-

In talks with OCC officials, "it became obvious that we would not gain near-term approval given their recent experience with multifamily and CRE positions," FirstSun CEO Neal Arnold says. The companies announced other revisions to their deal, too.

May 3 -

Consolidation has slowed since the pandemic, but UMB's agreement to buy Heartland Financial — the largest deal in three years — is one of several merger announcements in the past two weeks. Talks among other potential buyers and sellers are said to be picking up.

April 30 -

The Philadelphia-based bank's parent company, Republic First Bancshares, had been roiled by a yearslong proxy battle involving activist investors groups and its former CEO.

April 26 -

After several quarters of slumping investment banking and trading fees, the Charlotte, North Carolina-based company reported a big uptick from that division, which helped compensate for a large decline in net interest income.

April 22 -

Leaders of ORNL Federal Credit Union are piloting Zest AI's new artificial intelligence-powered assistant to ensure equitable underwriting practices and measure performance against similar institutions.

April 19 -

Ohio-based Liberty Home Mortgage joins several companies who started using a more modernized FICO credit score for nonconforming mortgage originations recently.

April 17 -

Net charge-offs at the Charlotte, North Carolina-based bank increased by more than 80% in the first quarter compared with a year earlier. BofA executives say that the rising losses were in line with the bank's risk appetite.

April 16 -

Citigroup's earnings topped analysts' estimates as corporations tapped markets for financing and consumers leaned on credit cards.

April 12 -

The company reported net interest income that slightly missed analyst estimates, a sign the benefit of higher interest rates may be waning amid pressure to pay out more to depositors. Costs rose on higher compensation and an FDIC assessment.

April 12 -

Mortgages that homebuyers locked in March rose 17% even with FICOs at record high for Optimal Blue's dataset, suggesting there are many qualified borrowers.

April 8 -

The $12.1 billion-asset DCU launched the loan platform in 2022, and has seen volume jump by close to $600 million from when talks began in 2019 to last year.

April 5 -

Federal Deposit Insurance Corp. Chair Martin Gruenberg said the agency would prioritize urging banks to invest in underserved communities as part of a revised economic inclusion plan unveiled Thursday.

April 4 -

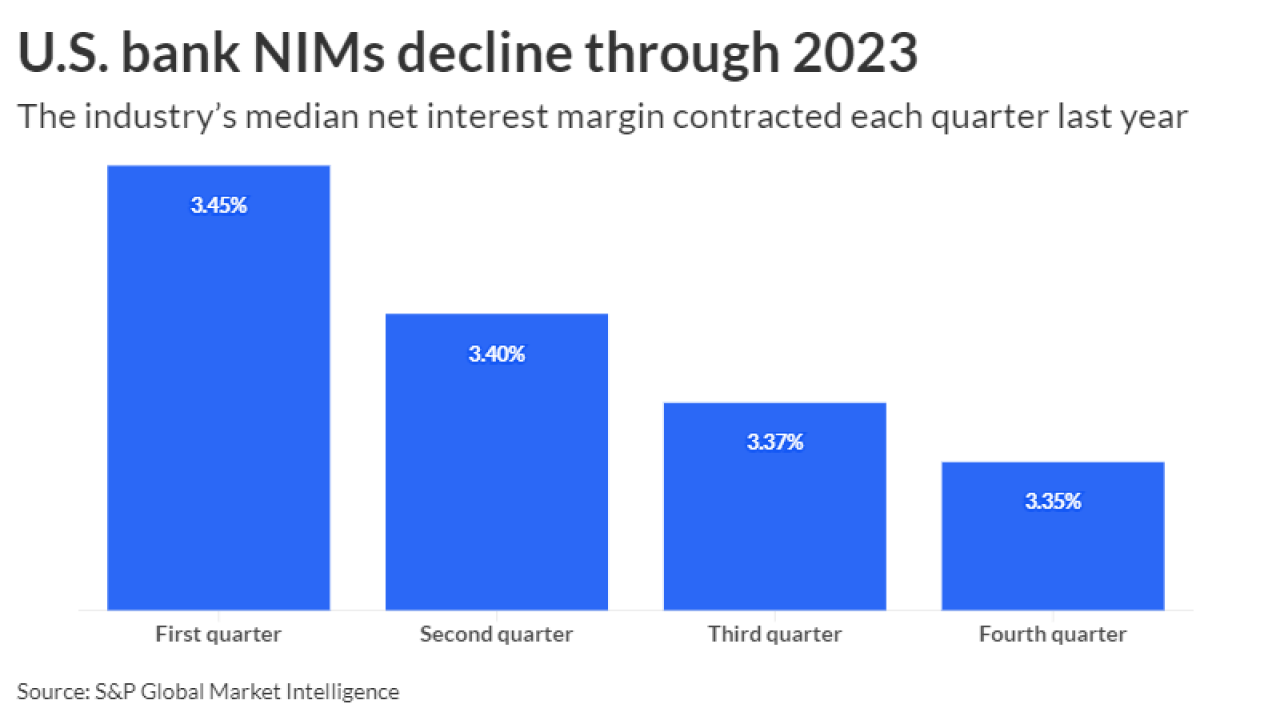

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Dean Wheeler will drive the firm's growth push in the U.S. and follows the London firm promoting Serenity Morley to COO, to drive growth globally.

April 2 -

Houston-based Prosperity Bancshares said it closed its purchase of Lone Star State Bancshares about a year later than initially planned.

April 2 -

Last year, the Raleigh, N.C.-based Integrated called off a deal to sell itself to MVB Financial after bank stocks took a hit in the aftermath of the regional bank failures. Capital hopes to expand its government-guaranteed lending with the transaction.

March 28 -

What recent patterns in FHA delinquencies, distressed loan outcomes, foreclosures and the rates at which loans are prepaying or underwater can reveal about where the market is headed.

March 26 -

Compared to their older counterparts with similar limited credit history, Gen Z and millennial borrowers were also more likely to move into higher tiers of creditworthiness between 2021 and 2023, according to new research.

March 25 -

Lower commodity prices and decreases in government assistance are expected to push farm income lower this year and raise credit risk for banks.

March 25 -

The Justice Department and the CFPB are increasingly relying on emails among employees that contain discriminatory comments to strengthen their hand in cases against lenders.

March 24