Commercial banking

-

Banks in the hurricane's path are focused on finding employees and restarting operations. Those that do business in Western North Carolina are facing an especially grueling recovery.

September 30 -

After the bank's 2014 spinoff from Royal Bank of Scotland, its executives worked to shore up weaknesses. Now they're concentrating on how to close the gap with regional banking peers.

September 24 -

After hikes pinched profits across the industry, a move in the opposite direction could be the start of a more promising trend. But bankers caution that the immediate effects of a September rate cut figure to be small.

September 6 -

Prophecies about a wave of bank failures caused by sickly CRE loans haven't yet come true. But there are still plenty of caution signs in a saga that will take years to play out.

September 6 -

Trimont CEO Bill Sexton acknowledges that a "daunting" volume of commercial real estate loans need to be refinanced in the next few years. But he says nonbank lenders are well equipped to provide financing that will allow troubled buildings to be reimagined.

August 30 -

The third-largest Canadian bank's proposed minority stake in KeyCorp is an unconventional way to generate more U.S. revenue. Analysts say it's a less risky approach than buying an American bank outright.

August 23 -

Shares in U.S. banks weren't immune to a global market sell-off, as worries mounted over whether the U.S. economy's recent resilience is faltering. The turmoil hit some tech stocks hard and led to the worst day for Japanese stocks since the 1980s.

August 5 -

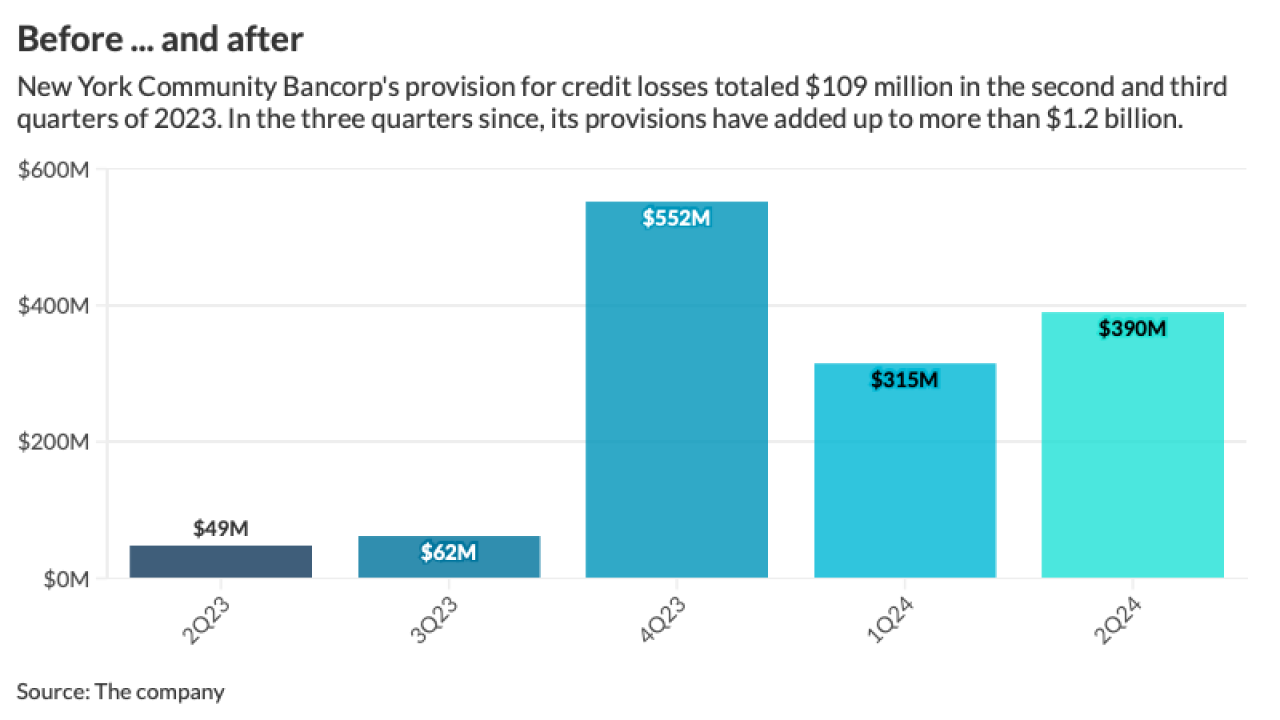

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

Bank OZK is the latest commercial real estate-heavy bank to announce plans to diversify its business. CEO George Gleason emphasized that he's confident in the bank's loan portfolio, but said he thinks misperceptions are dragging down the stock price.

July 22 -

The Dallas-based company, whose earnings per share fell short of consensus by 6 cents, lowered its revenue forecast and raised its expense outlook. Its stock price fell more than 8% on Thursday.

July 18 -

The Charlotte, North Carolina-based bank saw profits and net interest income dip in the second quarter, but made up lost revenue through investment banking fees.

July 16 -

The Pittsburgh-based superregional bank reported a small quarter-over-quarter advance in net interest income, and it expects loan growth to pick up in the second half of the year. PNC, which announced job cuts last year, also said that it has identified an additional $25 million in cost savings.

July 16 -

Investment banking fees shot up at the nation's largest bank, thanks to rebounds in M&A and the equity capital markets segment. And despite higher credit costs in the company's card business, a top bank executive expressed confidence in the health of U.S. consumers.

July 12 -

First Foundation will use the large investment to shrink its multifamily loan portfolio, which has weighed down its earnings since interest rates began rising.

July 2 -

Some banks with large commercial real estate concentrations are seeing their stock values take a roller-coaster ride as investors discount their assurances about the wobbly asset class.

June 17 -

During New York Community Bancorp's annual shareholder meeting, executives reiterated their mission to restore value in the beleaguered Long Island-based company. Questions from shareholders suggested at least some discontent following a capital influx that significantly diluted their position in the company.

June 7 -

Sandro DiNello, who briefly led New York Community Bancorp amid turmoil earlier this year, is staying on the company's board. But Joseph Otting, the company's recently installed CEO, is taking on the executive chairman position.

June 4 -

Executives at the Toronto-based bank said last year that they planned to add 150 branches in the United States. But when pressed on Thursday, they could not say how much they'll scale back their ambitions due to investigations over TD's anti-money laundering practices.

May 23