-

Fannie Mae has obtained reinsurance for $510 million of credit losses on $20.4 billion of single-family residential mortgages through a pair of credit insurance risk transfer transactions.

March 24 -

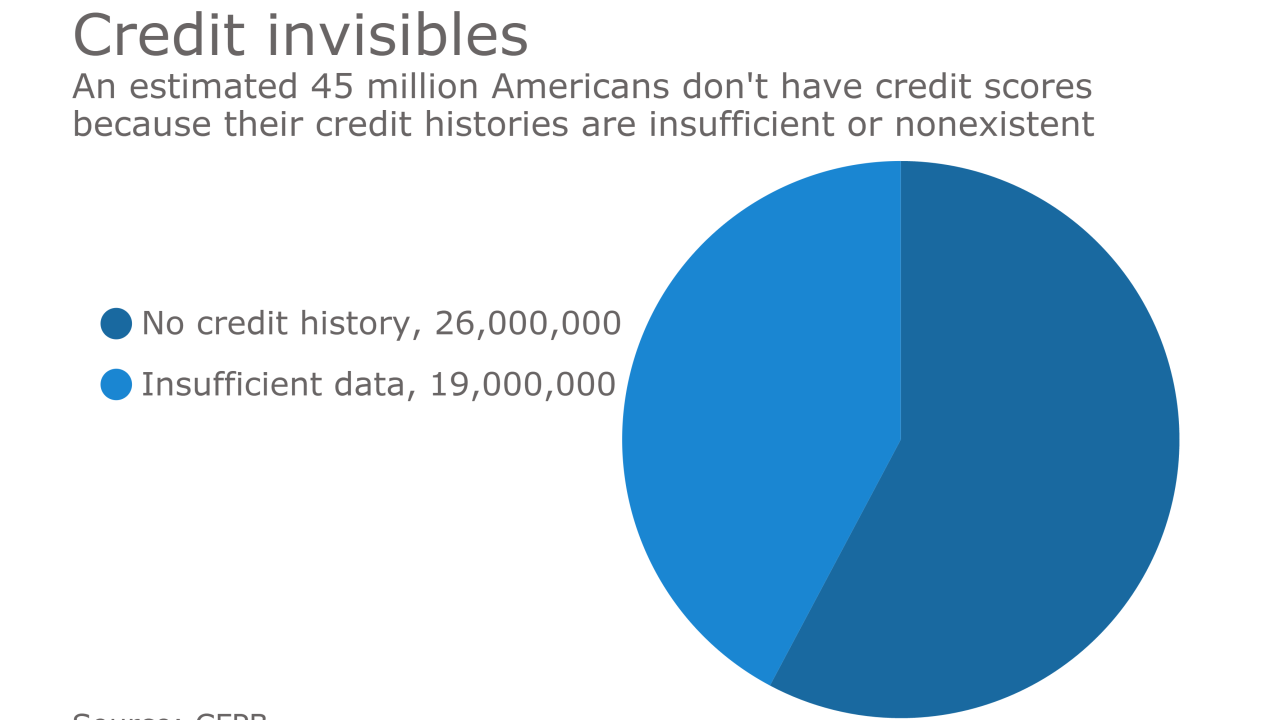

Freddie Mac will soon allow automated underwriting of borrowers who lack scores but have other financial records.

March 23 -

Servicers are able to borrow more against their Ginnie Mae mortgage servicing rights as financing providers become more comfortable with the collateral.

March 23 -

A $165 million cash settlement has been reached in a class-action lawsuit that alleged investors were misled about the safety of mortgage-backed securities comprised of loans originated by now-defunct subprime lender NovaStar Mortgage Inc.

March 15 -

Industry critics argue the Invitation Homes deal will create new risks for Fannie Mae and remove affordable inventory from homebuyers.

March 15 -

Freddie Mac is considering backing loans that finance single-family rental homes for the first time, mirroring a controversial transaction that Fannie Mae disclosed in January.

March 10 -

Freddie Mac is preparing a transaction that transfers credit risk on $640 million of super-conforming residential mortgages.

March 9 -

Mill City Holdings is returning to market with its fourth securitization of reperforming residential mortgages, this time with a sliver of home equity lines of credit added to the mix of collateral.

March 9 -

Altisource Portfolio Solutions has launched a new mortgage trading platform for mortgage bankers and loan investors.

March 6 -

The Mortgage Bankers Association has partnered with Altisource subsidiary Lenders One Cooperative, providing the organization's members with expanded benefits.

March 6