-

The weighted average FICO credit scores of securitized reperforming loans are deteriorating a little, according to a DBRS study of the bonds.

January 16 -

Housing regulators should not adopt an alternative credit scoring model until the banking industry is on board.

January 16

-

The average VantageScore last year was higher than it has been since 2007 due to improved hiring and despite stagnant wages that aren't keeping pace with rising debt levels.

January 11 -

Consumer credit scores are improving, but many qualified borrowers are still hesitant about buying a house. New tools are helping lenders better assess risk and show consumers with lower credit scores they can qualify for mortgages.

January 8 -

The gap between the average credit score for homebuyers and other consumers has widened to its highest point in 12 years, and lenders don't know what, if anything, to do about it.

January 3 -

The average credit score of loans made to members of the millennial generation were a little lower than they were a year ago, according to Ellie Mae.

January 3 -

The credit bureau enraged many with its response to a massive data breach this fall, but closing the company down would ultimately harm consumers.

December 29 Consumers' Research

Consumers' Research -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

Consumer credit bureau and data aggregator Experian will gain a foothold in the U.K. mortgage market by acquiring a minority stake in mortgage brokerage London & Country Mortgages Limited.

December 11 -

Consumer default rates are up month-to-month, which may reflect a gap between spending and income that is stressing second mortgages and bank cards, Standard & Poor's and Experian find.

November 22 -

Over half of mortgage industry executives anticipate first-time home buyer growth in 2018, estimating that market will grow at a faster pace than the overall housing market, according to Genworth Financial.

November 17 -

The Consumer Financial Protection Bureau is seeking more information about consumers' experience with free access to credit scores.

November 13 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

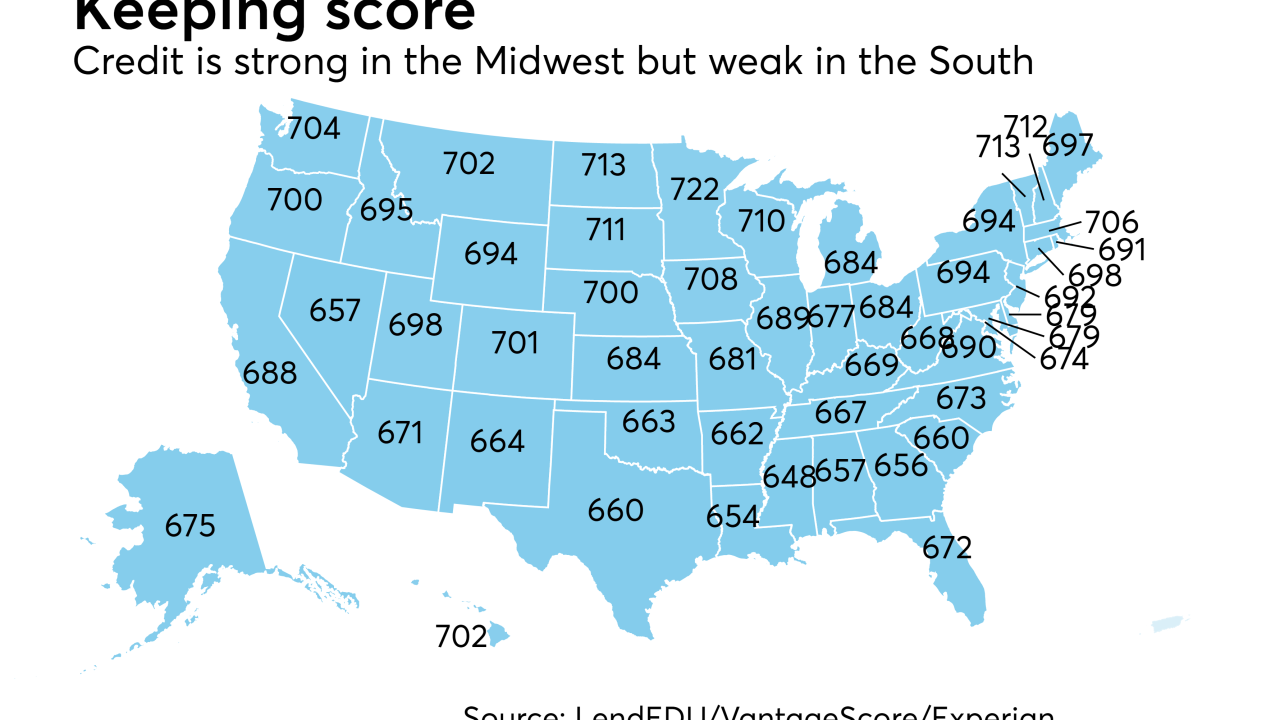

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

The percentage of refinance loans rose in September as interest rates dipped to a 2017 low, according to Ellie Mae.

October 18 -

Cybersecurity and breach notification procedures have caught the most public attention following the massive hack at Equifax, but lawmakers are also interested in the accuracy of credit reports.

October 17 -

Mortgage defaults keep rising and are getting much nearer to where they were in 2016 as damage from natural disasters continues to add to slight upward pressure on credit.

October 17 -

CFPB Director Richard Cordray is using the Equifax breach to suggest the CFPB be given power to examine credit reporting agencies for potential cybersecurity lapses.

October 10 -

Congress may soon try to limit the personal identifiable information that companies and the government can collect on consumers based on their reaction to the massive data breach at Equifax.

October 4 -

Richard Smith came to Capitol Hill this week to speak about the massive breach at Equifax, but it was clear Tuesday that he will be defending the entire credit reporting industry.

October 3