-

The Consumer Financial Protection Bureau will require underperforming servicers to document the technology and process changes they're making to implement the agency's recently released servicing regulations.

October 25 -

-

David Stevens, the chief executive and president of the Mortgage Bankers Association, revealed Monday that he has been diagnosed with cancer in prepared remarks at the association's annual conference in Boston.

October 24 -

A title agent's cost for closing a loan increased an average of $210 nationwide in the third quarter because lenders are using disparate processes after implementing the TILA/RESPA integrated disclosures, according to First American.

October 24 -

The U.S. housing market is about 10 times larger than Canada's, but we can learn a few lessons from the country's cautious approach to its housing policy.

October 24 Steel Curtain Capital Group LLC

Steel Curtain Capital Group LLC -

As Rodrigo Lopez begins his term as chairman of the Mortgage Bankers Association, the Nebraska multifamily lender seeks to use the platform to embrace the challenges of improving diversity and technology throughout the industry, while remaining vigilant about the ever-changing regulatory landscape.

October 23 -

The Consumer Financial Protection Bureau's proposed changes to new mortgage disclosure requirements do not go far enough, according to many in the industry.

October 21 -

Moody's Corp. said federal officials are planning a lawsuit over its ratings of residential mortgage securities that critics contend were inflated to win business in the years leading up to the 2008 financial crisis.

October 21 -

A federal court appeals decision could theoretically mean that Comptroller of the Currency Thomas Curry now answers directly to Treasury Secretary Jack Lew, a significant break from the agency's history of independence.

October 21 -

In an election year dominated by controversy and big personalities, political contributions from the mortgage industry have remained muted, reflecting apathy and uncertainty toward Hillary Clinton and Donald Trump.

October 21 -

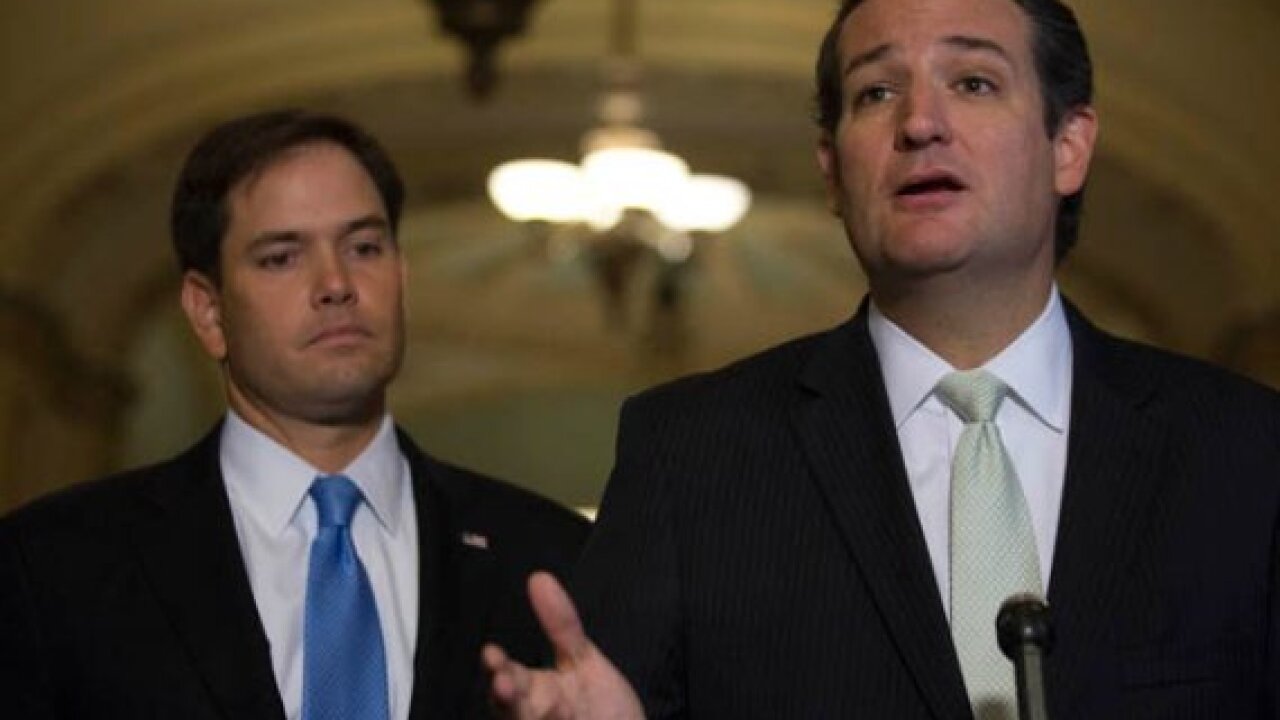

From the future of Dodd-Frank to GSE reform, the next Congress will make major decisions that will shape the mortgage industry's future. Here's a look at the Senate candidates who have received the most money in political donations from the mortgage industry.

October 21 -

With the election just weeks away, here's a look at the mortgage industry firms whose employees have made the largest political contributions during the 2016 election cycle.

October 21 -

From House Speaker Paul Ryan to Financial Services Committee Chairman Jeb Hensarling, these 10 candidates for the House of Representatives attracted the most in campaign donations from the mortgage industry.

October 21 -

The mortgage industry remains deeply uneasy with efforts by Fannie Mae, Freddie Mac and their regulator to experiment with front-end credit risk transfers, with some arguing it helps borrowers and lenders, while others fear it will cut out small institutions.

October 20 -

In a move designed to help further calm lender fears about mortgage repurchase liability, Fannie Mae is preparing to offer immediate representation and warranty relief to lenders that use its suite of automated quality assurance technology.

October 20 -

Lenders asking whether bank loans are safe are missing the point and should instead be more concerned with the standard they apply when underwriting them.

October 19 Offit | Kurman

Offit | Kurman -

The Internal Revenue Service's indefinite delay of a deadline for a new authentication procedure has headed off concerns about potential interruptions in mortgage production.

October 19 -

The Consumer Financial Protection Bureau decried an appeals court ruling last week that found its single-director structure unconstitutional, saying the opinion was "wrongly decided" and had "no basis in the text of the Constitution or in Supreme Court case law."

October 19 -

Lenders and servicers haven't faced the same scrutiny over data security as their peers in retail and other financial services sectors. But mortgage companies must remain vigilant, as the extensive data they collect can expose consumers to identity theft if it got in the wrong hands.

October 18 -

By decreasing costs through technology, outsourcing and scale, servicers not only can give their margins a much-needed boost, but also set themselves up to reap rewards in the future.

October 18