-

The alternative minimum tax would challenge at least one influential nonbank and big depositories, according to a new Keefe, Bruyette & Woods report.

June 7 -

The funding requests break sharply with the Trump administration's calls to eliminate key housing funds and backing for community development financial institutions. The White House also wants to substantially increase the budgets of the Treasury Department and the Small Business Administration.

May 28 -

With Rohit Chopra’s nomination now in its fourth month, some of the consumer bureau's rulemaking efforts remain on hold. Experts say Democrats first want the Senate to confirm a new member of the Federal Trade Commission to replace Chopra so that Republicans don't gain control.

May 28 -

The plan "is part of a larger democratic attack on home ownership that includes an increase in the taxes on capital gains as well as an end to 1031 exchanges for the sale of property," writes the head of Whalen Global Advisors.

May 27 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

COVID-19 has shown us that technology can rapidly evolve to meet customer needs, in areas from contactless payments to digital banking to mobile wallets. However, we still see great disparities when it comes to the use of contactless and digital banking by low- to moderate-income (LMI) workers. The question is, will emerging tech in the post-COVID economy provide an opportunity to include new people in the financial system-- or leave them even further behind?

-

The Biden administration may finally be close to naming an acting comptroller of the currency. Whoever gets the interim job or is confirmed to run the agency over the longer term will have a lengthy to-do list, from Community Reinvestment Act reform to deciding the fate of divisive Trump-era rules.

May 6 -

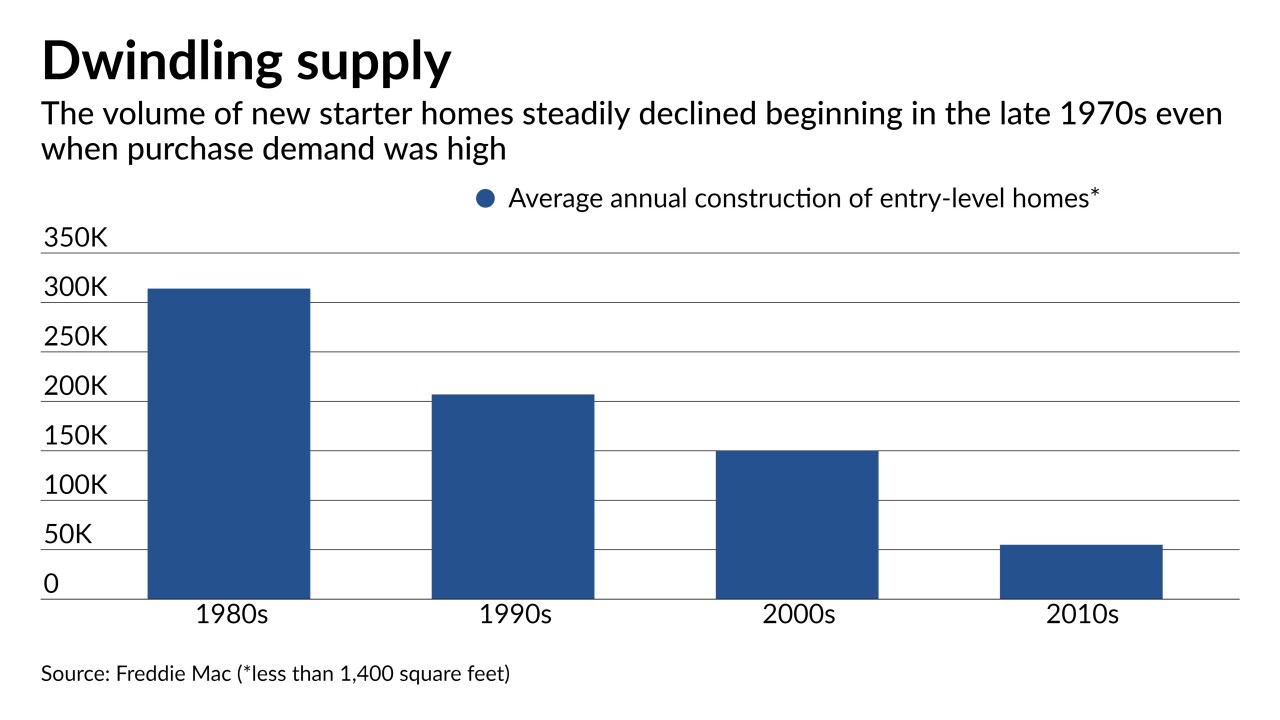

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27 -

Three months into President Biden’s term, the White House has yet to select a nominee to run the Office of the Comptroller of the Currency or pick an acting chief. That inaction will make it more difficult for Democrats to unwind Trump-era policies, critics say.

April 23 -

Municipal bonds have a direct effect on the social and cultural character of cities, metropolitan areas, counties, and states. Munis and the initiatives they support such as public education, housing subsidies, public transit systems, and more, can often be linked to local or regional politics. Join Lynne Funk, Executive Editor at The Bond Buyer and Destin Jenkins, Neubauer Family Assistant Professor of History at the University of Chicago as they explore how municipal bond mismanagement can have contrasting influences on the different ethnic groups in our cities.

-

The draft of the Downpayment Toward Equity Act of 2021 calls for grants for a limited segment of the market: those whose parents don't own homes.

April 19 -

The Department of Housing and Urban Development will revive a 2013 rule that makes lenders liable for practices that were unintentionally discriminatory as well as 2015 guidelines for how local jurisdictions comply with the Fair Housing Act.

April 14 -

The agency announced it was rescinding seven policy statements issued last year meant to help companies combat fallout from COVID-19 but that the bureau's current chief said came at the expense of consumers.

March 31 -

But private mortgage insurers should not see significant impact on business if a 25 basis point reduction were to occur sometime after 2021, according to BTIG.

March 31 -

Although the Federal Housing Administration's insurance fund is "well above" its legal minimum, HUD Secretary Marcia Fudge said the mortgage agency has no plans to cut prices.

March 30 -

The full Senate could deadlock on Rohit Chopra’s nomination as the Banking Committee did. If that happens, Vice President Kamala Harris is expected to cast the decisive vote in his favor.

March 30 -

Relying on retained earnings alone, it would be until at least 2036, if not longer, before government control of Fannie Mae and Freddie Mae might end.

March 18 -

The credit could cover the minimum down payment for the average Federal Housing Administration-insured mortgage in most large metropolitan areas.

March 16 -

In its final days, the Trump administration imposed limits on Fannie Mae and Freddie Mac’s holdings of mortgages with loan-to-value ratios above 90% and certain other characteristics. Critics say the changes were unnecessary and disproportionately penalize borrowers of color.

March 11 -

Credit scores have an effect on almost every aspect of a person's financial life. A less-than-ideal credit score can make it much harder to get a house or car loan, start a business, or even get a job. President Biden plans to change credit reporting So what does the new administration's plan mean for consumers and lenders? In this episode, we explore the pros and cons of the Biden proposal, what it means for consumers, and how it will impact lending institutions' strategy and operations.

-

Some nominees poised to take their agencies in a new direction appear headed for Senate confirmation while an intraparty squabble has delayed the administration’s choice to lead the Office of the Comptroller of the Currency. Here’s the roster update.

March 9