-

Mortgage REIT says five-year transition plan won't have an impact on its financing model.

February 5 -

HSBC North America Holdings has agreed to pay $470 million to settle allegations it engaged in abusive practices in its mortgage foreclosure, origination and servicing operations.

February 5 -

Wells Fargo has reached a $16.2 million settlement in a class-action lawsuit regarding an alleged kickback scheme involving the shuttered Owings Mill, Md.-based Genuine Title.

February 5 -

A number of bankers used quarterly earnings calls to assure investors that they are carefully monitoring their exposure to commercial real estate at a time when regulators are expressed concern about eroding underwriting standards.

February 4 -

The rate of home price recovery during the seven years that a foreclosure remains on a consumer's credit report is one measure of whether borrowers who strategically defaulted made the right choice by walking away. But the results vary, depending on when, where and in what price tier that borrowers defaulted.

February 4 -

Borrowers who walked away from underwater mortgages are coming back to the market. Some lenders are ready to give them a second chance.

February 4 -

After years of refi-fueled origination volume, lenders have their hopes pegged to a resurgent purchase market in 2016 and beyond. But it raises an important question: will strategic default rear its head again in the next downturn?

February 4 National Mortgage News

National Mortgage News -

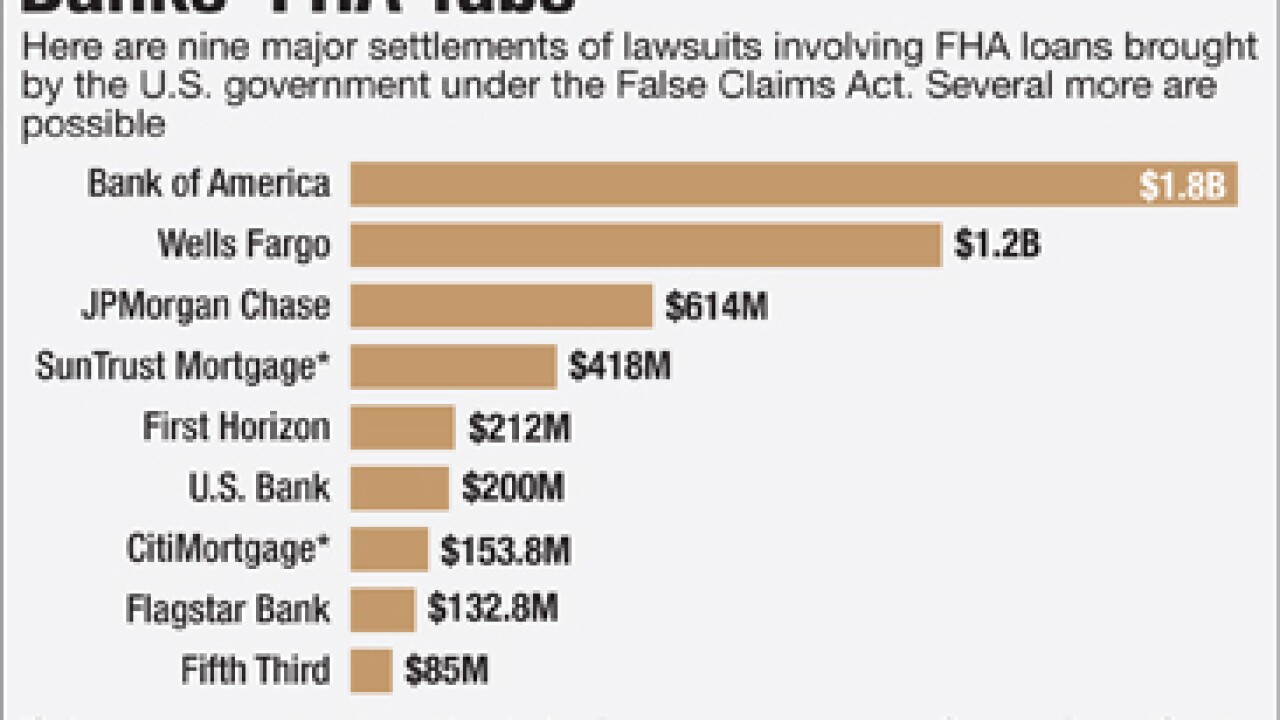

Wells Fargo's tentative agreement to pay $1.2 billion to resolve claims by the Justice Department that it made shoddy FHA loans is bad news for other banks that are the targets of similar probes.

February 3 -

The House approved a bill 427-0 that would revamp the Federal Housing Administrations condominium loan program and expedite the approval process for Rural Housing Service guaranteed loans.

February 3 -

Opus Capital Markets Consultants, a unit of Wipro, has created a division for identifying operational and loan-level risks within a residential mortgage servicing operation.

February 3 -

Wells Fargo & Co., the largest U.S. home lender, agreed to pay $1.2 billion to resolve claims related to its Federal Housing Administration mortgage practices.

February 3 -

Morgan Stanley will pay $63 million to settle a series of government lawsuits claiming the bank misrepresented securities it sold to banks that later failed.

February 2 -

Fannie Mae and Freddie Mac unveiled an appeals process Tuesday that will allow an independent arbitrator to resolve disputes between lenders and the government-sponsored enterprises over loan repurchase demands.

February 2 -

The near future may find more banks ceasing to originate residential mortgages in an effort to stop the slide in stock prices.

February 2

-

Key Democratic lawmakers are urging the Department of Housing and Urban Development to tighten its program for selling nonperforming guaranteed loans to ensure servicers have exhausted all loss mitigation options before the loans are sold to private investors.

February 1 -

While most federal banking regulators use enforcement actions as a way to shape industry practices, the Consumer Financial Protection Bureau is taking that to a whole other level, frequently using orders as a substitute for new rules or guidelines.

February 1 -

The Federal Housing Finance Agency's Duty-to-Serve rule must include a substantive commitment from the government-sponsored enterprises to purchase chattel loans.

February 1 Manufactured Housing Institute

Manufactured Housing Institute -

By implementing a platform designed specifically to support quality control, lenders can continuously prepare for an audit while simultaneously executing on everyday loan quality tasks.

January 29 ACES Risk Management Corp.

ACES Risk Management Corp. -

The Department of Housing and Urban Development is reducing the mortgage insurance premiums it charges on Federal Housing Administration multifamily loans to encourage the renovation of affordable housing units and promote energy-efficient upgrades.

January 28 -

Amid concerns about the added complexity of the TILA-RESPA integrated disclosures and growing demand for purchase loans, Flagstar Bancorp plans to reduce its over-reliance on third-party originations by expanding its retail mortgage business.

January 27