-

Borrowers will likely have to put more assets on the line to get forbearance extensions.

August 13 -

Developer Parkway Corp. has closed on $187 million in funding through commercial real estate finance firm Meridian Capital Group to build a Center City Philadelphia office tower for law partnership Morgan, Lewis & Bockius.

August 13 -

A new Marriott Residence Inn is expected to sprout next to the Millbrae BART station after landing a construction loan that serves as a welcome counterpoint to the pall of economic uncertainty cast by the coronavirus.

August 13 -

Developer Doug Loose says he is "living in a cloud" after recently securing financing through Frankenmuth Credit Union for a portion of his $4.2 million purchase of a damaged condominium complex in Midland, Mich.

August 10 -

Citizens Bank Financial Group is funding the construction of two apartment buildings in neighborhoods northwest of Center City with a total of $27.5 million in loans, allowing the projects to move forward despite economic headwinds from the coronavirus pandemic.

August 7 -

Commercial real estate fundamentals improved in July, but the pandemic continues to affect development projects and is likely to remain a significant challenge for more than a year, according to a COVID-19 impact report by the NAIOP Commercial Real Estate Development Association.

August 6 -

PREIT, which owns a number of large malls, is trimming the salaries of its CEO and chief financial officer while suspending dividend payments as part of a deal with its lenders to stave off default as the coronavirus pandemic continues to take its toll on the troubled company.

August 4 -

While the multifamily loan forbearance rate is lower than the most pessimistic projections, Pat Jackson says borrowers are hardly out of the woods yet.

July 6 -

As the coronavirus reshapes urban life — and prompts businesses to rethink where they want to be — a pair of California real estate investors are pushing what might seem like an unlikely vision for the future.

June 29 -

For banks with assets between $10 billion and $100 billion, the average exposure is 165% of capital.

June 24 -

Starwood Capital Group missed two monthly payments on securitized debt tied to five shopping malls anchored by bankrupt department stores including Sears and J.C. Penney.

June 18 -

But deal sponsors are primarily restricting property assets to the lower risk multifamily and office buildings that lenders are more confident will weather the economic strains brought by the coronavirus pandemic.

June 12 -

As brick-and-mortar shopping centers steadily lost market share to online competitors, the family behind three of the four biggest malls in North America built a thriving business by infusing their properties with heavy doses of entertainment.

June 9 -

Kalahari Resorts defaulted on a $347 million mortgage originated by JPMorgan Chase

May 27 -

Mounting economic fallout from the pandemic is fueling apartment landlords' concerns that more tenants will struggle to make their rent payments, even after most managed to come up with the money for April.

April 29 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

February 25 Boxwood Means

Boxwood Means -

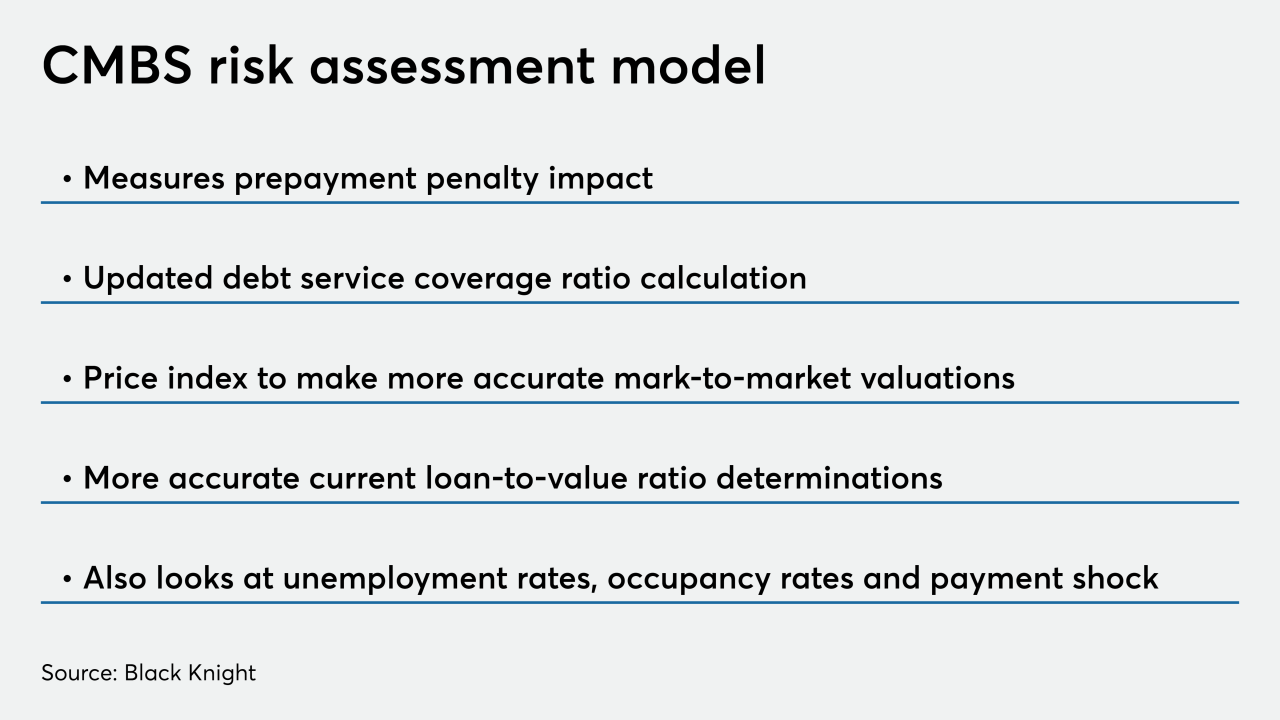

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10