-

Incenter Mortgage Advisors is putting up for bid a $712.8 million package of government-sponsored enterprise and Ginnie Mae mortgage servicing rights concentrated in the Southeast.

March 2 -

The Consumer Financial Protection Bureau is among several agencies that "continue to investigate events related to" last year's Equifax brief, the credit reporting firm said in a securities filing.

March 2 -

LendingClub, Marlette and others are looking at additional changes to both their securitization and whole-loan-sale programs that could further broaden their investor bases.

March 1 -

The interim head of the Consumer Financial Protection Bureau said the agency may allow prudential regulators to take the lead on more supervisory matters to cut down on duplication.

March 1 -

“Why we think we know better or how to protect consumers in your state surprises me,” acting CFPB Director Mick Mulvaney told a group of state attorneys general. “I don’t think we’ll being do much of that anymore.”

February 28 -

The bank will spend an additional $1.4 billion on technology in 2018 to gain share and boost efficiency, executives said Tuesday. But they were peppered with questions about whether the big investment will yield a big financial return down the road.

February 27 -

Acting CFPB Director Mick Mulvaney dismissed concerns by Sen. Elizabeth Warren, D-Mass., about his leadership of the consumer agency while supporting a lighter regulatory touch for credit unions.

February 27 -

Credit union executives talked up a pending regulatory relief effort while endorsing a radical shift in direction by the Consumer Financial Protection Bureau during a meeting with President Trump and other top White House officials on Monday.

February 26 -

In an interview during his first day on the job, Anthony Noto also spoke about improving the firm's culture and the prospects for an IPO.

February 26 -

The digital-only Ally Bank has taken several steps to deepen customer relationships through electronic channels, including use of personalized emails and websites that have yielded strong click-through and loyalty rates.

February 26 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

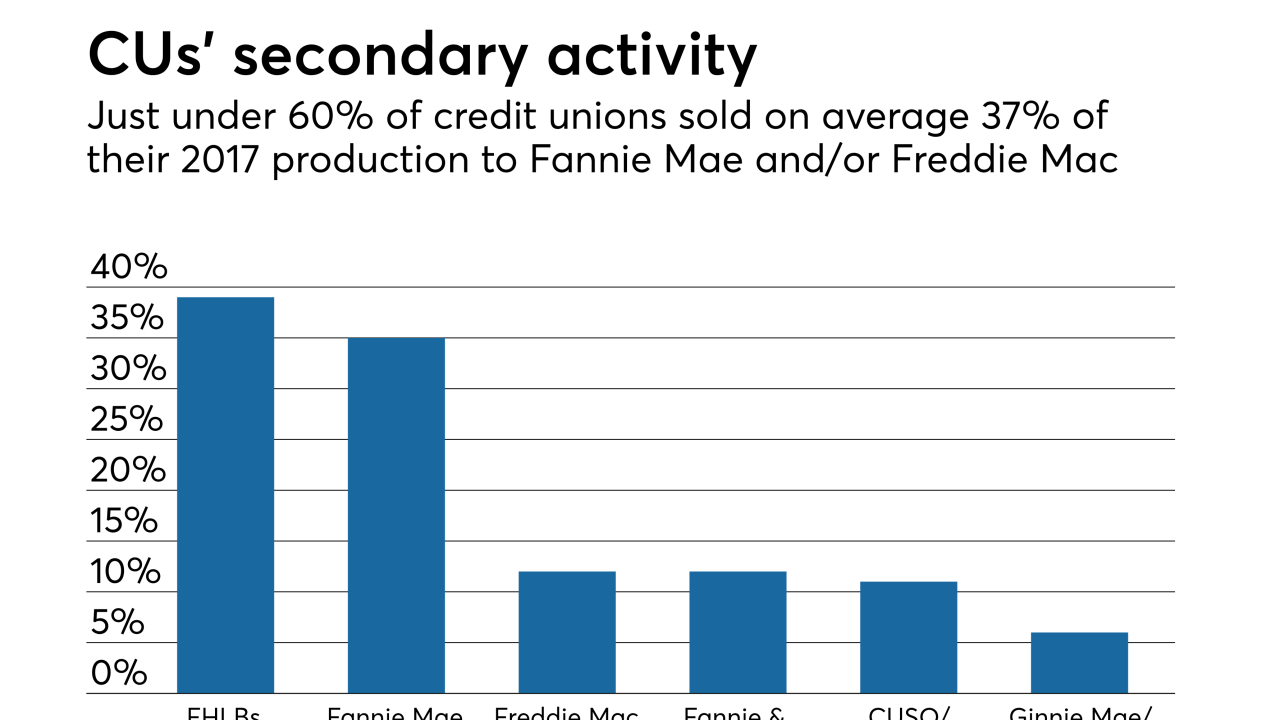

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

Blue Lion Capital, which is upset with the Seattle company's growth strategy, also wants to replace two of the company's directors.

February 26 -

Stephen Calk is in the national media glare because his small Chicago-based bank made two enormous loans to Paul Manafort, President Trump's onetime campaign manager. Here’s a look at Calk's career and how he ended up in this spot.

February 23 -

The war of words between acting Consumer Financial Protection Bureau Director Mick Mulvaney and Sen. Elizabeth Warren, D-Mass., the agency's architect, is escalating.

February 23 -

Delinquencies from Hurricanes Harvey and Irma are starting to subside, even as pre-storm foreclosures that were put on hold resume.

February 23 -

Some Wells Fargo customers on social media Thursday afternoon expressed frustration with not being able to log in to accounts digitally. The San Francisco bank responded in a tweet acknowledging the problem.

February 22 -

William Parsley was most recently PNC's chief investment officer and treasurer and had previously served as head of consumer lending.

February 22 -

The Chicago bank is denying a report that its CEO, Steve Calk, made $16 million in mortgage loans to former Trump campaign chairman Paul Manafort in exchange for a job in the White House.

February 21 -

The Puerto Rico-based bank failed in 2015. The FDIC, its receiver, is seeking unspecified economic and punitive damages from 16 lenders, including Bank of America, Barclays and Credit Suisse.

February 21