-

Technology startup Eave is making a foray into Colorado's fast-moving, high-end mortgage lending market by offering software designed to quickly analyze jumbo borrowers' more complex incomes and assets.

April 9 -

A pair of the nation's largest banks, Citigroup and Wells Fargo, made changes to their mortgage banking executive teams.

April 2 -

There is an oncoming liquidity crisis that will force consolidation in the mortgage industry as margins tighten and funding sources dry up.

March 28 -

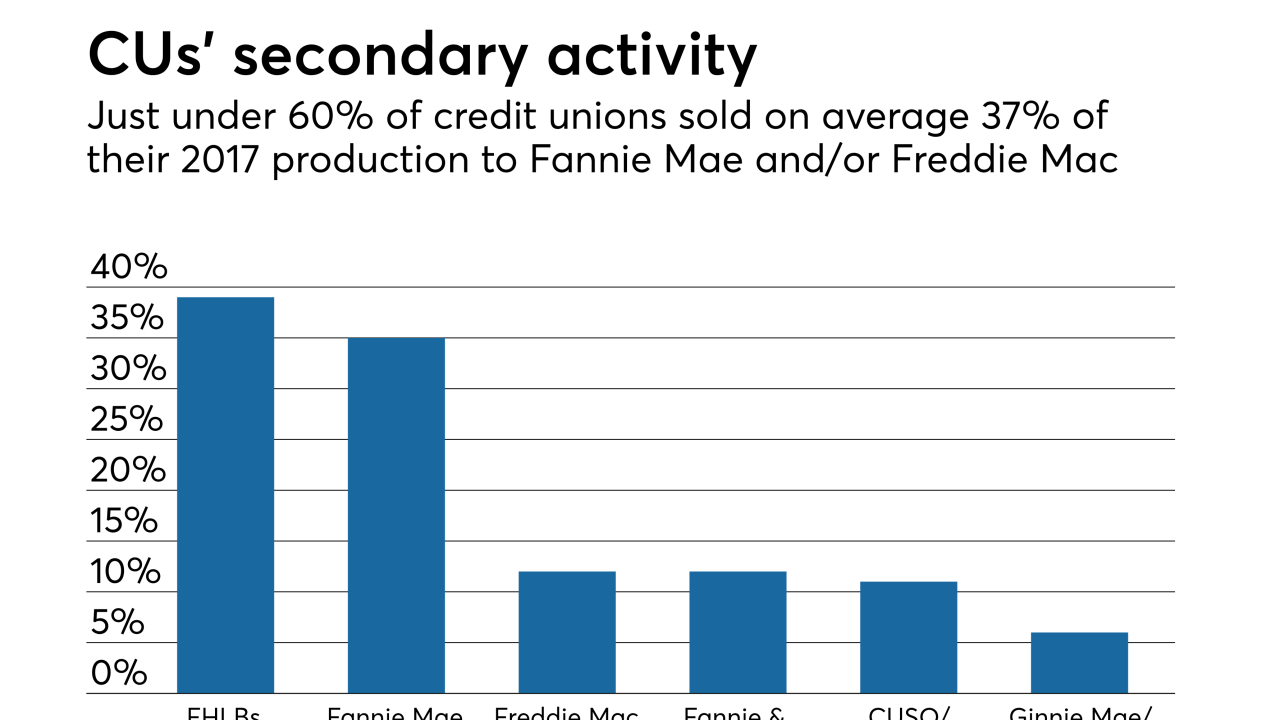

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

Freddie Mac is now accepting bids on $420 million in nonperforming loans, its first NPL sale of 2018.

February 16 -

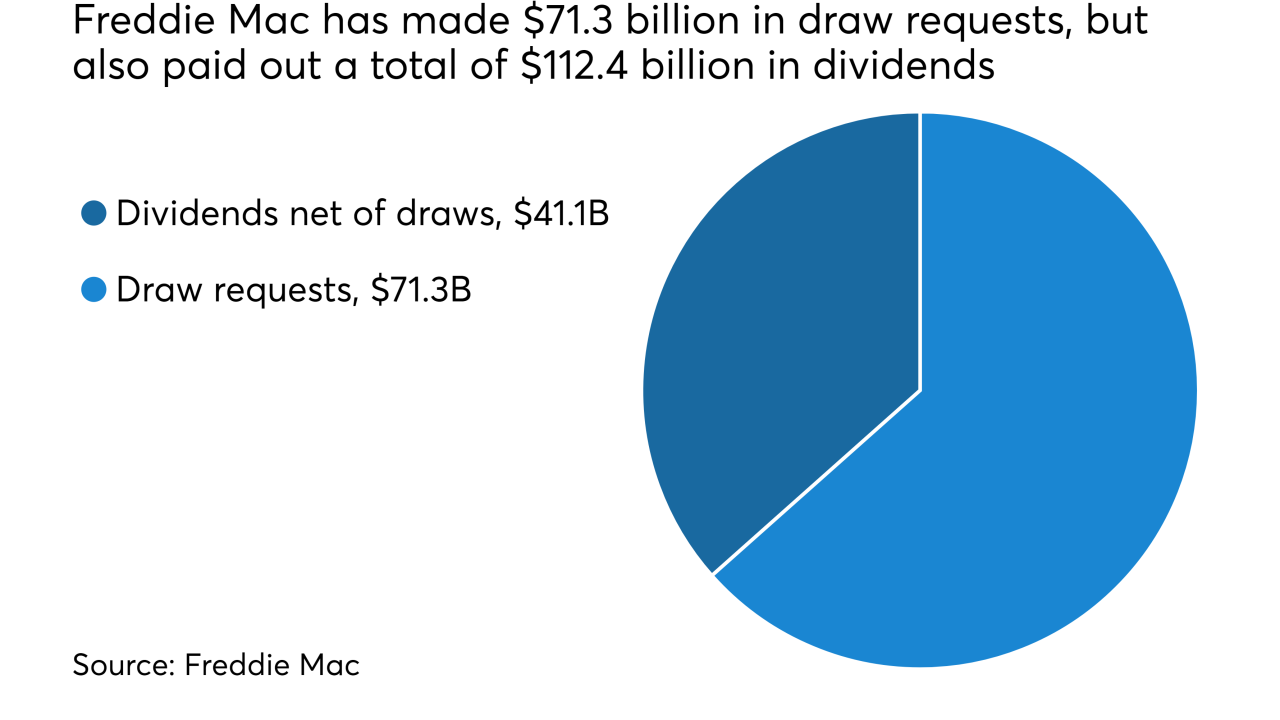

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

The company that holds Washington Mutual's legacy reinsurance business has agreed to purchase a controlling interest in Nationstar Mortgage and invest in its growth.

February 13 -

Walter Investment Management Corp. plans to emerge from Chapter 11 bankruptcy and start trading again under a new name in a matter of days.

February 8 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

Lenders need to be aware of a possible investor backlash as critical defects found in closed loans increased in frequency as the shift continued to a purchase market.

January 30 -

Loan defaults associated with the three late summer hurricanes could have a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

January 18 -

Mayor Keisha Bottoms said housing affordability, transparency, public safety, education, and transportation are priorities.

January 4 -

Genworth Financial's acquisition by a Chinese insurance company, which has already been delayed several times, might be in peril following the failure of another cross-border merger to gain approval.

January 4 -

Billionaire Dan Gilbert's Quicken Loans Inc. outgrew almost every U.S. mortgage provider by unfurling technology like its online Rocket Mortgage platform faster than big banks.

December 28 -

From origination to servicing and everything in between, here's a look at what's in store for the mortgage industry in 2018.

December 26 -

Fannie Mae and Freddie Mac have new technology-driven initiatives planned for 2018 that are expected to help lenders improve the borrowing experience for home buyers and make full use of the government-sponsored enterprises' credit box.

December 26 -

DoubleLine Capital is embarking on a plan to originate and securitize mortgages, seeking to fill a niche that has traditionally belonged to banks and brokerage firms.

December 21 -

Fannie Mae and Freddie Mac's final Duty to Serve plans are moving ahead with expanded support for manufactured housing through both single-family and multifamily programs, including controversial personal property loans.

December 18 -

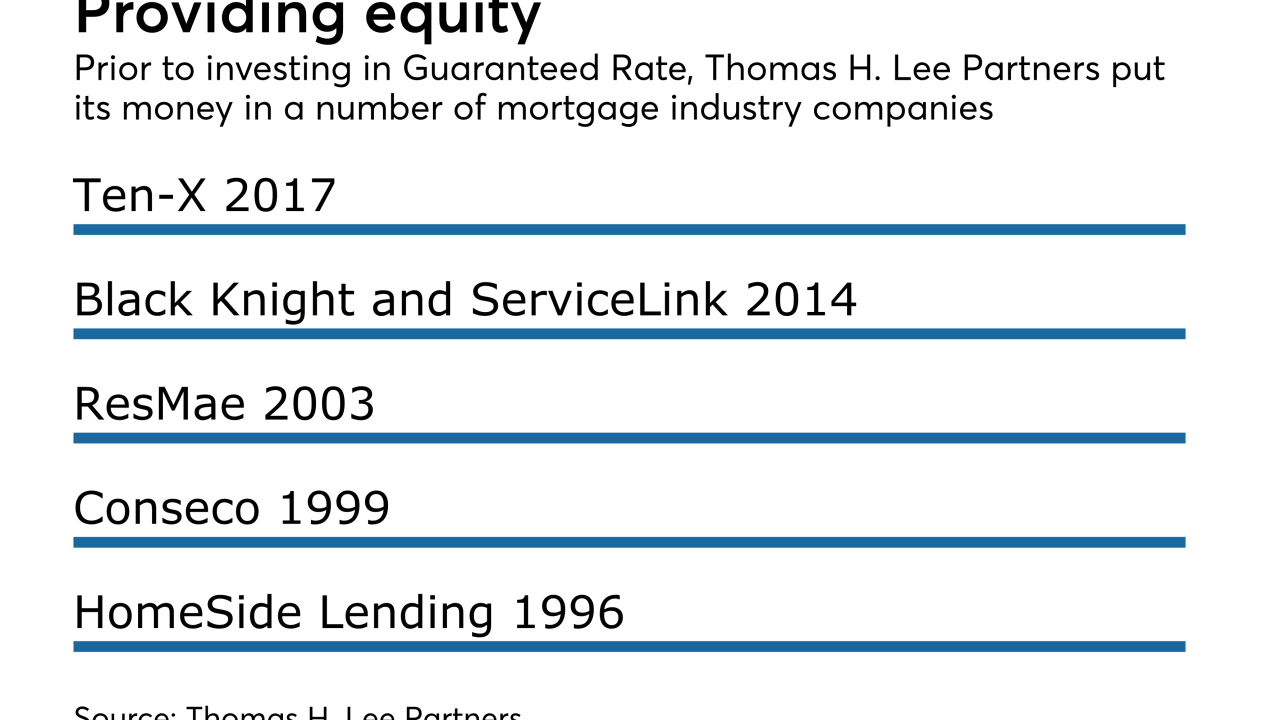

Guaranteed Rate Inc. is the latest mortgage industry investment for Boston-based private equity firm Thomas H. Lee Partners LP.

December 15