Community banking

Community banking

-

Unity National Bank of Houston, which has reported losses three straight years, is receiving guidance and resources from Citigroup through a Treasury mentoring program.

March 6 -

MVB in West Virginia will gain a 47% stake in the partnership in exchange for contributing its mortgage unit's assets to the new company.

March 3 -

Bernie Sanders’ rise to front-runner status for the Democratic nomination worries many bankers, but their opinions diverge on his electoral chances and whether a Sanders presidency would pose a direct threat.

February 23 -

Provident Bank in Amesbury, Mass., has entered warehouse lending after buying a business from People’s United Financial in Bridgeport, Conn.

January 22 -

People's United in Connecticut is letting the loans run off its books as it invests in higher-yielding commercial loans.

January 17 -

Susan Riel succeeded Ronald Paul as CEO of the Maryland bank shortly before questions surfaced about credit quality and lending practices.

December 31 -

Tom Lopp abruptly suspended a program that accounted for 83% of Sterling Bancorp's mortgage production this year. An ongoing audit of the program and pressure to diversify beyond mortgages are reasons to watch Lopp and Sterling in 2020.

December 27 -

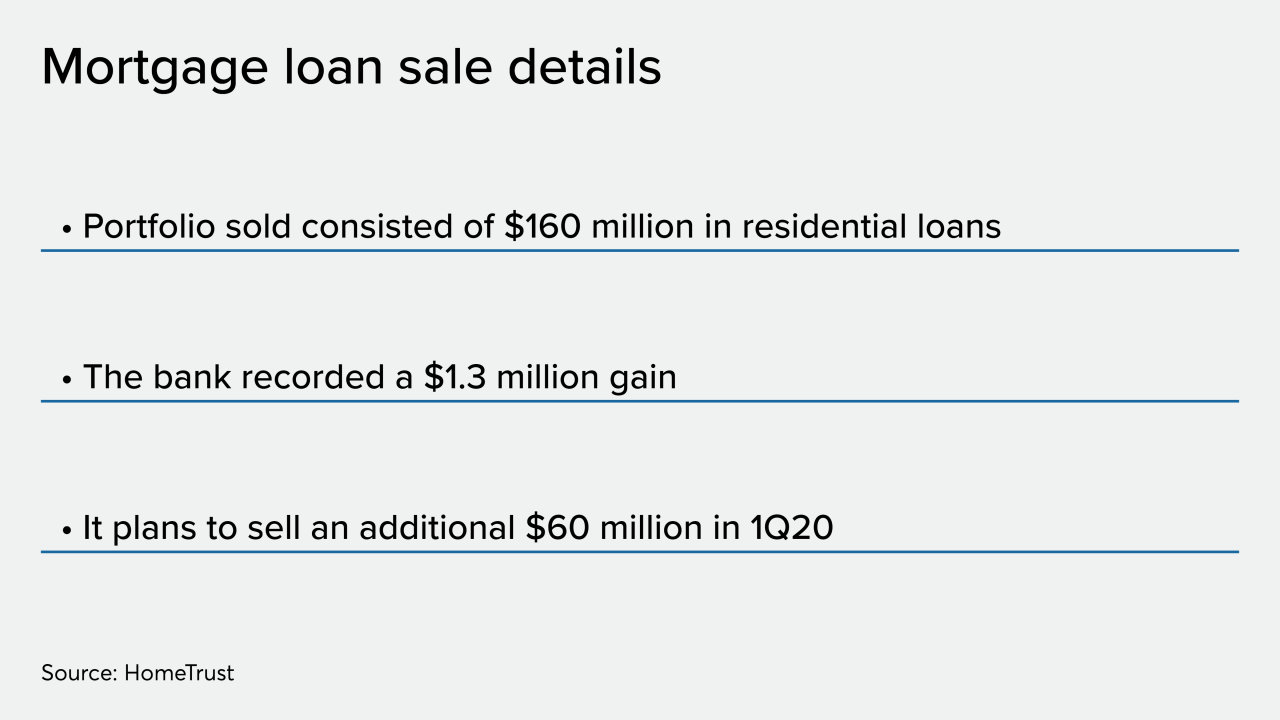

HomeTrust Bancshares in Asheville, N.C., sold a portfolio of residential mortgages as part of a balance sheet restructuring, with plans to sell more.

December 20 -

The company will hold off on making loans under the Advantage Loan program as it conducts an audit and implements new policies and procedures.

December 9 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

David Becker, who founded First Internet Bank two decades ago, says traditional banks' digital-only ventures are only making his bank look more mainstream.

November 26 -

Stephen Calk, who faces a bribery charge in connection with loans his bank made to former Trump campaign chair Paul Manafort, is asking a judge to suppress evidence that prosecutors obtained from his mobile phone.

November 18 -

Such credits, which reflect borrowers with financial challenges, increased significantly during the third quarter.

November 13 -

The FDIC ordered the Seattle bank to pay a nearly $1.4 million fine tied to improper agreements with real estate brokers and homebuilders.

November 6 -

The Dallas company said it should be able to avoid restating past financial results. It also reported higher quarterly earnings helped by increased mortgage activity.

November 1 -

The National Credit Union Administration has unveiled a proposal to address a federal judge's concerns that its 2016 field-of-membership overhaul could discourage lending in low-income areas.

October 24 -

Malaga Financial has no intention of diversifying its portfolio despite heavier competition and potential funding challenges.

October 20 -

The four prudential agencies, which will enforce the new credit loss methodology developed by the Financial Accounting Standards Board, said they want to promote consistency.

October 17 -

The court passed up a recent opportunity to clarify confusion about Americans with Disabilities Act requirements for business websites, raising concerns among bankers that they could become an even more inviting litigation target.

October 9 -

Caught in the middle of a credit-subsidy debate, the program would have shut down on Tuesday without congressional action.

September 27