-

The persistent opposition to the Consumer Financial Protection Bureau which has been fierce since day one has been puzzling, and has been cloaked in misleading arguments about the structure of the agency.

January 9 Senate Banking Committee

Senate Banking Committee -

The Federal Housing Administration said it would cut the annual premium by 25 basis points starting on Jan. 27, giving President-elect Donald Trump a limited window to delay or scrap the cut.

January 9 -

In a letter Monday to Comptroller Thomas Curry, Sens. Sherrod Brown, D-Ohio, and Jeff Merkley, D-Ore., registered their strong opposition to the concept of the charter, which would allow certain types of fintech companies to avoid state licensing requirements by obtaining a limited-purpose national bank charter.

January 9 -

HSBC was fined $32.5 million for failing to comply with a 2011 consent order that directed the bank to revamp its mortgage servicing and foreclosure practices.

January 9 -

The Federal Housing Administration is cutting its annual mortgage insurance premium by 25 basis points, lowering it to 60 basis points starting Jan. 27, the agency said Monday.

January 9 -

The Department of Housing and Urban Development has charged Bank of America with discriminating against prospective Hispanic mortgage borrowers at a branch in Charleston, S.C.

January 6 -

The House Financial Services Committee will see a shuffling of deck chairs among the leadership of its subcommittees in the new Congress as it also welcomes 10 new Republican members.

January 6 -

Ohio has prohibited the use of plywood to board up certain vacant or abandoned properties in foreclosure.

January 6 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

The Senate Banking Committee is scheduled to hold a hearing Jan. 12 on the nomination of Dr. Ben Carson as Secretary of the Department of Housing and Urban Development.

January 5 -

Former Jefferies LLC managing director Jesse Litvak "lied to his customers" about the prices of mortgage-backed securities, a prosecutor told jurors as the U.S tries for a second time to win a conviction that sticks.

January 5 -

A California consumer group has urged the Senate Finance Committee to delay an upcoming nomination hearing into Treasury Secretary-designate Steven Mnuchin after a leaked 2013 memo described alleged illegal foreclosure practices at OneWest Bank when he was chairman and CEO.

January 5 -

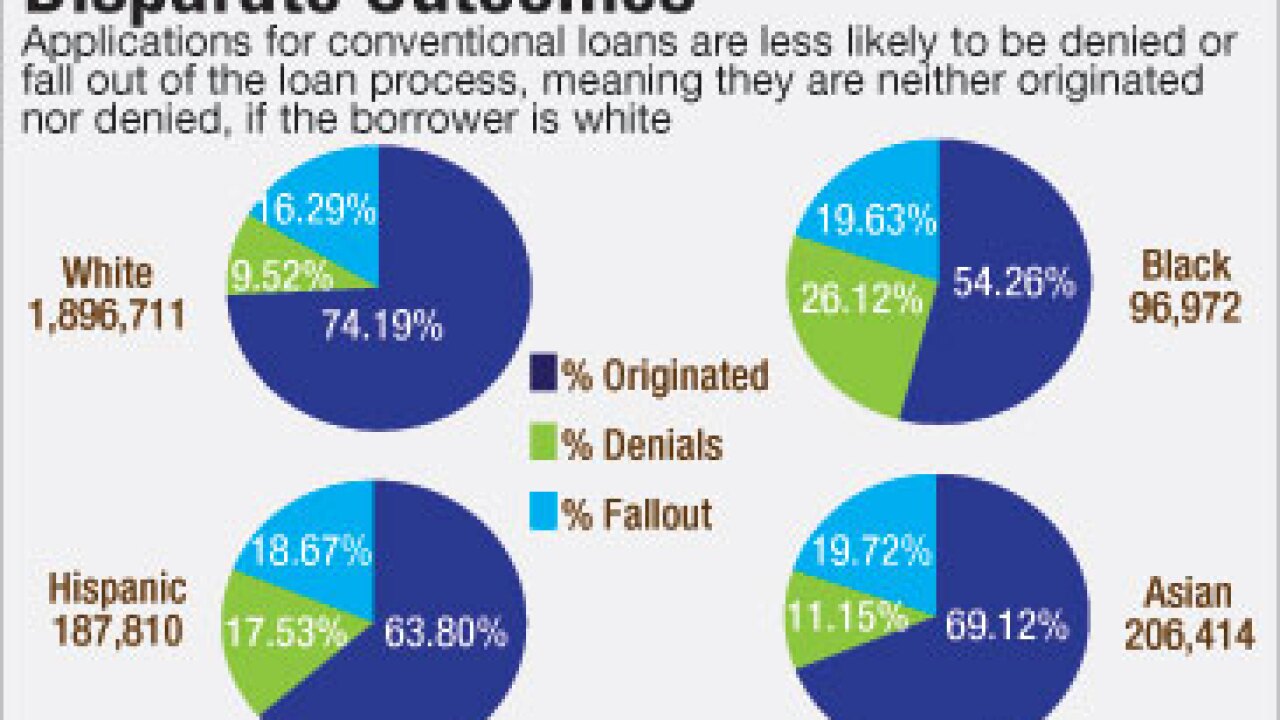

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Deutsche Bank is considering an unusual approach to providing relief to subprime mortgage borrowers as part of a $7.2 billion settlement with the U.S. government: lending money to private equity firms and hedge funds.

January 5 -

Donald Trump's election sent interest rates higher, and the mortgage industry is waiting to see what other effects he will have. Here's a look at how the housing market performed during the first years of recent presidencies.

January 4 -

President-elect Donald Trump's choice of well-known Wall Street lawyer Jay Clayton to head the Securities and Exchange Commission was a relatively safe move that suggests his other financial appointments may be equally conservative, industry observers said.

January 4 -

In hindsight, the U.S. Treasury's support of Fannie Mae and Freddie Mac was structured in a way that proved to be counterproductive.

January 4

-

The bank formerly run by Steven Mnuchin, President-elect Donald Trumps' nominee to head the Treasury Department, allegedly used illegal practices in foreclosing on delinquent homeowners, according to a leaked 2013 memo from the California Attorney Generals Office.

January 3 -

The Senate Banking Committee will have six fresh faces in the new Congress as Republicans grapple with a slimmer majority.

January 3 -

In an enforcement action totaling more than $23 million in fines and restitution, the Consumer Financial Protection Bureau found that TransUnion and Equifax two of the largest consumer credit reporting agencies had misled consumers on the value of the data they marketed.

January 3