-

The rush to unload mortgage-backed securities signals that a credit meltdown that began with corporate bonds is spreading to other corners of the market.

March 23 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

Commercial real estate market participants could be missing the stresses that are wearing down the foundations of growth in the small-cap segment.

February 25 Boxwood Means

Boxwood Means -

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Simon Property Group agreed to buy rival shopping-mall operator Taubman Centers for about $3.6 billion, a combination that comes as e-commerce continues to roil brick-and-mortar retail.

February 10 -

Negotiations went to the brink of a foreclosure trial for a Bradenton, Fla., mall, before a settlement was reached between the owners and the lender.

February 3 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

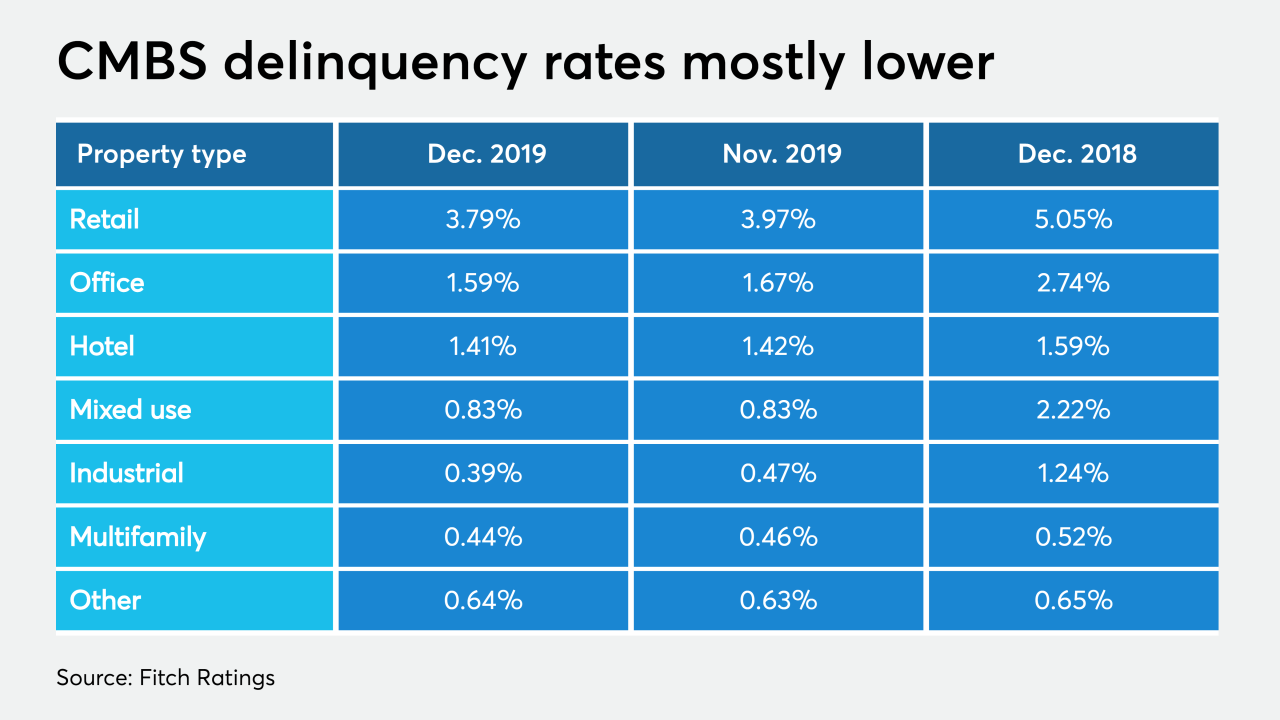

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

The developer of three adjacent lots said one of the reasons for the sale was her time was up with her mortgage holders.

January 10 -

Goldman Sachs is sponsoring a $1.33 billion bond offering backed by commercial mortgages, in the first rated conduit deal of the year.

January 7 -

A Charlotte, N.C., developer detailed plans to build apartments and commercial space through a federal tax program that has faced scrutiny in recent months.

January 7 -

The foreclosed former home of Fireman's Fund Insurance in Novato, Calif., could become the site of a mixed-use development.

January 6 -

Freedom Credit Union has listed for sale the three downtown Springfield, Mass., office buildings it took back in November in a mortgage foreclosure.

January 2 -

Susan Riel succeeded Ronald Paul as CEO of the Maryland bank shortly before questions surfaced about credit quality and lending practices.

December 31 -

The board- and management-level handing of CRE concentration was the chief concern of FDIC examiners, making up more than 56% of all the supervisory recommendations regulators made in the two-year period.

December 24 -

The owner of the MacArthur Center Mall in Norfolk, Va., has defaulted on a $750 million loan which includes the property as collateral.

December 20 -

Downtown San Jose, which has been overshadowed by its Bay Area neighbors, is having a real estate development boom because it qualifies as an opportunity zone

December 20 -

The head of the firm's real estate investment arm pushed back at the idea that buildings with coworking companies as lead tenants are risky bets for lenders.

October 10 -

The firm’s financial woes are mostly a result of overspending, but they have raised questions about how banks’ commercial real estate portfolios might fare if the coworking sector implodes.

October 7