-

Call it mutual respect. Bankers from mutually owned British building societies and similarly structured U.S. thrifts recently gathered in New England to address common challenges and share ideas about staying relevant at a time of rapid change in financial services. Here are the takeaways from their meetings.

May 18 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

Mick Mulvaney’s recent comments about the CFPB Qualified Mortgage rule have triggered a debate over whether regulators should take into account more than one underwriting model.

May 17 -

Commercial and multifamily loan originations may not be up by much from a year ago, but borrowing and lending behaviors were drastically different in the first quarter.

May 17 -

Supporters say pending legislation would help consumers with little or no credit history. But the bill would instead roll back key consumer protections.

May 17 Pennsylvania Utility Law Project

Pennsylvania Utility Law Project -

Acting CFPB Director Mick Mulvaney has dropped agency plans to crack down on overdraft programs and large marketplace lenders. Here's what else he's changing.

May 16 -

Late payments on single-family home mortgages improved on a consecutive quarter basis as more recovery from Hurricanes Harvey and Irma took hold, but more potential loan performance concerns lie ahead.

May 16 -

Capitol Federal Financial has mostly relied on mortgages throughout its history. Its acquisition of a commercial lender will change that.

May 11 -

Mutual of Omaha Bank's purchase of Synergy One Lending will add reverse mortgages to its product line.

May 10 -

Wells Fargo must pay $97 million to home mortgage consultants and private mortgage bankers in California who didn't get the breaks they were entitled to under the state's stringent labor laws.

May 9 -

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8 -

Lorie Shannon, recruited from SunTrust, will oversee a strategy that features large, non-QM mortgages in key markets.

May 7 -

The public face of the Trump administration's revamp of the Consumer Financial Protection Bureau is by no means working alone.

May 7 -

The removal of costly appraisal requirements on tens of thousands of smaller commercial properties could help community banks better compete for loans they say they have been losing to nonbank lenders.

May 4 -

Preferred Bank's experience with an apartment developer is a reminder of how important strict underwriting terms will be as loan demand increases, rates rise and lenders try to outdo each other.

May 4 -

Costs rose at the global bank, profit in North America fell 16% and questions are mounting for new CEO John Flint ahead of the release of his strategic plan.

May 4 -

Leader Bank says it can land property managers as commercial clients by helping them handle tenant deposits — and possibly create opportunities to boost CRE lending.

May 3 -

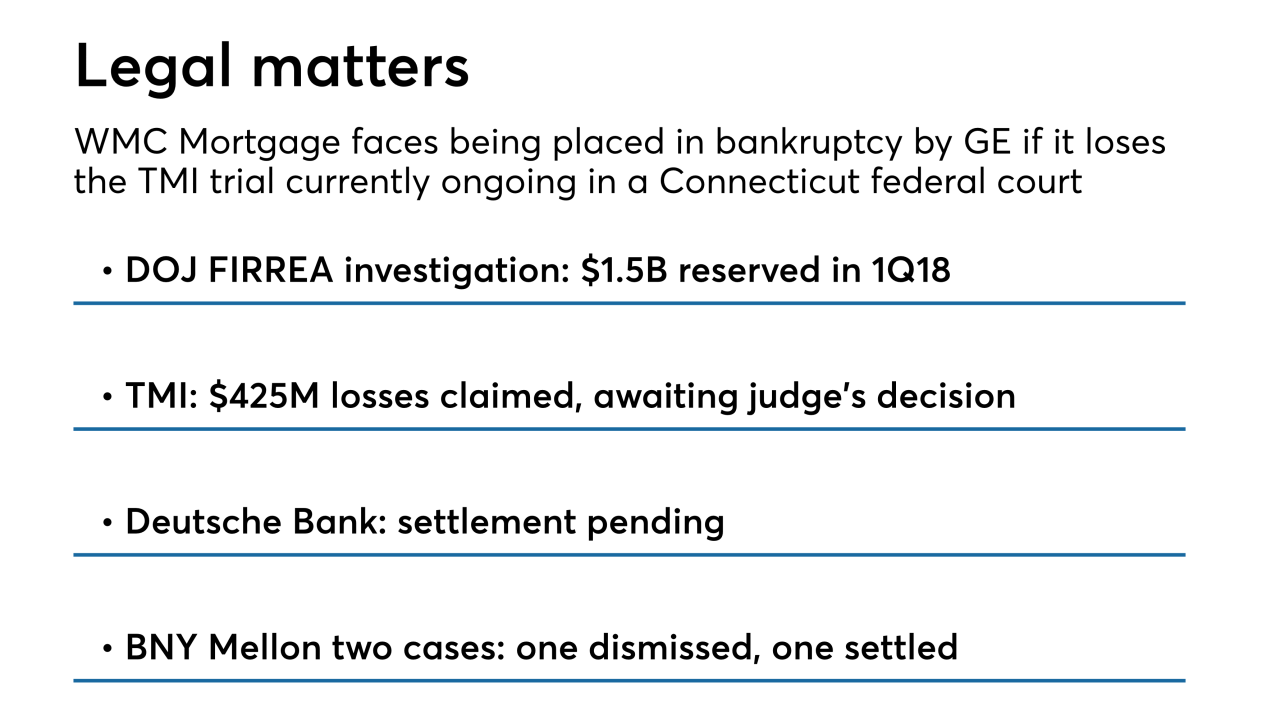

WMC Mortgage, a leading subprime originator during the boom era, could file for bankruptcy by parent company General Electric if it loses a legal proceeding regarding indemnifications on mortgage-backed securities.

May 3 -

As the mortgage industry makes more strides with technology, the time it took millennials to close loans for new-home purchases shrank to its fastest time yet.

May 2 -

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1