-

A new Marriott Residence Inn is expected to sprout next to the Millbrae BART station after landing a construction loan that serves as a welcome counterpoint to the pall of economic uncertainty cast by the coronavirus.

August 13 -

So far, only Tulsa County has opted in, but the Indian Nation Council of Governments is working with officials across the state to get other counties on board.

August 6 -

Many commercial property owners are locked out of existing coronavirus relief by financing terms that bar them from taking new loans. Under a House bill, they would receive government-backed equity investments.

July 22 -

As revenue-starved retailers fall further behind on rent payments, landlords' cash flow will be strained, and defaults on commercial real estate loans could rise.

June 10 -

As brick-and-mortar shopping centers steadily lost market share to online competitors, the family behind three of the four biggest malls in North America built a thriving business by infusing their properties with heavy doses of entertainment.

June 9 -

Kalahari Resorts defaulted on a $347 million mortgage originated by JPMorgan Chase

May 27 -

Cited the current capital markets and economic environment as the reasons for pulling out of the transaction.

May 25 -

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

May 4 -

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

March 30 -

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

March 25 -

The rush to unload mortgage-backed securities signals that a credit meltdown that began with corporate bonds is spreading to other corners of the market.

March 23 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

February 25 Boxwood Means

Boxwood Means -

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Simon Property Group agreed to buy rival shopping-mall operator Taubman Centers for about $3.6 billion, a combination that comes as e-commerce continues to roil brick-and-mortar retail.

February 10 -

Negotiations went to the brink of a foreclosure trial for a Bradenton, Fla., mall, before a settlement was reached between the owners and the lender.

February 3 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

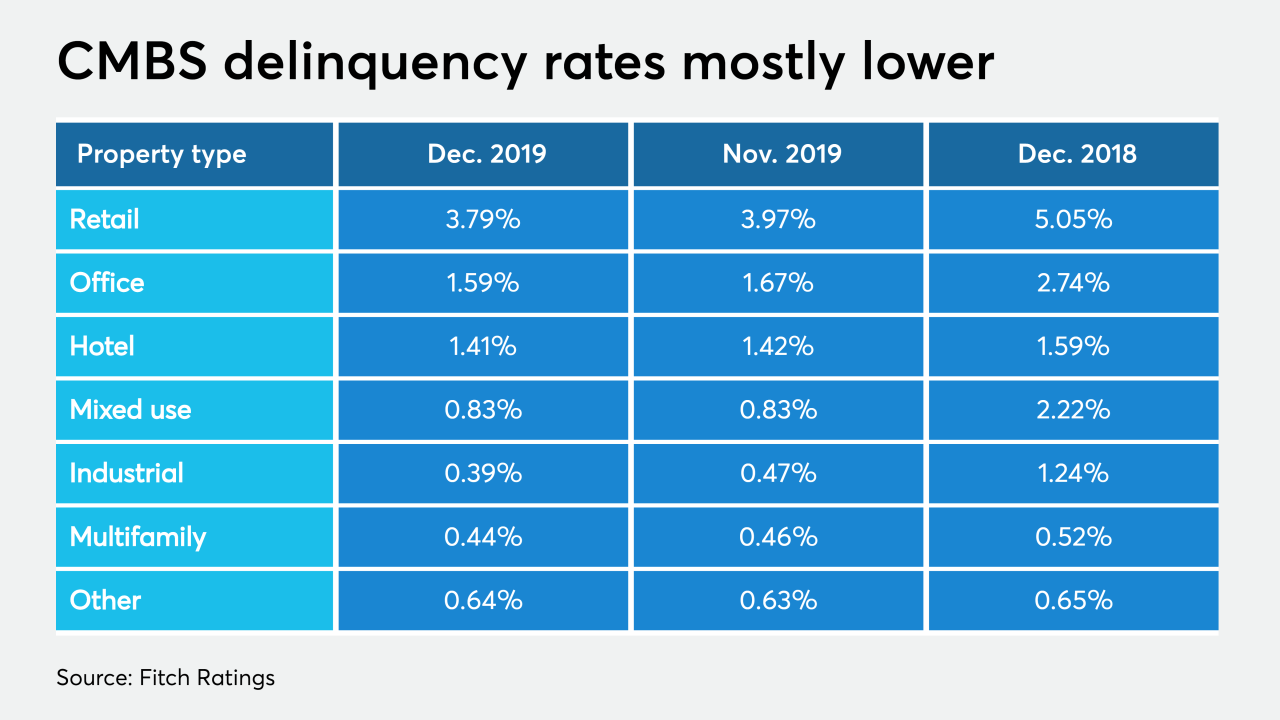

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

The developer of three adjacent lots said one of the reasons for the sale was her time was up with her mortgage holders.

January 10