-

Blend, a provider of mortgage point of sale systems, is offering a new product that uses machine learning to streamline loan closings and analyze loan data quality.

September 18 -

Ellie Mae EVP Joe Tyrrell talks customer acquisition strategy. Crafting a personalized consumer experience, he says, starts with data.

September 18 -

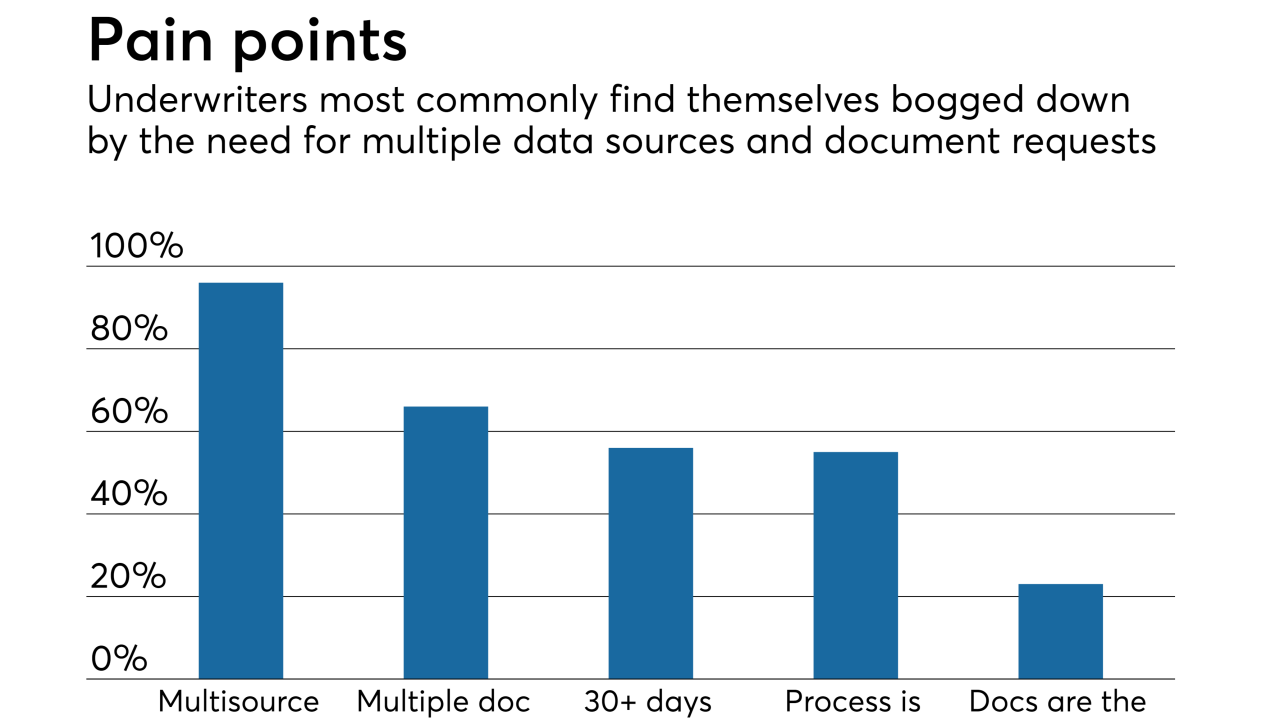

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

A man from Hialeah, Fla., will face sentencing in November after pleading guilty to conspiracy in an $8 million mortgage and tax-refund scheme.

September 12 -

Due diligence firm American Mortgage Consultants has launched a new subsidiary in response to growing lender and servicer interest in digital transactions.

September 10 -

Wire fraud committed through business email compromise schemes has emerged as a serious threat to mortgage and real estate transactions. Defending against these scams requires a comprehensive strategy that includes technology, training and nonstop vigilance.

August 27 -

Fraudsters can track a home sale from the moment it goes on the market until the deal closes, make these transactions a ripe target for business email compromise scams that seek to intercept wire transfers and steal from legitimate participants in a deal.

August 27 -

Post-crisis measures made it harder for rogue borrowers and employees to commit fraud. Now, a new threat has emerged from scammers posing as title agents, real estate professionals and more.

August 24 -

The CFPB made changes to a rule that allows financial firms to be exempt from sending annual privacy notices to customers if they meet certain conditions.

August 10 -

Capital One's dispute with Plaid raised questions about the ability of banks and aggregators to work together. But the end of that fight, and Capital One's deal with Finicity, show common ground can be reached — eventually.

August 10