-

Starwood Capital Group missed two monthly payments on securitized debt tied to five shopping malls anchored by bankrupt department stores including Sears and J.C. Penney.

June 18 -

But deal sponsors are primarily restricting property assets to the lower risk multifamily and office buildings that lenders are more confident will weather the economic strains brought by the coronavirus pandemic.

June 12 -

As brick-and-mortar shopping centers steadily lost market share to online competitors, the family behind three of the four biggest malls in North America built a thriving business by infusing their properties with heavy doses of entertainment.

June 9 -

Kalahari Resorts defaulted on a $347 million mortgage originated by JPMorgan Chase

May 27 -

Mounting economic fallout from the pandemic is fueling apartment landlords' concerns that more tenants will struggle to make their rent payments, even after most managed to come up with the money for April.

April 29 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

February 25 Boxwood Means

Boxwood Means -

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

A bankruptcy court judge denied a lender's motion to foreclose on properties controlled by an Austin real estate investor. But the judge then issued a warning, saying an exit plan better be ready by Feb. 2.

January 14 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

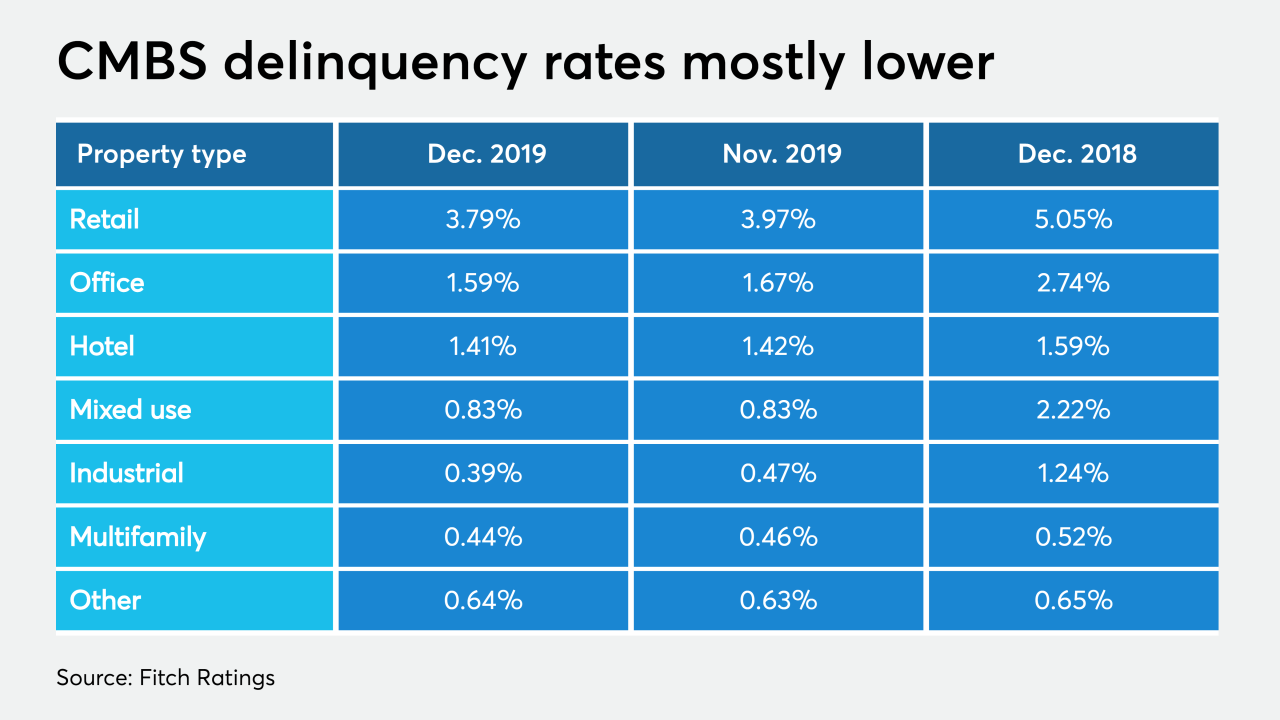

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

Bridge REIT LLC is sponsoring a $449.6 million bridge-loan securitization backed mostly by transitional multifamily properties.

January 6 -

The foreclosed former home of Fireman's Fund Insurance in Novato, Calif., could become the site of a mixed-use development.

January 6 -

General Motors is providing $40 million in seller financing to the purchaser of its Lordstown, Ohio assembly plant.

December 9 -

GameStop's plan to shutter up to 200 stores could adversely affect commercial mortgage-backed securities loans with a combined allocated property balance of almost $42 million, according to Morningstar Credit Ratings.

October 21 -

The Chateau Hotel and Conference Center in Bloomington, Ill., is under new ownership after a judge agreed to enter a foreclosure judgment.

October 7 -

The commercial mortgage-backed securities sector will weather the fourth quarter's slowing but steady growth in the U.S. economy, as better loan performance counters a continued decline in volume, Morningstar said.

October 2 -

Rising demand and plummeting mortgage rates pushed multifamily origination dollar volume above 2017's record to a new peak, according to the Mortgage Bankers Association.

September 27