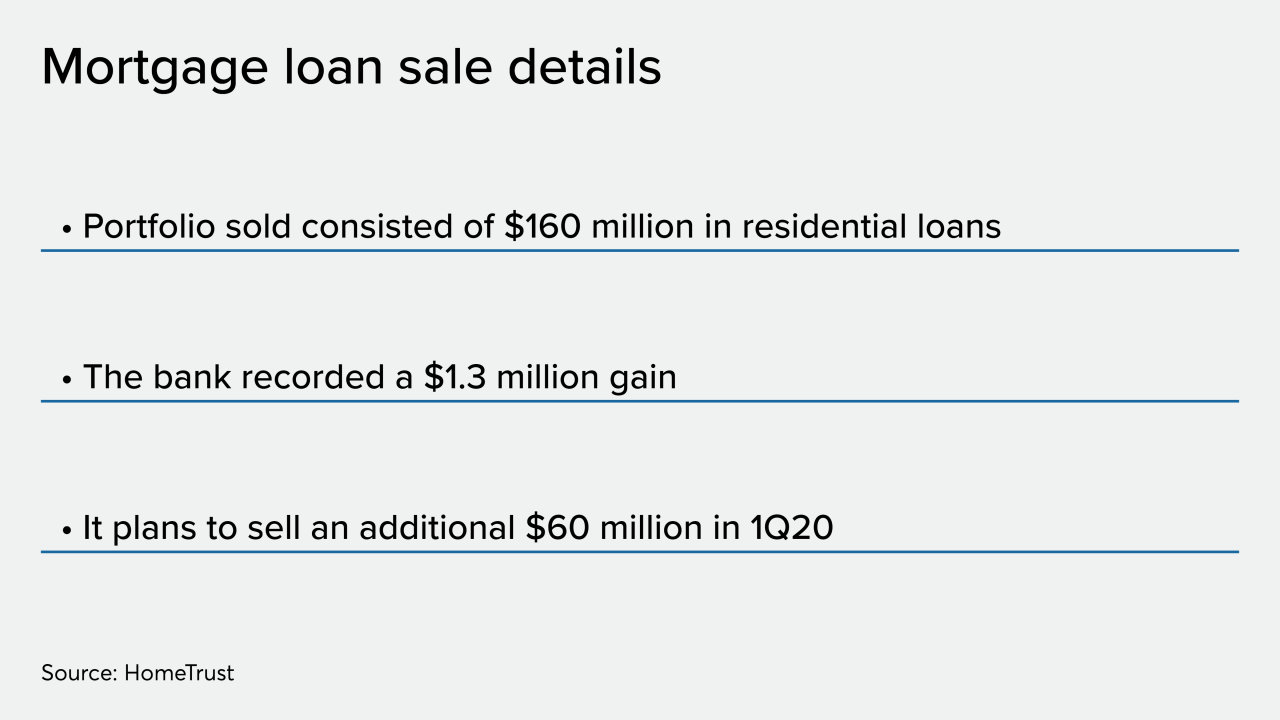

HomeTrust Bancshares in Asheville, N.C., sold a portfolio of residential mortgages as part of a balance sheet restructuring, with plans to sell more.

December 20 -

The proposed changes laid out by banking regulators would clear up confusion about what qualifies for CRA credit within so-called Opportunity Zones. But not all community development advocates are convinced that the changes are for the better.

December 17 -

The city of Philadelphia and Wells Fargo have agreed to resolve a 2017 lawsuit in which the city accused the bank of violating the Fair Housing Act by steering minority borrowers into risky, high-cost loans.

December 16 -

Without admitting wrongdoing, the bank has agreed to contribute $10 million to city programs promoting homeownership for low- and moderate-income residents.

December 16